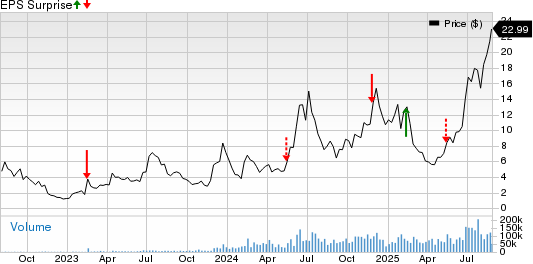

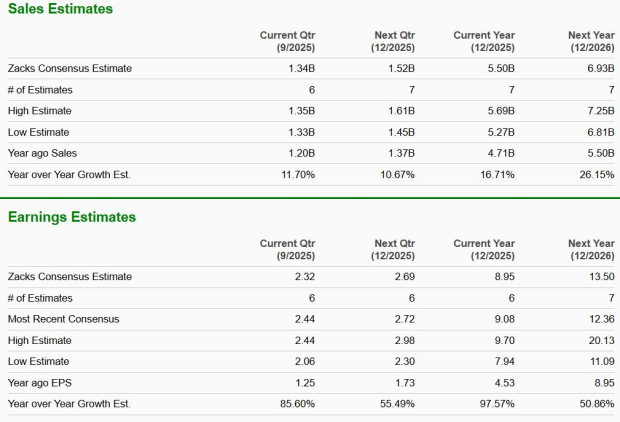

Shareholders of NetApp, Inc. (NTAP) can enhance their income through a covered call strategy by selling a January 2027 call option with a $150 strike price, which has a bid premium of $5.00. This approach could yield an additional 3.3% annualized return, bringing the total potential return to 5.1% if the stock is not called away. For the stock to be called, NTAP would need to rise 35.6%, resulting in a total return of 40.1% from the current trading level of $110.59.

As of mid-afternoon trading on Wednesday, the put volume among S&P 500 components stood at 682,557 contracts, while call volume reached 1.38 million contracts, marking a put-to-call ratio of 0.49. This indicates a higher preference for calls, as the long-term median put-to-call ratio is 0.65.