EPAM Systems‘ stock shot up 8% on Thursday following its release of fourth-quarter 2023 results, which surpassed expectations. The company reported non-GAAP earnings of $2.75 per share, outperforming the Zacks Consensus Estimate of $2.51. Although this figure represented a 6.1% decrease year over year, it exceeded market expectations.

EPAM’s revenues also impressed, coming in at $1.16 billion, exceeding the consensus mark of $1.14 billion. However, the top line experienced a 6% year-over-year decline. Notably, when factoring in EPAM’s withdrawal from the Russian market, the constant-currency basis illustrated a 7.1% decrease year over year.

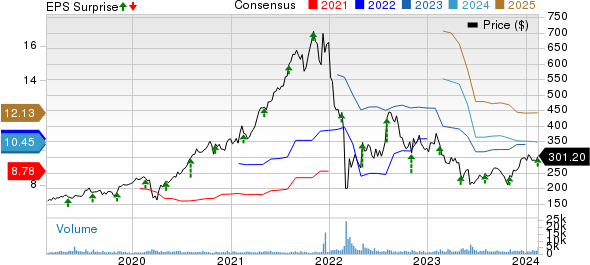

EPAM Systems, Inc. Price, Consensus, and EPS Surprise

EPAM Systems, Inc. price-consensus-eps-surprise-chart | EPAM Systems, Inc. Quote

EPAM’s revenue generation exhibited geographical variations. The company derived 58.4% of its total revenues from the Americas, signaling a 7.6% year-over-year decline. The EMEA region, contributing 39.2% to total revenues, saw a 0.3% year-over-year decrease. Sales in the Asia Pacific region, accounting for 2.3% of revenues, declined by 10.9% year over year. Central and Eastern Europe, representing 0.1% of revenues, experienced a substantial 91.6% year-over-year plunge.

Quarterly Details

Segment-wise, Business Information & Media declined by 14.8% year over year to $178 million, comprising 15.4% of the company’s revenues. Financial Services decreased by 7.1% year over year to $242.3 million, accounting for 20.9% of revenues. Software & Hi-Tech dropped by 16.8% to $169 million, and Travel & Consumer declined by 4.4% to $258.2 million. Life Science & Healthcare, however, jumped 11.6% year over year to $140 million, comprising 12.1% of revenues. The Emerging Verticals segment improved by 4.2% year over year to $169.7 million and contributed 14.7% to the revenues.

Furthermore, EPAM’s non-GAAP gross profit declined by 9% to $382 million while the gross margin expanded by 110 basis points to 33%. The non-GAAP operating income also witnessed a decrease of 8.7% year over year to $200.4 million. The non-GAAP operating margin contracted by 50 basis points to 17.3%.

Balance Sheet and Cash Flow

As of December 31, 2023, EPAM reported cash, cash equivalents, and restricted cash of $2.04 billion, marking an increase from $1.88 billion as of September 30, 2023. The long-term debt stood at $26.1 million, down from $27.5 million as of September 30, 2023.

In the fourth quarter of 2023, EPAM generated operating and free cash flows of $171.4 million and $161.4 million, respectively. Throughout fiscal 2023, the company generated operating and free cash flows of $562.6 million and $534.2 million, respectively.

Guidance

For the first quarter of 2024, EPAM provided a revenue guidance range of $1.155 billion to $1.165 billion, indicating a year-over-year decline of 4% at the midpoint. Management projects the non-GAAP operating income in the range of 13.5-14.5% of revenues. Non-GAAP earnings are expected to range between $2.26 and $2.34 per share.

Looking ahead to 2024, EPAM forecasts a revenue growth rate in the range of 1-4% and anticipates non-GAAP operating income to range between 14.5-15.5% of revenues. Non-GAAP earnings per share are projected in the range of $10.00-$10.40. The company expects 59.3 million weighted average diluted shares outstanding for 2024, with a non-GAAP tax rate of 24% for both the first quarter and fiscal 2024.

Zacks Rank and Stocks to Consider

As of now, EPAM holds a Zacks Rank #3 (Hold). Over the past year, EPAM’s shares have struggled, declining by 10.9%.

Therefore, in the broader technology sector, investors may consider exploring other options such as BlackLine (BL), Dell Technologies (DELL), and Arista Networks (ANET), each currently holding a Zacks Rank #2 (Buy).

Efforts by the companies are reflected in the performance of their stocks. For instance, BlackLine’s shares have witnessed a 16.2% decline, while Dell’s shares have surged by 94.7% and Arista Networks’ shares have rallied by 92.8% over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

EPAM Systems, Inc. (EPAM) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.