Brightcove Upgraded to Buy: Analysts See Significant Growth Ahead

Analysts Predict a Rosy Future for Brightcove

Fintel reports that on November 5, 2024, Lake Street upgraded their outlook for Brightcove (NasdaqGS:BCOV) from Hold to Buy.

Price Target Suggests Potential for 54.70% Increase

As of October 22, 2024, the average one-year price target for Brightcove stands at $3.95 per share. This target ranges from a low of $2.78 to a high of $5.25, indicating a potential rise of 54.70% from its most recent closing price of $2.56 per share.

Discover more about companies with the strongest price target upside on our leaderboard.

Financial Projections Highlight Positive Outlook

Brightcove is projected to generate annual revenue of $232 million, marking an increase of 15.95%. The anticipated annual non-GAAP earnings per share (EPS) is set at 0.35.

Fund Sentiment Shows Mixed Trends

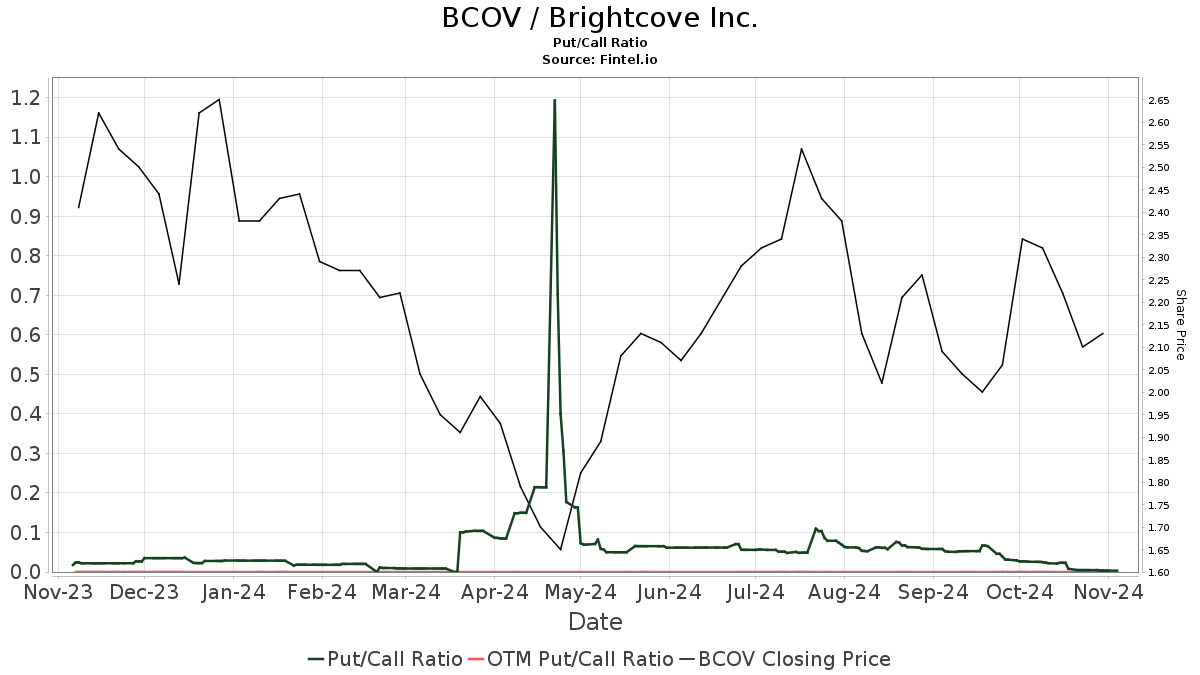

Currently, 207 funds or institutions are holding positions in Brightcove, a decrease of 9 owners or 4.17% in the last quarter. The average portfolio weight of all funds in BCOV has increased by 60.27% to 0.09%, though total shares held by institutions have dropped by 4.63% to 34,564K shares.  The put/call ratio for BCOV is 0.00, suggesting a generally bullish outlook among investors.

The put/call ratio for BCOV is 0.00, suggesting a generally bullish outlook among investors.

Key Shareholders Showing Activity

Edenbrook Capital owns 6,531K shares, equating to 14.54% of the company. Their recent filing indicates an increase from 6,435K shares, which is an increase of 1.47%. The firm’s portfolio allocation in BCOV grew by 98.10% in the last quarter.

Lynrock Lake holds 4,408K shares, representing 9.81% ownership. This is up from 4,308K shares reported previously, marking a 2.27% increase as they ramped up their BCOV allocation by 53.09% over the last quarter.

Trigran Investments saw a decrease in shares, holding 3,487K, down from 3,721K, representing a 6.73% drop, and reducing their allocation in BCOV by 51.70% this past quarter.

180 Degree Capital holds 1,361K shares, down slightly from 1,384K shares a quarter ago, reflecting a 1.68% decline. Despite this, they increased their allocation by 37.65% last quarter.

Nantahala Capital Management made a significant move, holding 1,314K shares now compared to 0 shares previously, which indicates a substantial increase of 100.00% in their ownership.

About Brightcove

Brightcove Background Information

(This description is provided by the company.)

Founded in 2004, Brightcove has transformed how organizations utilize video. Through its innovative technology, the company empowers clients in over 70 countries to engage their audiences in captivating and effective ways. Brightcove’s success stems from pushing technological boundaries, offering unparalleled customer support, and leveraging a robust global infrastructure. Video remains one of the most compelling mediums available today.

Fintel is a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global fundamentals, analyst reports, ownership insights, fund sentiment, options analysis, insider trading, and more. Additionally, we provide exclusive stock picks powered by advanced quantitative models for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.