EOG Resources Inc EOG reported robust first-quarter 2024 results, with both earnings and revenues beating the Zacks Consensus Estimate.

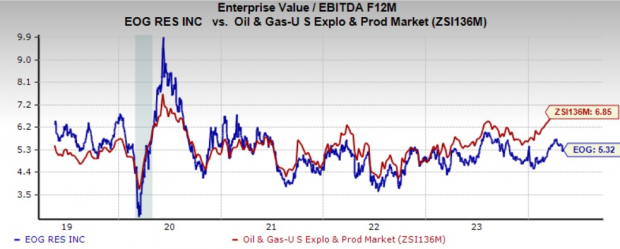

Although the quarterly results were strong, the stock price has dipped 1% since its earnings release on May 2, a movement unrelated to the company’s fundamentals. It is cheap now, and the current affordability of the stock is evident from its trailing 12-month enterprise value-to-EBITDA (EV/EBITDA) ratio, which stands at 5.32, notably lower than the Zacks US Oil & Gas Exploration & Production industry average of 6.85.

Image Source: Zacks Investment Research

Before delving into the recently reported quarterly results, let’s understand the large crude oil and natural gas exploration and production company’s business.

Upstream Business Overview

In the United States, EOG Resources is among the largest upstream energy players, having its proved reserves across the United States and the Republic of Trinidad and Tobago (Trinidad).

EOG prioritizes positioning itself as one of the top oil and gas producers in terms of high returns, low costs and minimal emissions, playing a pivotal role in shaping the future of energy. Notably, it aims for net zero scope 1 and scope 2 GHG emissions by 2040.

Robust Q1 Results

EOG Resources, carrying a Zacks Rank #2 (Buy), reported first-quarter adjusted earnings per share of $2.82, which beat the Zacks Consensus Estimate of $2.70. The bottom line also increased from the year-ago quarter’s level of $2.69.

Total quarterly revenues of $6.1 billion beat the Zacks Consensus Estimate of $5.9 billion. The top line also surpassed the prior-year quarter figure of $6.04 billion.

Higher oil equivalent production volumes primarily aided the crude and gas explorer’s strong quarterly results.

Operational Performance

In the quarter under review, EOG Resources’ total volumes increased 10.2% year over year to 93.6 million barrels of oil equivalent (MMBoe), primarily on higher U.S. production. The figure also beat our estimate of 92.4 MMBoe.

Crude oil and condensate production totaled 487.4 thousand barrels per day (MBbls/d), up 6.5% from the year-ago quarter’s level and beating our estimate of 484 MBbls/d.

Natural gas liquids (NGL) volumes increased 9.2% year over year to 231.7 MBbls/d, also outpacing our estimate of 226.4 MBbls/d.

Natural gas volume increased to 1,858 million cubic feet per day (MMcf/d) from the year-earlier quarter’s level of 1,639 MMcf/d. The reported figure surpassed our estimate of 1,830.1 MMcf/d.

The average price realization for the company’s crude oil and condensates increased 1.5% year over year to $78.45 per barrel. Natural gas was sold at $2.26 per Mcf, however, indicating a year-over-year decline of 35.6%. Quarterly NGL prices decreased to $24.32 per barrel from $25.67.

Performance of Other Energy Giants

Exxon Mobil Corporation XOM and Chevron Corporation CVX are the two integrated energy giants that have already reported first-quarter earnings. While ExxonMobil missed the Zacks Consensus Estimate of earnings for the first quarter, Chevron beat the consensus mark for the same.

One of the largest integrated energy firms, Shell plc SHEL, has also reported earnings. The company said that it has once again achieved a quarter marked by robust financial and operational performance. Apart from reducing emissions, Shell is also showcasing its strong commitment to generating handsome value for shareholders.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.