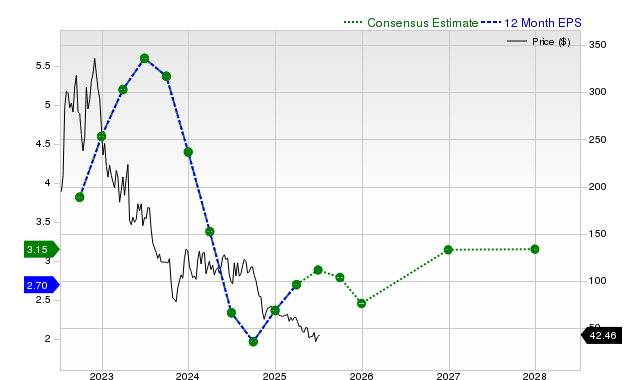

Enphase Energy (ENPH) reported a significant decline in its stock performance, returning -7.6% over the past month, while the S&P 500 composite rose by +3.2%. The company is part of the Zacks Solar industry, which gained 12.9% during the same period. For the current quarter, analysts estimate earnings of $0.51 per share, down 65.3% year-over-year, with a consensus estimate of $2.93 for the fiscal year, representing a decrease of 33.6% from the previous year.

The consensus sales estimate for the current quarter is $309.92 million, reflecting a 56.4% decline year-over-year. Last reported revenues were $263.34 million, down 63.7% from the same period last year, with an EPS of $0.35 compared to $1.37 a year ago. Enphase Energy holds a Zacks Rank #3 (Hold), indicating it may perform in line with the broader market.

For the next fiscal year, the consensus earnings estimate of $4.93 suggests a recovery with a growth of 68.3% compared to the prior year. The company’s valuation score is graded as D, indicating it is trading at a premium compared to its peers.