Overcoming Investing Biases for Financial Success

Editor’s Note: Our offices will be closed on Monday for Memorial Day to honor those who served in the military. Customer Service will assist you when we reopen on Tuesday at 9 a.m. Eastern time.

Have you ever encountered a headline that made you frustrated with your own investing choices? You know the ones.

“TSLA up 1,200% since 2019…”

“Nvidia breaks $1 trillion market cap…”

And all you can think is: “I saw that. I knew that. Why didn’t I act? I missed it!”

It’s a common experience. You learn about a new megatrend or a company with groundbreaking technology, and you tell yourself, “That’s interesting. I’ll keep an eye on it to see if I want to invest.”

Then life intervenes. The market fluctuates, and things begin to feel uncertain.

Months later, that once “little idea” has catapulted select stocks, making other investors wealthy while you remained inactive.

Just this week, I experienced one of those moments with quantum computing stocks. Numerous headlines about IONQ caught my attention.

Another notable mention was D-Wave:

Last year, both quantum computing companies were on my radar, yet I failed to take action.

However, there is good news: The market always provides another opportunity.

One of the most successful growth investors over the last 40 years has suggested that your next opportunity may be unfolding right now.

Don’t Let Headlines Drive Your Investment Decisions

Just because headlines are buzzing about a certain trend or group of stocks does not mean you should let them dictate your investment choices. Consider the recent market decline following President Donald Trump’s Liberation Day press conference.

During that drop, many investors fled the market to avoid further losses. When the news turns negative, investors typically react by seeking safety in numbers. They tend to sell low and wait for media signals to feel optimistic again. Worse, they rush into whatever stocks bounced the most the day before.

In this Digest, we’ve extensively discussed how our brains are wired to exhibit this behavior—known as crowd-seeking bias.

This instinct has been encoded in humans for tens of thousands of years. Imagine being part of a hunter-gatherer tribe on the move to find new fresh water.

Along the way, you see a group of terrified neighboring tribespeople running in panic. Your innate reaction is to flee because, clearly, something is wrong, even if you can’t see the danger.

This survival instinct is the underlying reason for our tendency to flock to crowds. Today, we understand that having a strong social network contributes to longer and healthier lives.

However, these emotions do not necessarily lead to wealth in the stock market.

Strategies to Overcome Your Investing Biases

To break free from these biases, it’s essential to develop a disciplined investment strategy. Research, data analysis, and a long-term outlook can guide your decisions more effectively than fleeting headlines.

# Strategic Stock Picks Amid Market Uncertainty

Navellier’s Stock Grader operates independently from the news cycle.

It ignores political shifts.

It remains unaffected by market volatility, scanning over 6,000 stocks weekly. It focuses on analyzing fundamentals and price dynamics to identify stocks likely to generate explosive near-term gains.

This method has led Louis to pinpoint over 175 stocks that achieved 1,000%+ returns.

Insights from a Previous Bear Market

During the bear market of 2022, when the S&P 500 struggled, Louis’ system sifted through numerous options to uncover potential winners.

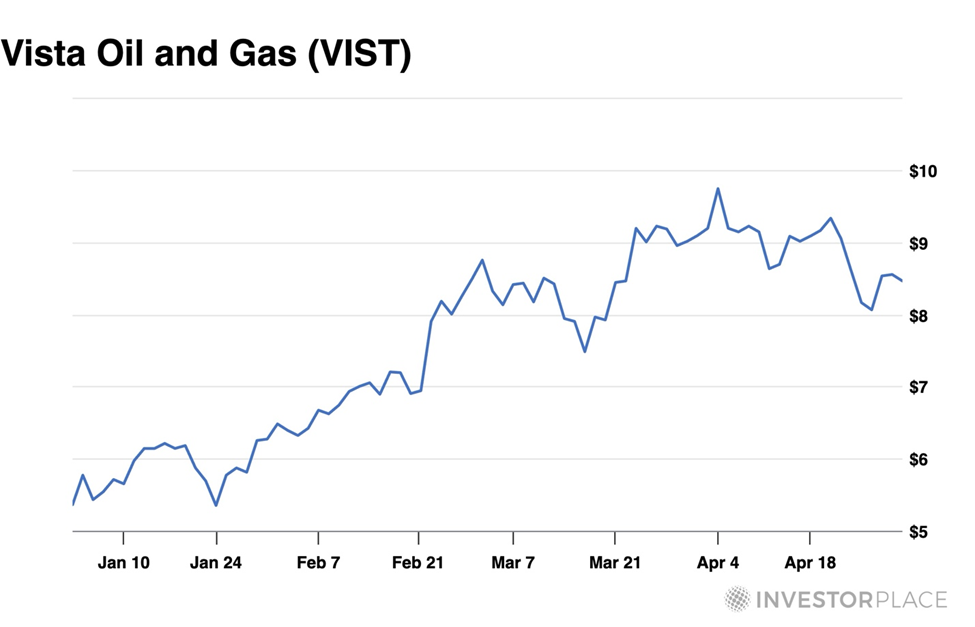

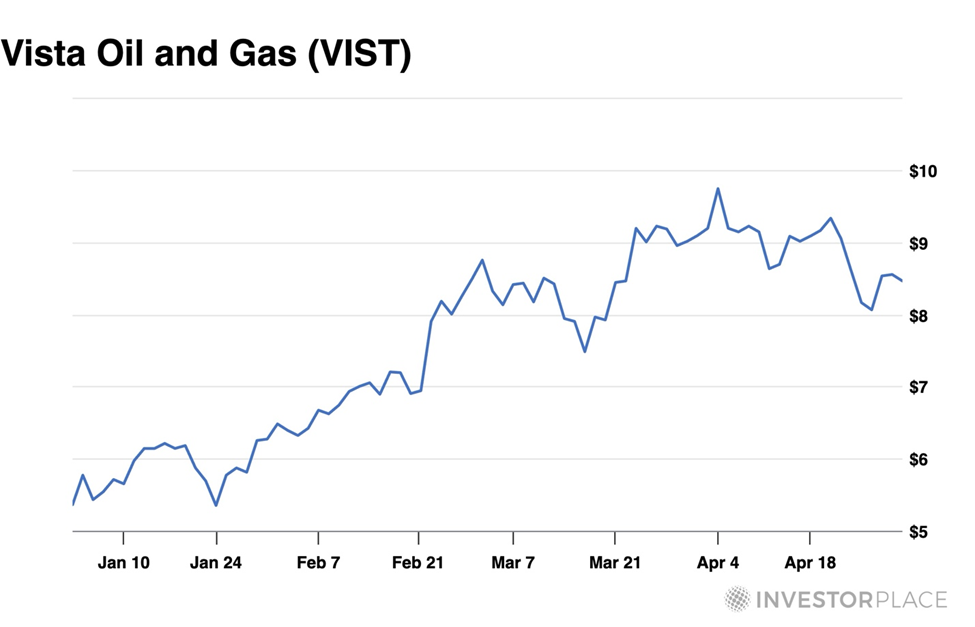

One standout was Vista Energy (VIST), a lesser-known oil and gas company in Latin America. Louis’ Stock Grader rated VIST with an “A” due to strong earnings growth, increasing cash flow, and a notable rise in institutional buying.

After conducting his own analysis, Louis found the stock appealing.

As a result, VIST recorded a 117% gain in less than three months while broader market indices fell.

Current Market Analysis

Now, amidst perceived political and economic turmoil, Louis’ system continues its function—locating winning stocks.

He refers to Trump’s new economic initiative as Liberation Day 2.0, which is causing ripples in the market. Many investors remain focused on surface fears.

However, underlying data reveals:

- A notable divergence between consumer spending and sentiment

- A significant rise in institutional accumulation

- A shift of capital towards underappreciated sectors expected to benefit from new policies

This is not mere speculation; it’s driven by data.

According to the indicators, the time to act is now.

Many investors may skip this opportunity by allowing emotions to dictate their actions.

Instead of waiting for overall market reassurances or succumbing to fearful headlines, it’s essential to look deeper.

Louis emphasizes that stocks with strong fundamentals are already on the rise—progressing quietly and predictably. These stocks are primed to lead when Trump’s economic strategy unfolds in the coming year.

Discovering these potential winners requires insight.

Louis will outline his findings during the Liberation Day 2.0 Summit scheduled for next Wednesday, covering:

- Why this new economic environment differs significantly from the past four years

- The three sectors poised for significant growth under Trump’s economic plan

- His top stock pick for the next 90 days, offered at no cost

Louis’ presentation will focus on producing consistent profits—$2,500, $4,800, even $45,000 or more gain after gain, utilizing a robust investment framework.

Despite chaotic markets and heightened emotions, those who remain calm and rely on data stand to benefit the most.

Register now to secure your spot at Louis’ Liberation Day 2.0 Summit.

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace