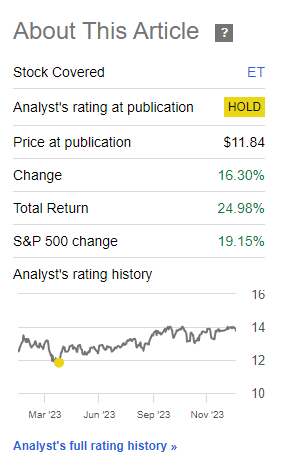

Assessing Performance: ET vs. S&P 500

In the previous update on Energy Transfer (NYSE:ET), a ‘Neutral/Hold’ rating was attached to the security. In the time since, ET has presented a total shareholder return of +24.98%, surpassing the S&P 500’s +19.15%, resulting in a missed opportunity for +5.83% alpha:

Thesis Retraction

A more bullish outlook on Energy Transfer grows, yet awaiting a better discount for purchase holds weight. The decision between ‘buy’ and ‘wait’ teeters on the edge. For now, retaining a ‘Neutral/Hold’ stance is prudent, considering:

- Crestwood serves as a potent acquisition to fortify ET’s portfolio.

- ET’s robust position to exploit NGL export trends.

- A preference for a valuation discount prior to purchase.

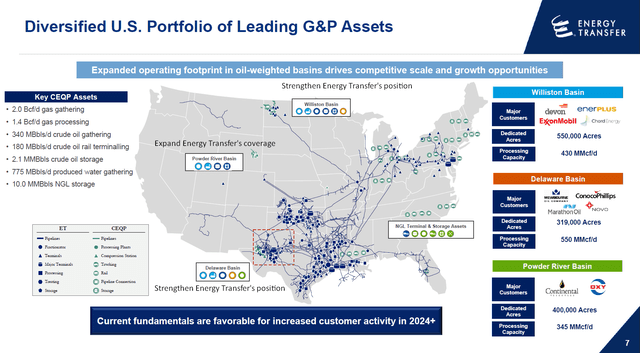

Crestwood: An Upward Acquisition

ET’s rationale for procuring Crestwood Equity Partners’ (NYSE:CEQP) business stands clear. Clarity in capital market transaction rationale is pivotal for M&A or spinoff decisions. Conversely, murky rationale has often undermined positivity in stocks. For instance, TC Energy’s (TRP) spinoff of their liquids pipeline business typifies unclear rationale.

The amalgamated portfolio will bolster ET’s current presence in the Williston and Delaware Basins and facilitate expansion into the Powder River Basin. The company anticipates $40 million of annual cost-saving synergies due to close business overlap. Additionally, the deal augments FCF, crucial for yield-focused investors.

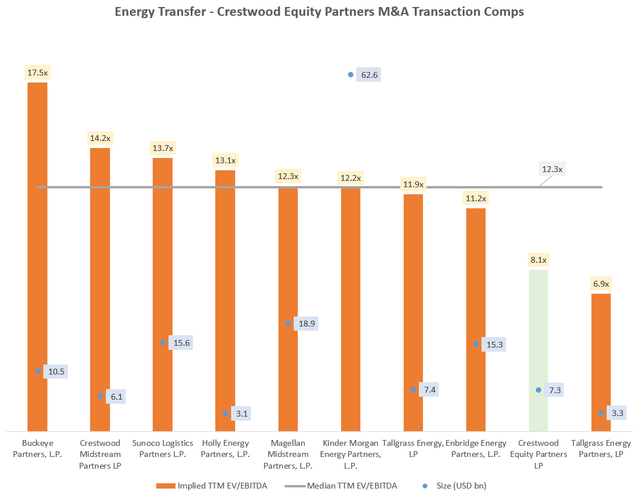

This acquisition, totaling $7.3 billion, is not exorbitant relative to similar M&A transaction multiples. The ET – CEQP deal transpired at a TTM EV/EBITDA of 8.1x, corresponding to a 34% discount to the median transaction multiple of 12.3x. Thus, the risk of overpayment lessens considerably.

ET: Primed for NGL Export Trends

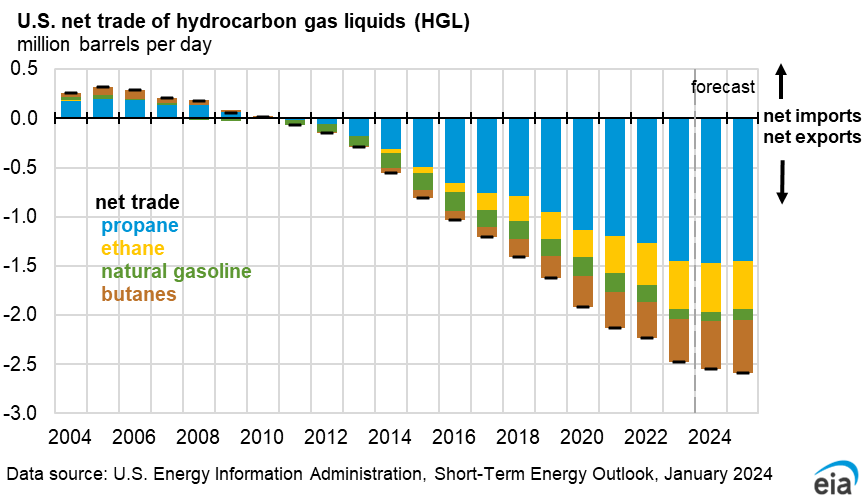

The US Energy Information Administration predicts amplified US exports of hydrocarbon gas liquids in 2024:

Natural gas liquids (NGL) is a subset of hydrocarbon gas liquids.

This bodes well for ET, owning a 20% global market share in NGL exports and 40% in US NGL exports. ET’s co-CEO Thomas Long highlights robust growth in this domain during the Q3 FY23 earnings call:

Total NGL export volumes surpassed a 20% uptick over the third quarter of 2022, marking a new partnership record. This surge was largely spurred by heightened international NGL demand.

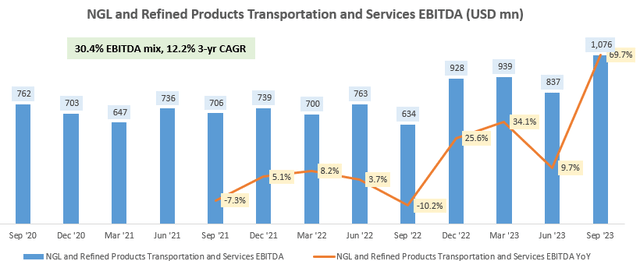

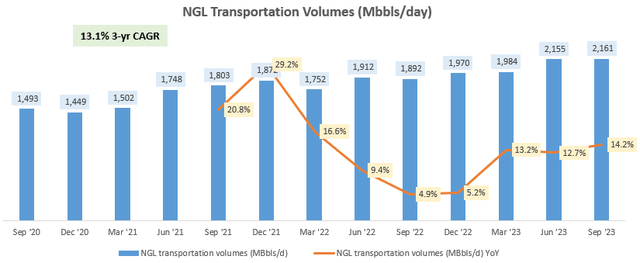

Substantial growth in this segment over several quarters and years is evident:

This sector constitutes 30.4% of overall EBITDA for ET.

NGL transportation volume growth has accelerated notably in 2023. Given the encouraging outlook, this trend is expected to persevere.

Seeking Valuation Discount for Purchase

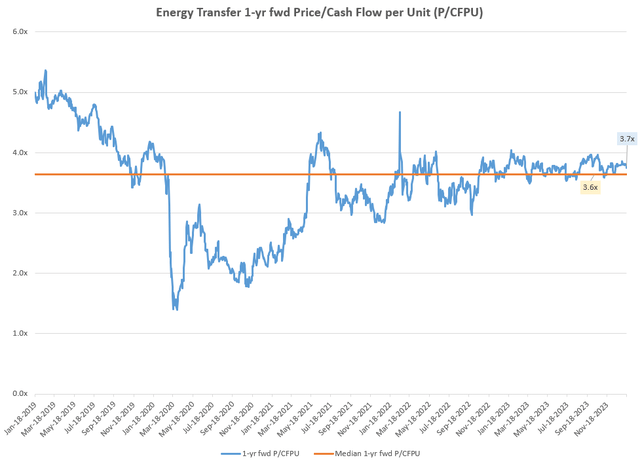

Given the modest variability in cash allocated to unitholders, employing a cash flow multiple for valuation assessment seems fitting. Currently, ET trades at a 1-yr fwd P/Cash Flow per Unit (P/CFPU) of 3.7x, just above the 5-yr median of 3.6x.

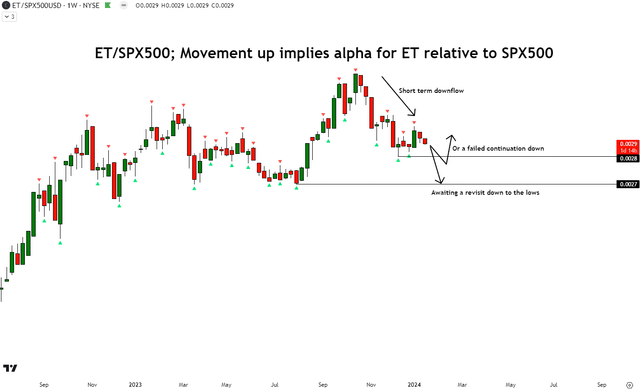

While purchases are justifiable within this range, a bit of a discount is preferred, particularly after considering the technicals:

Analyzing Technicals

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do.

Before delving into the technical analysis,

The Bull’s Eye on Energy Transfer: A Detailed Analysis

Energy Transfer has been under the investment lens, with a dividend yield of 8.99% and potential alpha generation over the S&P 500 (SPY) (SPX). Investors are examining the best deal possible and the company’s alpha potential against the S&P 500.

Examining the relative weekly chart of ET/SPX500, the analysis shows a short-term downflow due to a sequence of lower highs and lower lows. Technical alignment of buys is suggested at specific revisit points.

Leverage and Debt Assessment

ET’s net debt/EBITDA stands at 3.6x as of Q3 FY23, with a target to be in the lower end of 4-4.5x in the future. A mitigating factor could be potential rate cuts in 2024, while Fitch Ratings has granted ET a BBB- credit rating, viewing this favorably.

Insights and Future Prospects

In a previous update, the stance on Energy Transfer was ‘Neutral/Hold’, having missed out on +5.83% alpha over the S&P 500 (SPY) (SPX). The acquisition of Crestwood Equity Partners (CEQP) adds strategic value, solidifying existing market positioning and enabling entry into new basins. The transaction was made at a reasonable multiple below the median of comparable transactions, reducing the risk of a capital allocation blunder. From an operational perspective, the bullish growth outlook for US NGL exports, wherein ET holds 40% market share, adds to its potential. Valuation-wise, ET is trading close to its 5-yr 1-yr fwd price to cash flow per unit multiple. Despite the promising technicals possibly suggesting an opportunity to accumulate at lower prices, a cautious approach is being adopted.

Stance: ‘Neutral/Hold’

Deciphering Hunting Alpha’s Ratings:

Investment stance:

Strong Buy: Outperformance of the S&P 500 with higher than usual confidence

Buy: Outperformance of the S&P 500

Neutral/Hold: In-line performance with the S&P 500

Sell: Underperformance against the S&P 500

Strong Sell: Underperformance with higher than usual confidence

The typical time-horizon for investment views is multiple quarters to around a year. Updates on changes in stance will be shared in a pinned comment to this article, and new articles may also be published to discuss the reasons for the changes in view.