“`html

The global competition for critical minerals is intensifying as two companies, United States Antimony Corporation (UAMY) and The Metals Company (TMC), pursue distinct strategies. UAMY is experiencing significant growth, reporting a 160% year-over-year revenue increase to $17.5 million in the first half of 2025, while TMC, though without recent revenue, aims for long-term gains through deep-sea mining with an assessed net present value exceeding $23 billion for its NORI-D project.

UAMY has successfully initiated domestic antimony mining for the first time in 40 years at Stibnite Hill, Montana, while expanding operations and cash reserves to $38.5 million. In contrast, TMC is focused on regulatory compliance and technological advancements for seabed mineral extraction, with a projected EBITDA margin of 50% by 2040.

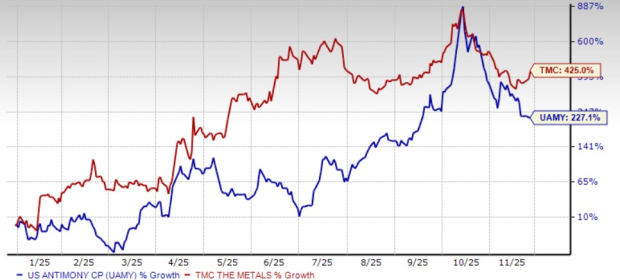

Year-to-date stock performance shows UAMY shares have increased by 425%, while TMC’s stocks have risen by 227.1%. Despite their differences, both companies are crucial for U.S. supply chain independence in critical minerals.

“`