Wix.com Expands E-Commerce Reach with New YouTube Integration

Wix.com Ltd. WIX has launched a new integration with YouTube Shopping, enabling merchants to sell their products directly on the platform. This update builds off Wix’s existing partnership with Google Shopping and allows merchants to create dedicated store displays on their YouTube profiles, enhancing their social shopping capabilities.

Through this integration, merchants can now tag products during YouTube videos, live streams, and shorts, which increases visibility and audience engagement. Products are visible in the YouTube store tab, simplifying the purchasing process for viewers. Additionally, Wix synchronizes product details, such as descriptions and images, across both platforms, while merchants can track shopping behavior using YouTube’s analytics tools.

Easy Management and Enhanced Features for Merchants

Wix emphasized how this integration could help businesses broaden their reach and engage audiences on a widely used social platform. Merchants are able to manage YouTube Shopping through the Google & YouTube Sales Channels section in the Wix dashboard, utilizing features such as product tagging and drops. Wix supports these efforts by managing backend processes like inventory control and checkout.

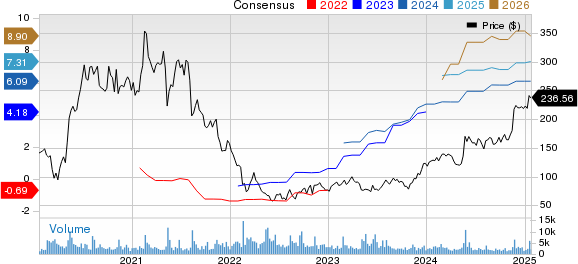

Wix.com Ltd. Price and Consensus

Wix.com Ltd. price-consensus-chart | Wix.com Ltd. Quote

Based in Tel Aviv, Israel, Wix is a cloud-based platform focused on web development. The company provides solutions that empower businesses, organizations, and individuals to create customized websites and applications to enhance their online presence.

Wix’s E-Commerce Growth and AI Innovations Signal Strong Future

Wix is capitalizing on substantial e-commerce growth, utilizing its cloud technology to adapt to merchants’ changing needs as social media, mobile devices, and data analytics evolve the shopping landscape. According to a report by Mordor Intelligence, the global e-commerce market is projected to reach $10.19 trillion by 2025 and $21.22 trillion by 2030, growing at a rate of 15.8% annually during that period.

The company’s focus on generative artificial intelligence (AI) also indicates a promising growth avenue. Wix has introduced 29 AI business assistants to date, enhancing operational efficiency and customer conversion rates. Notably, on December 11, 2024, Wix launched AI Site-Chat, a virtual assistant that aids businesses in engaging visitors at all hours, responding to inquiries, and providing real-time information. This technology not only enhances customer experiences but also has the potential to increase sales.

Positive Indicators for Financial Performance

Wix experienced strong booking growth, driven by increased demand for Studio subscriptions and commerce activity. A significant portion of new partner bookings is attributed to Studio accounts as more agencies choose Wix for their projects. The usage of Wix Payments among registered users has consistently risen each quarter throughout 2021 and continued this upward trend into the third quarter of 2024. Following robust third-quarter results, management has revised its 2024 outlook for bookings, revenues, and free cash flow. Revenue expectations have increased to $1,757-$1,764 million, up from the prior guidance of $1,747-$1,761 million.

Wix’s Stock Performance and Zacks Rank

WIX currently holds a Zacks Rank #2 (Buy). The company’s stock has surged by 86.4% over the past year, outpacing the industry’s growth of 12.1%.

Image Source: Zacks Investment Research

Stocks Worth Watching

Among other high-ranking stocks in the tech sector, BlackBerry Limited (BB), InterDigital, Inc. (IDCC), and Amazon.com, Inc. (AMZN) are noteworthy. BB and IDCC both hold a Zacks Rank #1 (Strong Buy), while AMZN carries a Rank #2. For a comprehensive list of today’s top Zacks stocks, visit our site.

BlackBerry has consistently exceeded Zacks Consensus Estimates in the last four quarters, achieving an average surprise of 131.25%. In its latest quarter, BB recorded an impressive earnings surprise of 200%, leading to a 72.7% increase in share price over the past six months.

For InterDigital, the Zacks Consensus Estimate for 2024 earnings per share (EPS) is set at $15.19, remaining steady over the past month. The company has outperformed Zacks Consensus Estimates in the last four quarters, with an average surprise of 163.7%. Its long-term earnings growth rate stands at 15%, and shares have surged 45.2% in the past six months.

Lastly, Amazon’s 2024 EPS estimate is $5.29, unchanged in recent days. Similar to its peers, AMZN has surpassed earnings expectations in each of the trailing four quarters, posting an average surprise of 25.85%. The company boasts a long-term earnings growth rate of 28.2%, with shares increasing by 49.3% over the last year.

Zacks Identifies #1 Semiconductor Stock

Identified as a top stock, this company is much smaller than NVIDIA, which skyrocketed by over 800% since our recommendation. Despite NVIDIA’s continued momentum, this new semiconductor stock has significant potential for growth.

Strong earnings growth and a growing customer base position it well to meet the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The worldwide semiconductor manufacturing market is expected to expand from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Interested in the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days and access this free report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.