Installed Building Products Offers Covered Call for Enhanced Income

Installed Building Products Inc (Symbol: IBP) shareholders can increase their income by selling a December covered call at the $195 strike. This move allows investors to collect an $8.20 premium, which annualizes to a 9.5% return based on the current stock price, bringing the total potential yield to 10.4% if the stock is not called away.

Should IBP shares rise above $195, any gains beyond that price would be forfeited. The stock would need to increase by 25.7% for this scenario to occur, resulting in a 31% total return for shareholders, in addition to collected dividends.

Dividend amounts can fluctuate, reflecting the company’s profitability. Examining IBP’s dividend history is crucial for assessing the sustainability of the current 0.9% annualized dividend yield.

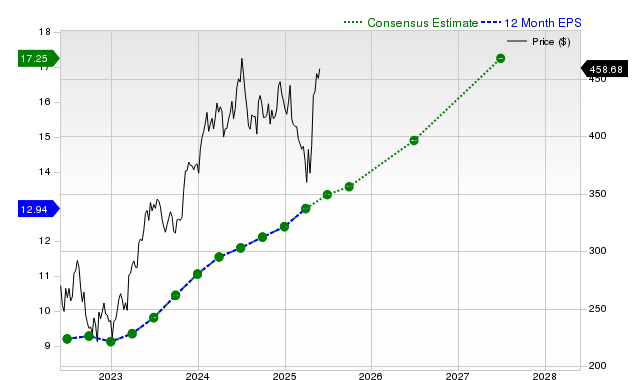

Additionally, the chart below highlights IBP’s trailing twelve-month trading history, noting the $195 strike in red:

Analyzing both the chart and IBP’s historical volatility is essential for evaluating the risk and reward of selling the December covered call. The trailing twelve-month volatility for Installed Building Products is calculated at 47%, considering the last 250 trading days and the current price of $155.45. For alternative call options and expiration dates, visit the IBP Stock Options page on StockOptionsChannel.com.

As of mid-afternoon trading on Thursday, S&P 500 put volume reached 1.32 million contracts, while call volume was 2.28 million. This results in a put-to-call ratio of 0.58, indicating higher call volume relative to puts. Investors are currently favoring calls in options trading today.

![]() Top YieldBoost Calls of the S&P 500

Top YieldBoost Calls of the S&P 500

Additional Resources:

- Electronics Stores Dividend Stocks

- AEHL Shares Outstanding History

- TPIC Shares Outstanding History

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.