“`html

2024 Trading Trends: Markets Surge and ETFs Thrive

Last year, several new records were achieved, setting the stage for a closer examination of trading trends in 2024.

Global Markets Reached New Heights

As interest rates decreased, global markets saw significant rallies. In 2023, stock investors in many regions enjoyed a prosperous year, with markets reaching all-time highs. Notably, the Japanese market took over three decades to rebound from peaks last seen in 1990.

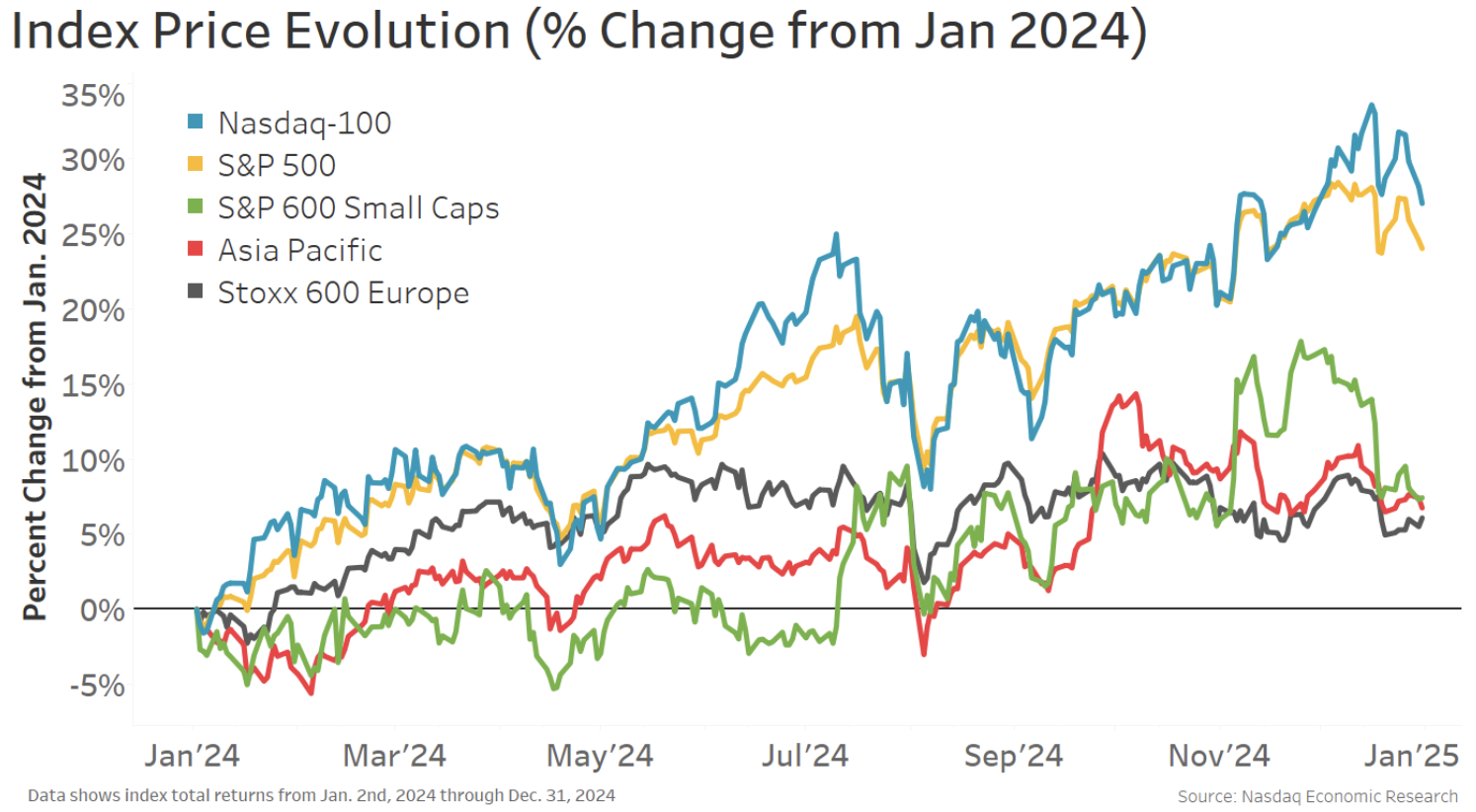

The rise in global markets was also fueled by increased consumer spending and a rebound in company earnings, particularly among those involved in the artificial intelligence sector. This explains the strong performance of the Nasdaq-100® and U.S. large-cap indexes.

Chart 1: Global indexes surged with U.S. large caps leading

Record Inflows into ETFs

The U.S. exchange-traded funds (ETF) industry experienced unprecedented inflows in 2024, surpassing $1 trillion in creations for the first time.

This influx, combined with positive investment returns, led U.S. ETF assets to exceed $10 trillion in assets under management (AUM) by the end of the year.

Most New ETFs Are Actively Managed

ETFs saw inflows double compared to active mutual fund outflows of $450 million. It’s important to note that equating this solely to a shift from active to passive investing would be misleading.

Data indicates that most new ETF launches are actively managed. In fact, inflows into active ETFs represented 28% of all ETF inflows.

Chart 2: Active ETFs dominate new listings, capturing over 28% of ETF inflows

Understanding the Composition of ETFs

It’s crucial not to directly compare U.S. ETF inflows with the U.S. stock market capitalization, which reached nearly $72 trillion at year-end. Not all U.S. ETFs contain U.S. stocks, as the U.S. ETF AUM incorporates:

- Bond ETFs amounting to $1.8 trillion (17.3%).

- International stocks totaling $1.5 trillion (14.8%).

- Commodities and currencies (including Crypto ETFs), which contribute $286 billion (2.75%).

Chart 3: ETP assets under management continue to trend higher

Top-Performing ETFs from 2024

A closer look at the most popular ETFs reveals their significant impact in 2024.

The table below showcases the ETFs with the largest trading flows and changes in their market share. The rankings highlight that investors were:

- Diverse, actively participating in stock, bond, and currency ETFs.

- Focused on U.S. large cap, with highest net flows in ETFs related to Nasdaq-100® or S&P 500.

- Reducing bond holdings, as negative net flows were noted in bond-related ETFs.

- Investing in new Bitcoin ETFs, with IBIT emerging as the fastest ETF to reach $50 billion in AUM.

Chart 4: Top ETFs ranked by trading and flows

Trading Volumes on the Rise Again

While quarterly volumes haven’t matched the record highs observed during the meme stock phenomenon in 2020, a steady increase has been noted since the initial rise during the pandemic, especially after retail investors received stimulus checks and capitalized on commission-free trading. In Q4 of 2024, the average daily volume (ADV) surpassed 13 billion shares.

Growth Driven by Low-Priced Stocks

Interestingly, the bulk of the recent increase in overall ADV is attributed to trading in sub-$1 stocks, which have seen a growing share in the trading landscape since 2017.

Due to their low prices, these stocks may trade more shares while accounting for a smaller portion of total value. In Q4 of 2024, sub-$1 stocks represented:

- 16% of volume (ADV) traded.

- Only 0.1% of total value traded.

“`

Surge in Off-Exchange Trading and Options Activity Shapes Today’s Market

Recent trends reveal that 60% of trading occurs off-exchange, with 18% of shares changing hands “overnight” (right after the market closes until just before it reopens).

Decline in High-Priced Stock Trading

Notably, trading volumes in stocks priced above $5 have remained stable. This stability exists despite several prominent stock splits in recent years, including those by AMZN, GOOG, and NVDA. Projections for 2024 forward splits indicate that these have contributed an additional 479 million shares traded daily during the year, suggesting a decline in activity for higher-priced stocks.

Record Levels in Off-Exchange Trading

Market fragmentation continues to rise, having been a trend for decades. Back in 2008, the three leading exchanges accounted for nearly 69% of equity volume. Since then, off-exchange trading has steadily gained market share. In 2024, off-exchange trading surpassed 50% of average daily volume (ADV) on 37 different days.

Interestingly, an academic once proposed that reaching 50% off-exchange trading would mark a critical point for market quality, creating enough competition to establish the National Best Bid and Offer (NBBO) as a reliable benchmark for protecting investors.

Options Trading Experiences Remarkable Growth

Over the last eight years, options trading has outpaced stock trading, with volumes skyrocketing by 317%, compared to a 221% increase in stock volumes. The rise of options is partly attributed to their growing use within managed portfolios, notably among ETFs featuring built-in options hedges. Additionally, the composition of options trading has evolved, with ETF options experiencing the most substantial growth.

Moreover, index options ADV has also more than doubled, driven by factors such as:

- Growing demand for broad market hedging.

- Tax benefits associated with trading index options, which enjoy favorable long-term capital gains treatment (60/40 rule).

- Increased reliance on shorter-dated options that necessitate more frequent rollovers.

Options tied to the Nasdaq-100 Index® (NDX®) have seen a year-over-year ADV increase of 39% in 2024, following a record set in 2023.

The evidence points to a rising involvement of retail investors in options trading as well. Our estimates suggest that retail options ADVs grew by 13% year-over-year in 2024, having more than tripled since 2019, now representing over 30% of the options market.

Options and Stocks Volumes: A Comparative Challenge

While some claim that options trading surpasses stocks in daily value, this assertion requires careful consideration. Most options traded have delta values well below 50%, indicating a limited theoretical impact on stock prices from hedging activities.

Additionally, due to their expiration, traders must frequently manage their positions—rolling over options each quarter, month, or week. This demand for maintaining exposure has become pronounced with the growth of shorter-dated weekly options, leading to increased trade volume on expiry days.

Record Household Equity Exposure

Historically, stocks have reliably outperformed other household asset classes, such as bonds and real estate. Consequently, the current data showing household stock ownership at its highest point in over 80 years bodes well for many Americans nearing retirement.

The Continued Growth of U.S. Markets

The ongoing expansion of the U.S. stock and options markets continues to foster wealth accumulation for households and promotes financial independence. This growth also supports companies in funding their innovation and expansion, which has been a significant factor in market performance in 2024.

Enhanced market efficiency consequently leads to greater investment, job creation, and overall economic health. This is how well-functioning markets can benefit everyone.