Market Rebounds as Inflation Fears Subside Significantly

What a difference a month can make. In early April, stocks faced a steep decline, entering bear market territory due to concerns that President Trump’s “Liberation Day” tariffs would stall global trade, spark inflation, and trigger a recession. Following the April 2 tariff introduction, stocks plummeted 10% in just two days, a rare occurrence in the last century.

Fast forward to now: With tariff rollbacks and the resumption of trade, the market has experienced one of its most rapid rallies. The S&P 500 surged nearly 20% within a span of just over 20 days.

This upward momentum appears robust and shows no immediate signs of slowing down.

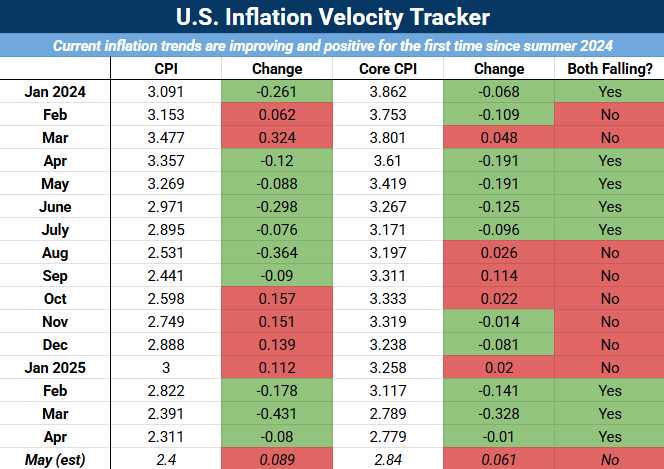

Consider yesterday’s Consumer Price Index (CPI) report, which offered encouraging news. This data not only met expectations but also suggests conditions could be ripe for a significant summer stock rally.

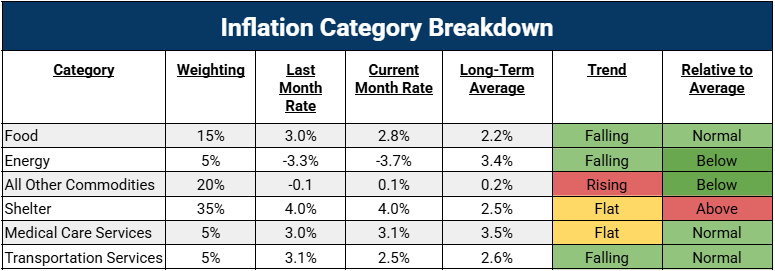

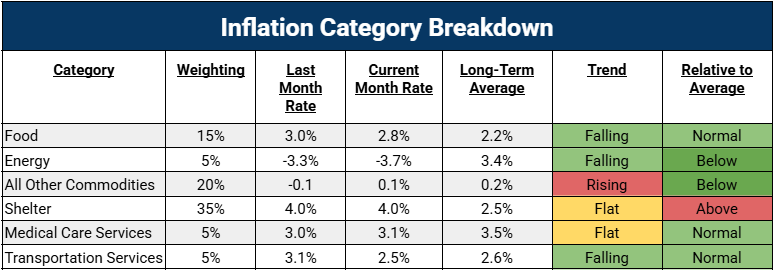

Headline CPI increased by just 0.2% month-over-month, falling short of the 0.3% forecast. Similarly, core CPI rose by only 0.2%, again below estimates. Most major components of the index either cooled or decreased altogether:

- Food price inflation decreased from 3.0% to 2.8% year-over-year

- Energy inflation continued to decline, dropping from -3.3% to -3.7%

- Transportation services inflation fell from 3.1% to 2.5%

While shelter prices remain high, signs of easing are beginning to appear.

In summary, inflation fears have not materialized as anticipated; instead, they have dissipated. This is undoubtedly a positive indicator for the market.

The crucial part? April’s soft inflation figures indicate a reduction in price pressures, signaling the end of one of the market’s biggest concerns this spring: tariff-driven reinflation.

Inflation Concerns Fade Away

After Trump’s imposition of tariffs in early April, many analysts warned of impending price hikes. However, the latest data suggests a different outcome.

CPI inflation was recorded at 2.4% in March, while post-tariff April saw a slight decrease to 2.3%. Currently, the Cleveland Fed’s Nowcasting indicates that real-time data for May is tracking back to 2.4%. It seems that fears of tariff-induced inflation were unfounded.

As for core CPI inflation, it remained stable: 2.8% in March, unchanged at 2.8% in April, and expected to remain at 2.8% in May. This consistency signifies a steady economic climate.

Market Optimism Grows as Inflation Eases and Tariffs Decline

What’s driving this optimism? Despite President Trump’s significant 125% tariff on Chinese imports, recent policy changes have softened the impact.

However, recent developments show a different direction.

Since “Liberation Day,” a 90-day tariff freeze has taken effect. This includes exemptions for auto parts and electronics, a trade deal with the UK, and a truce with China. These moves have reduced the average effective U.S. tariff rate from a high of 30% to a more manageable 13%.

If tariffs at 30% did not lead to reinflation, tariffs at 13% likely won’t either.

This evidence suggests that we can dismiss the reinflation narrative. Current trends indicate tariffs won’t contribute to reinflation in the near future.

Positive Economic Trends Strengthen Bull Market Outlook

With concerns about inflation receding, the market appears primed for a rally.

Let’s examine the current economic landscape:

- Inflation rates are decreasing: As of April, headline inflation fell to 2.3% year-over-year, down slightly from 2.4% in March.

- Tariff reductions are notable: U.S. tariffs on Chinese goods decreased from 145% to 30%, while Chinese tariffs on U.S. goods fell from 125% to 10%.

- Trade agreements are advancing: The recent U.S.-UK trade deal focuses on security cooperation, while the U.S. and China have signed an initial agreement to reduce tariffs and halt retaliation.

- The Federal Reserve may cut rates: There are expectations for two rate cuts in 2025, with the current federal funds rate set between 4.25% and 4.50%.

- Consumer spending remains resilient: Data from Bank of America reports a 1.6% annualized increase in consumer spending for April 2025, reflecting stability.

- Corporate earnings look robust: Analysts project S&P 500 earnings growth rates of 6.4% to 8.8% for the second through fourth quarters of 2025, with an annual growth estimate at 9.7%.

- AI stocks are performing well:

- Nvidia (NVDA) shares rose by 3% in premarket trading due to a new AI chip contract, boosting its market cap above $3 trillion.

- AMD (AMD) stock surged 5.5% following a $6 billion buyback announcement and a $10 billion joint venture with Saudi-backed firm Humain.

- Palantir (PLTR) shares hit all-time highs, climbing 2% premarket after an 8% gain, fueled by enthusiasm for AI and tariff reductions.

When combined, these factors create what could be termed a ‘no-brainer bull market’ setup.

The Final Analysis: Soft CPI Supports Potential Market Growth

The market’s technical indicators align with this positive macroeconomic environment.

The S&P 500 has risen 17% over just 23 trading sessions. Such rapid gains have occurred only seven times since World War II, each time signaling the start of a major bull market.

This sentiment echoes periods such as late 1998, spring 2009, and summer 2020. Investors who recognized the signals during those times were well positioned for significant returns.

# Investors Should Focus on AI Stocks Amid Easing Economic Conditions

Investors are encouraged to consider AI stocks at this moment.

These companies stand to gain significantly from the easing economic conditions.

Recent economic indicators, particularly April’s CPI report, have alleviated crucial barriers to a potential market rally. This report is pivotal as it suggests a combination of easing inflation, declining tariffs, and anticipated interest rate cuts—factors that can drive market growth.

The current market rally appears legitimate. With a clear trajectory ahead, investors are positioned to capitalize on upcoming gains.

Amid this expected surge, a new wave of AI technology—referred to as AI 2.0—is anticipated to dominate headlines and deliver substantial profits in the financial markets.

AI 2.0 transcends traditional improvements like faster chatbots and enhanced spreadsheets. It represents a movement towards integrating intelligence into everyday environments, impacting homes, factories, and urban landscapes. This includes advancements in machines capable of perception and decision-making, identifying companies poised to convert these capabilities into robust revenue streams.

While many focus on AI’s past achievements, astute investors are already considering its forthcoming advancements and implications.

For more insights on leading AI 2.0 opportunities, feel free to reach out with your questions or comments.