# Embracing Market Challenges: Long-Term Growth in American Innovation

Editor’s Note: Yesterday, InvestorPlace CEO Brian Hunt reminded us how free markets, innovation, and productive enterprises have enabled remarkable progress despite challenges like wars, recessions, and bear markets.

Today, Brian continues, presenting charts that demonstrate how American prosperity persists even during significant Stock market downturns. The key is to concentrate on long-term progress rather than reacting emotionally to short-term market fluctuations.

Hello, Reader.

In America, for every one challenge, countless brilliant minds strive for innovative solutions.

These innovators are the creators of transformative inventions like the lightbulb, television, pacemaker, airplane, and iPhone.

They possess the intelligence and dedication that have built iconic companies such as Starbucks, Facebook, Amazon, Whole Foods, Apple, Nike, and Google.

These organizations provide millions of jobs, cater to grateful customers, and generate substantial wealth for shareholders through innovation and entrepreneurship.

This trend has endured for centuries and is expected to continue in the future.

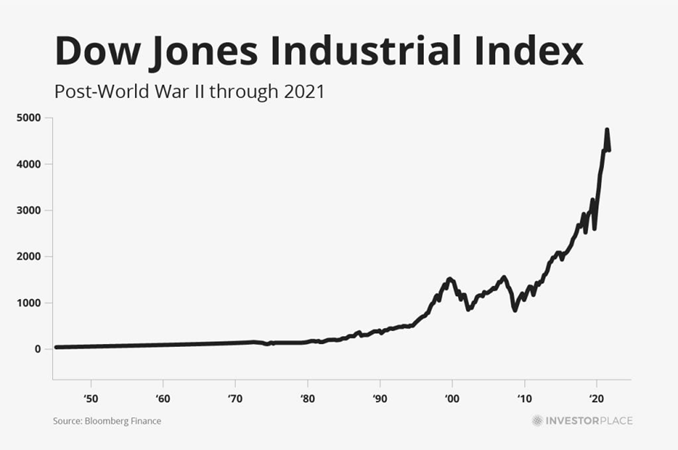

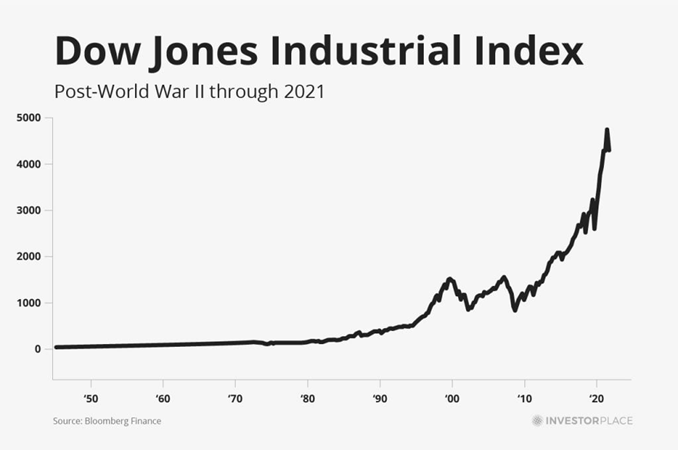

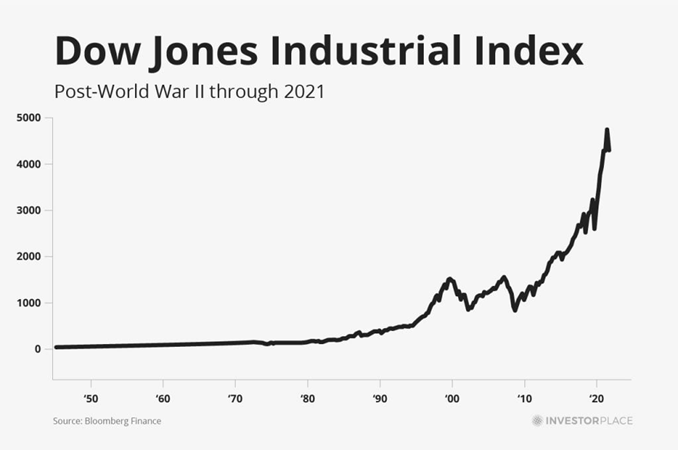

Below is a chart depicting the Dow Jones Industrial Index from the post-World War II era through 2021.

Incredible, right?

The declines in the Stock market during 1987, 2000, and 2008 were severe but ultimately minor bumps on the long-term trajectory. The clear takeaway is that over time, American prosperity increases, and the Stock market rebounds.

With this perspective, I advise you to “make the trend your friend” and dismiss the pessimists. Do not succumb to panic during market corrections or let fear-inducing headlines drive you to sell your shares of high-quality, innovative companies poised to impact the world positively.

During Stock market downturns, focus on what truly matters: progress, transformational industry shifts, creating value, and innovation.

Historical data reveals that, despite numerous negative events over the last century, shareholders in innovative companies serving their customers have accumulated considerable wealth.

This practice has proven to be the most reliable path to wealth-building in America for over 100 years—and it is likely to continue for another century. This belief in human progress and innovation is central to our mission at InvestorPlace.

This commitment informs our approach when subscribers ask for “bear market survival” strategies; we provide them this comprehensive essay.

Our “bear market survival” plan involves reviewing the above facts, maintaining a long-term mindset, and seeking high-quality stocks at discounted prices.

It does not involve panicking and selling stocks hastily.

I believe that when investors can “deprogram” themselves from fixating on interest rates and market fluctuations, and shift their attention to the foundational elements of investing, they elevate their understanding of finance and investing.

Achieving this clarity is a key milestone on the path to financial mastery.

The Next Time You’re Tempted to Panic, Look at These Eight Charts

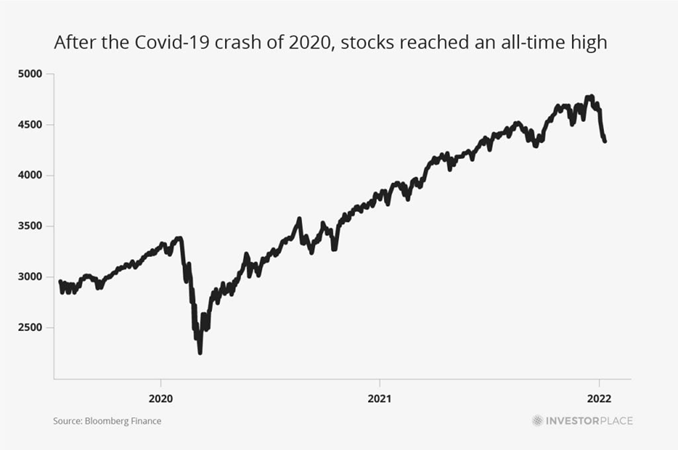

Since 1928, the S&P 500 Stock index has experienced 27 bear markets. Notably, after each of these downturns, stocks have reached new all-time highs, underscoring a perfect track record.

Recent history offers eight compelling examples that highlight the effectiveness of a smart “bear market strategy.” Keeping facts in mind, adopting a long-term view, and avoiding panic will guide investment decisions.

We believe these eight charts offer a remedy for what we define as the harmful financial condition of “Short-Term-itis.”

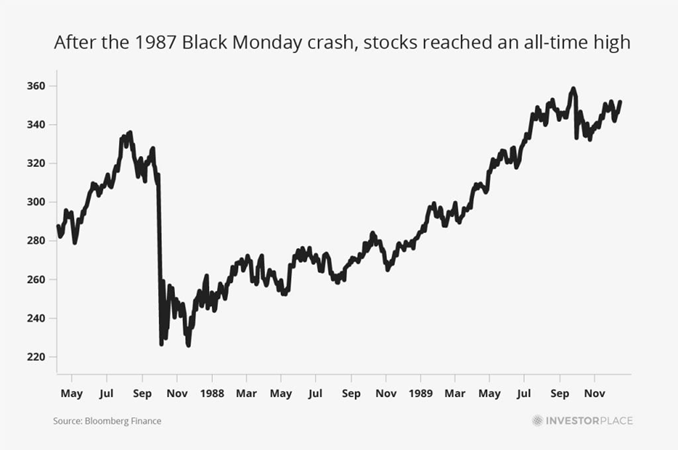

For instance, during the notorious 1987 “Black Monday” crash, the Stock market plummeted 33.5% in just one day, sparking global financial panic.

Nonetheless, less than two years later, the Stock market achieved an all-time high.

Historical Stock Market Declines: Trends and Recoveries Explained

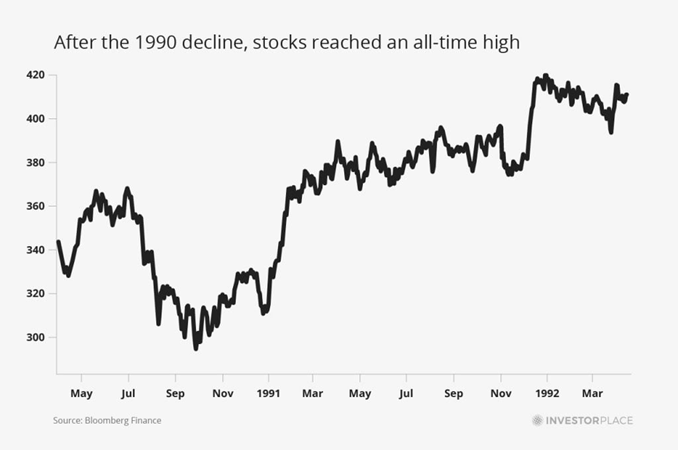

One significant market decline occurred in 1990, when concerns about a U.S. recession and the Gulf War triggered a 19.9% drop in stock prices. Despite this downturn, stocks rebounded within a year and reached a new all-time high.

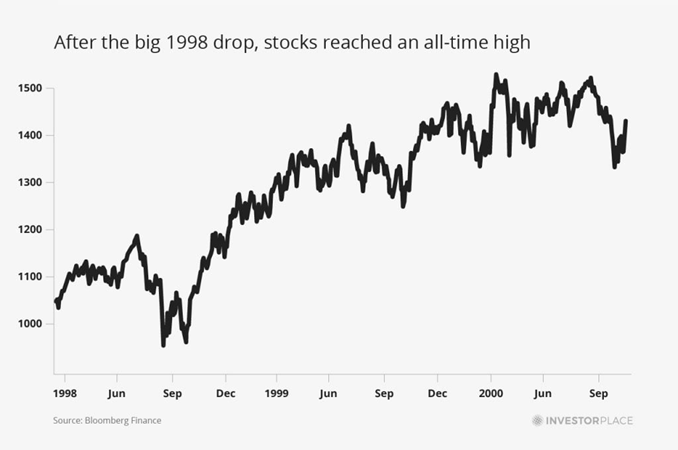

In 1998, the market faced another decline as stock values dropped 19.3% over several months. This impact was short-lived; by early 1999, the market had not only recovered but also achieved a new all-time high.

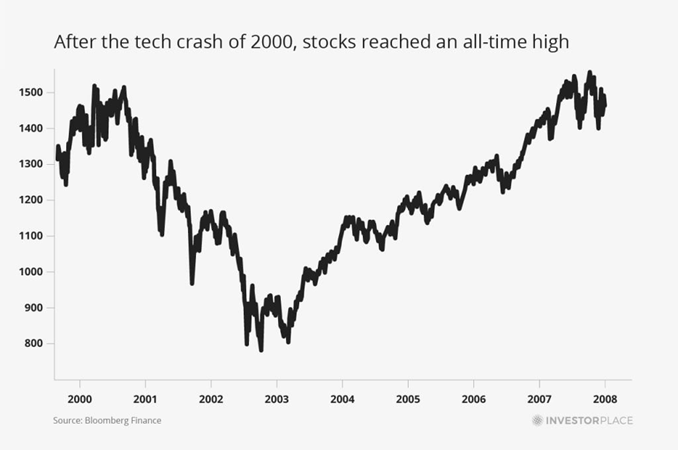

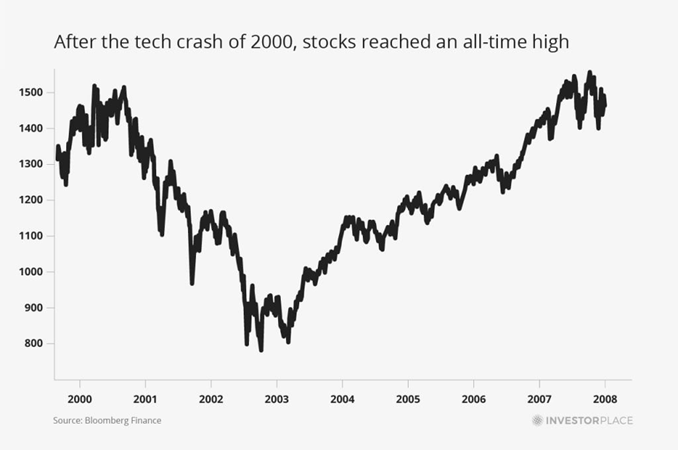

Moving forward, the infamous 2000-2002 bear market followed the peak of the dot-com boom in March 2000. This downturn is among the most severe in U.S. market history. Stocks eventually rebounded, reaching new highs by 2007.

Lastly, the stock market faced a substantial downturn during the 2008 Great Financial Crisis, where stocks plummeted by 56%. In its aftermath, the market embarked on a robust recovery, ushering in a decade-long bull market and attaining a new high by 2013.

Market Resilience: Historical Trends of Declines and Recoveries

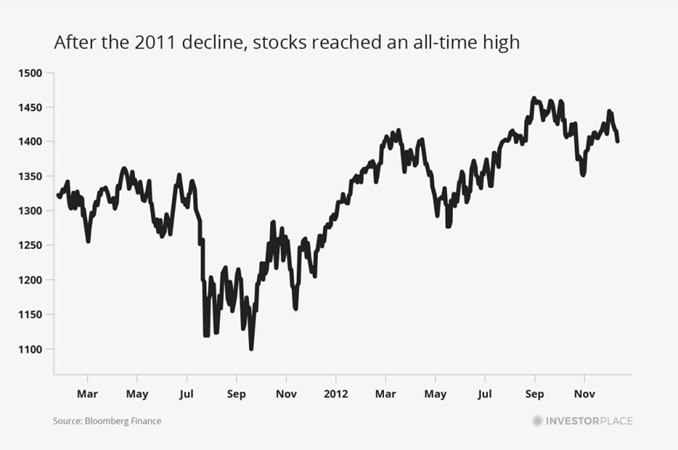

Throughout the recovery following the 2008 financial crisis, investors faced a significant decline in late 2011, with the market dropping approximately 19%. Despite this setback, stocks rebounded and hit a new all-time high by early 2012.

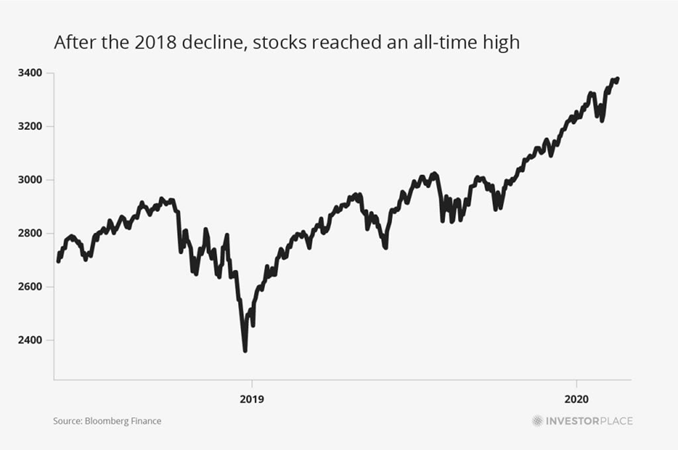

In 2018, the market faced another sharp decline, dropping 19% once again. However, just a year later, by the summer, stocks regained their footing, setting a new record high.

The pandemic brought a more dramatic market drop in 2020, triggering a swift decline of 53% in under two months as the seriousness of Covid-19 became apparent. Nevertheless, government stimulus measures provided a lifeline, enabling the market to recover swiftly, culminating in new all-time highs by the end of that year.

Historical Financial Crashes Precede Market Recoveries: Key Insights

Summing Up

In reviewing the past 60 years, we have explored some of the largest financial disasters. Historical events like the Black Monday crash of 1987, the dot-com crash of 2000, and the Great Financial Crisis of 2008 provide valuable lessons.

Importantly, each of these downturns was followed by market recoveries, resulting in new all-time highs. The consistent trend observed is striking:

Every major stock market correction, crash, and bear market in American history has been succeeded by new all-time highs.

This trend emphasizes a crucial investment principle. During stock market corrections, focus on key elements: progress, transformational industry trends, value creation, and innovation.

Investors should remember that despite many negative developments over the last century, shareholders of innovative companies have typically built significant wealth. Betting on the resilience of the American market often pays off.

To navigate future downturns, implement a sound “bear market survival” strategy. This involves reviewing important historical data, maintaining a long-term perspective, and holding onto quality stocks.

Regards,

Brian Hunt

CEO, InvestorPlace