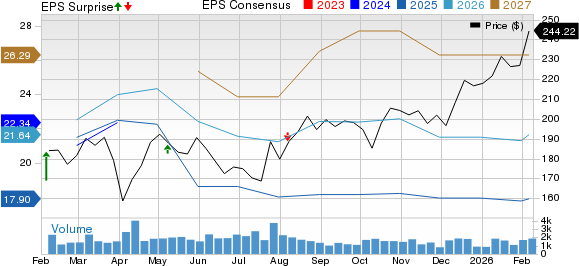

Shareholders of Paycom Software Inc. (NASDAQ: PAYC) can enhance their income by selling a December 2027 covered call at a $210 strike price, which could yield an annualized return of 6.9%, resulting in a total of 7.8% if the stock remains uncalled. The current stock price is $164.38, indicating a potential 27.3% increase for the stock to reach the call price. If called, shareholders would realize a 40.9% return from the current trading level, plus any dividends received prior to the stock being called.

As of Monday afternoon, Paycom’s stock volatility stands at 35%, calculated over the last 249 trading days. In broader market activity, S&P 500 put volume was recorded at 958,732 contracts, while call volume reached 2.08 million, resulting in a put-to-call ratio of 0.46, indicating a strong preference for call options among traders.