Encompass Health Corporation EHC recently announced the opening of The Rehabilitation Institute of St. Louis – West County, at 998 Woods Mill Road. This new 40-bed inpatient rehabilitation hospital is a joint venture (JV) between Encompass Health and BJC HealthCare, one of the largest nonprofit healthcare organizations in the country.

The move strengthens Encompass Health’s partnership with BJC HealthCare, which now includes three hospitals. The new hospital in Ballwin, MO, will help patients recover from amputations, brain injuries, complex orthopedic conditions, spinal cord injuries and strokes and regain function.

Patients are expected to receive at least three hours of intensive therapy five days a week and whole-day nursing care. The move expands EHC’s footprint in the state. It has 162 hospitals in 37 states and Puerto Rico. For 2024 alone, its plan for capacity additions includes six de novos with 280 beds. It plans to add 150 beds to existing hospitals.

Over the 2023-2027 period, Encompass Health plans to add 6-10 de novos, as well as make bed additions in the range of 80-120 per annum. It also targets to bring about a CAGR of 6-8% in discharges in the same time frame. These growth initiatives are expected to help the company address the growing demand for rehabilitation services and penetrate a highly fragmented market.

This will enable the company to capture a greater market share and deliver attractive financial returns. Its growth efforts are boosting patient volumes and discharges, leading to better cash generation. EHC’s net patient revenue per discharge gained 2.8% year over year in the first quarter of 2024.

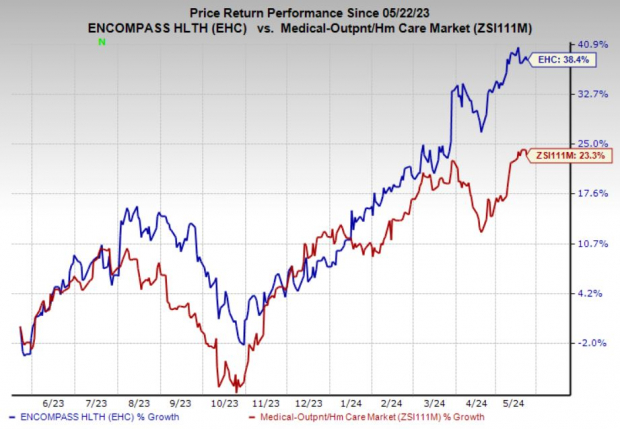

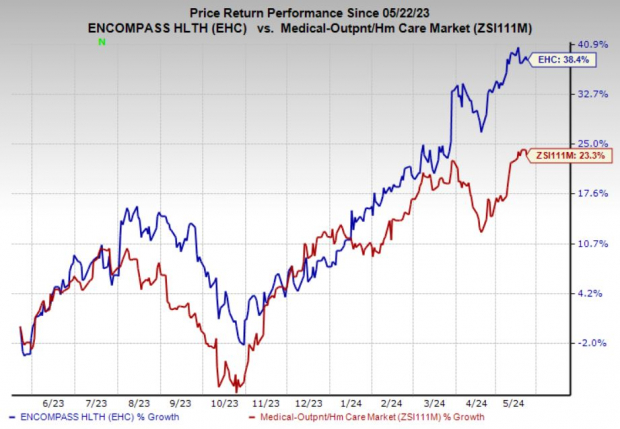

Price Performance

Shares of Encompass Health have gained 38.4% in the past year compared with the 23.3% growth of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Encompass Health currently has a Zacks Rank #2 (Buy). Investors interested in the broader Medical space may look at some other top-ranked players like Sera Prognostics, Inc. SERA, Brookdale Senior Living Inc. BKD and HealthEquity, Inc. HQY, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Sera Prognostics’ 2024 bottom line suggests a 19% year-over-year improvement. SERA‘s average earnings surprise for the past four quarters is at 3.7%. The consensus mark for its current-year revenues indicates a 14.4% year-over-year increase.

The Zacks Consensus Estimate for Brookdale Senior’s full-year 2024 earnings suggests a 38.1% year-over-year improvement. It has witnessed one upward estimate revision over the past month against no movement in the opposite direction. BKD beat earnings estimates in two of the past four quarters and missed on the other occasions.

The Zacks Consensus Estimate for HealthEquity’s current-year earnings implies a 28.9% increase from the year-ago reported figure. HQY beat earnings estimates in each of the last four quarters, with an average surprise of 17.4%. The consensus mark for its current-year revenues is pegged at $1.2 billion, which indicates a 15.5% year-over-year increase.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Sera Prognostics, Inc. (SERA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.