Shareholders of Allegion plc (Symbol: ALLE) can enhance their income by selling a June 2026 covered call at a $180 strike price, receiving a premium of $3.50. This strategy offers an annualized return of 4.3%, which, combined with the current 1.3% dividend yield, totals approximately 5.6% annually. If the stock rises above $180, shareholders would forfeit additional gains, but a potential price increase of 11.4% indicates a total return of 13.6% if called away.

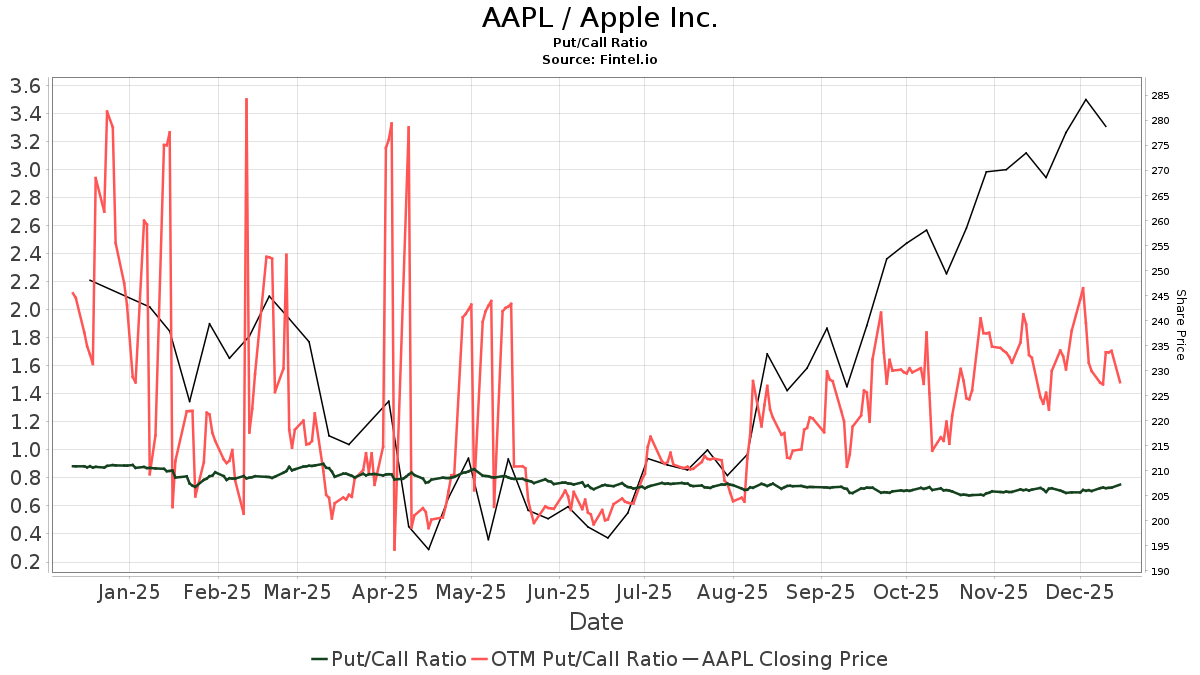

As of mid-afternoon trading on Wednesday, Allegion’s stock price was recorded at $160.85, with a trailing twelve-month volatility of 25%. In overall options trading for S&P 500 components, call volumes reached 1.65 million against 859,788 puts, resulting in a put-to-call ratio of 0.52, signaling a strong preference for call options among buyers.