Equity Commonwealth’s Preferred Shares Show Resilience Amid Market Movements

On Thursday, Equity Commonwealth’s 6 1/2% Series D Cumulative Convertible Preferred Shares (Symbol: EQC.PRD) yielded over 6.5%, based on its annualized quarterly dividend of $1.625. During the trading session, shares dipped as low as $24.97, contrasting with an average yield of 8.54% found in the preferred stock segment of the REITs category, as reported by Preferred Stock Channel. Notably, EQC.PRD traded at a 1.48% premium to its liquidation preference, compared to an average 26.52% discount within the same REITs category. These preferred shares are also convertible, with a conversion ratio of 1.9231.

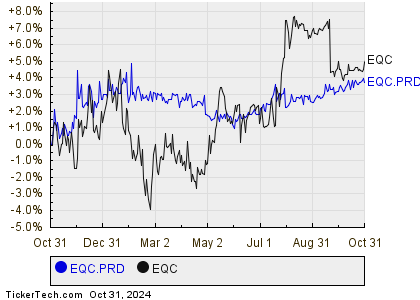

The accompanying chart illustrates the performance of EQC.PRD over the past year, alongside Equity Commonwealth’s common shares (Symbol: EQC).

A historical overview of dividends paid on the 6 1/2% Series D Cumulative Convertible Preferred Shares is shown in the chart below:

Discover Top 8%+ Monthly Dividends

In the latest trading, EQC.PRD saw an increase of about 0.3%, while the common shares of Equity Commonwealth (Symbol: EQC) experienced a slight decrease of approximately 0.5%.

Related Insights:

- Top Ten Hedge Funds Holding IMCB

- INPH Insider Buying

- Top Ten Hedge Funds Holding LBAY

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.