“`html

Understanding Economic Moats: A Key to Smart Investing in AI

Hello, Reader.

Just like castles rely on strong defenses, successful companies depend on an “economic moat.” This concept, popularized by Warren Buffett, refers to the competitive edges that protect firms from rivals and ensure lasting profitability.

Buffett defines a great business as one that has an enduring moat to safeguard its returns. He noted that the forces of capitalism will continually challenge any business earning strong profits. Thus, having a substantial barrier—like being the low-cost leader or having a globally recognized brand—is crucial for long-term success.

A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital… The dynamics of capitalism guarantee that competitors will repeatedly assault any business ‘castle’ that is earning high returns…

Therefore, a formidable barrier such as a company’s being the low-cost producer… or possessing a powerful worldwide brand… is essential for sustained success.

Buffett emphasizes that a solid moat not only shields a company during tough times but also allows for expansion and increased profit margins when the economy thrives. He seeks companies with strong defenses capable of fending off competitive “sharks.”

Reflecting on the dot-com boom of the early 2000s reveals that many of those high-growth stocks lacked a true competitive moat and financial strength. Consequently, many companies vanished as quickly as they appeared.

Many current players in the artificial intelligence sector are similarly at risk. Even those with proprietary AI technologies may face fierce competition from firms with stronger moats. While investing in companies building their moats can be appealing, these firms remain susceptible until they solidify their advantages.

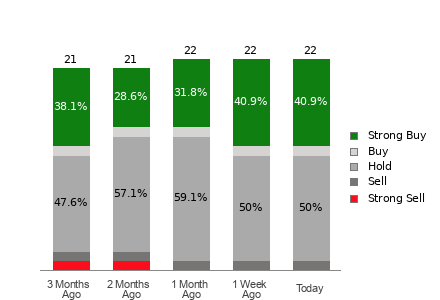

Investors should carefully evaluate the moats of prospective companies. Given today’s high stock market valuations, any dip may impact all stocks significantly.

Despite the risks, the transformative potential of AI offers remarkable investment prospects. Our goal is to seize these opportunities wisely.

This may involve investing in AI-focused firms, even if they haven’t fully established their moats. Such investments could yield high rewards, but they also carry more risk.

Therefore, alongside AI-specific companies, I suggest considering:

- Companies utilizing AI technologies in their operations.

- Companies operating in sectors where AI cannot easily, or ever, take over.

As I previously noted in the July issue of Fry’s Investment Report…

One of the best ways to invest in AI may be to invest in what it isn’t. Instead, invest in the industries or assets that AI could never replace.

No matter how intelligent AI becomes, for example, it will never morph into timberland. It will never sprout into a lemon tree or transform itself into an ocean freighter, platinum ingot, espresso bean, or stretch of sandy beach.

A select few industries are so “future-proof” that they deserve our attention… and a place in our portfolios…

These are things that an AI-centric world will require, no matter how intelligent it becomes.

A short list of examples might include industries like…

- Shipping

- Cosmetics

- Lumber

- Energy Generation and Storage

- Travel

- Sporting Goods

- Rail Transit

- Agriculture

While these industries may not be entirely immune to AI advances, they are relatively protected.

In my October issue of Fry’s Investment Report, I highlighted a unique energy opportunity tied closely to AI advancements. This investment is an ETF that encompasses a mix of uranium companies—those currently producing and those preparing to enter the market. With a resurgence in nuclear energy, uranium is experiencing a new bull market.

To discover more about this recommendation, click here to learn about Fry’s Investment Report today.

Smart Money Roundup

AI’s Impact on Longshoremen: Jobs at Risk

AI is both beneficial and harmful. It poses a threat to job security, as seen when dockworkers recently went on strike, demanding better wages and protections from AI automation. Let’s analyze this situation and what it reveals about the ongoing AI revolution.

Investing in Transformative Autonomous Vehicle Technology

“`

Tesla Introduces Cybercab: A Step Toward the Future of Ride-Hailing

On Thursday, Tesla CEO Elon Musk unveiled the Cybercab robotaxi during the company’s “We, Robot” event. According to my InvestorPlace colleague Luke Lango, this announcement could signal a major shift, making robotaxis and other autonomous vehicles mainstream by 2025. He has identified a method to profit from this upcoming revolutionary change.

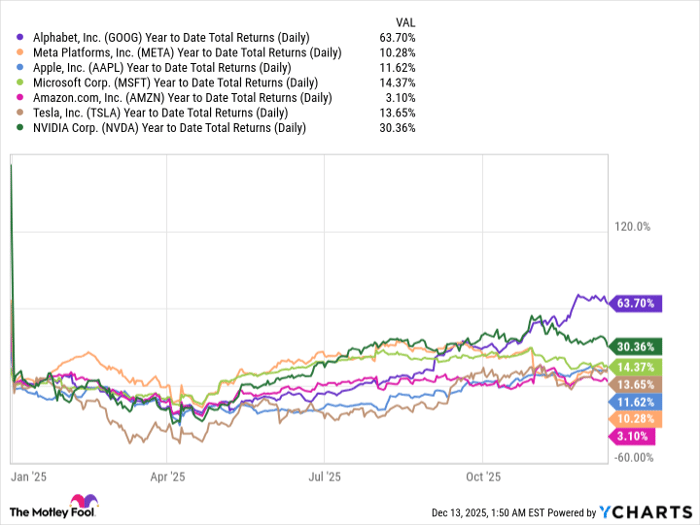

Autonomous Vehicles: Tesla’s Plans vs. AMD’s Current Success

The rise of Autonomous Vehicles is here. In a recent guest issue, Luke Lango shared his experiences with Waymo, a self-driving branch of Alphabet. The advances the company is making are impressive, yet it is not the only player in this transformative space. As autonomous vehicles gain popularity, significant investment opportunities are emerging. Click here to read more.

A New Financial Era is Starting – Discover Your Next Investment

Louis Navellier, an InvestorPlace colleague, anticipates a market “reset” that may provide fresh investment chances. This reset could arrive soon, impacting various sectors like travel and energy, where emerging AI applications may yield substantial returns.

What Lies Ahead

Louis Navellier forecasts a significant shift in AI stocks, suggesting that even unexpected stocks could start to soar this year. Meanwhile, well-known companies in your portfolio could face setbacks or struggle throughout 2024.

Being informed about these trends may lead to meaningful opportunities for gains in the upcoming year. Louis dives deeper into this topic and more in this essential broadcast.

We will further explore this evolving financial landscape later this week. Stay tuned.

Regards,

Eric Fry, Smart Money