SoundHound AI: Growth Amidst Challenges and Risks

Shares of SoundHound AI (NASDAQ: SOUN) have declined by 8% over the last six months as investor enthusiasm has waned. Although the voice AI developer is expanding swiftly, it is facing increasing losses.

Promising Growth with Lingering Losses

This year, the stock has more than doubled in value. Despite this, with a market capitalization of just $1.7 billion, there is potential for substantial gains if the company can grow and achieve profitability.

However, this potential comes with risks. Before deciding to invest in SoundHound AI, it is crucial to consider three key charts that reveal the company’s financial state.

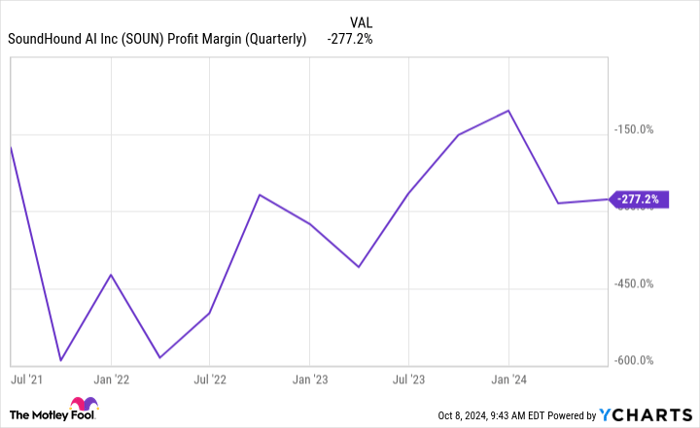

Profit Margins Are Troubling

Profitability is a major concern for SoundHound AI. Although the company is expanding, its losses are increasing. In the second quarter, revenue climbed 54% year-over-year to $13.5 million, but the net loss grew by 60% to $37.3 million. The chart below shows that it is uncertain when, or if, the company will reach a break-even point.

Data by YCharts.

While negative profit margins are not unusual for a growing company, potential investors must remain cautious. Ongoing losses can hinder the business while increasing the likelihood of future stock dilution.

Rising Share Count Signals Dilution Risk

Dilution poses another risk for investors considering shares of an unprofitable company. SoundHound AI needs funds for regular operations and growth, which often comes from debt or issuing new equity instead of its core business.

This has led to a significant increase in SoundHound’s share count over recent years.

Data by YCharts.

The company has reported operating cash outflows of $74.5 million in the past year. If cash flows do not improve markedly, additional dilution may be necessary, which could negatively impact stock prices.

High Short Interest Points to Potential Volatility

SoundHound AI contends with numerous competitors in AI voice services. Generating strong growth does not guarantee a sustainable competitive edge. Many investors seem to be betting against the company, as indicated by the high short interest in its stock.

Data by YCharts.

The presence of short-sellers can further depress the stock price. Without noticeable improvements in cash flow or profitability, more investors may continue to short the stock. High short interest raises the likelihood of volatility, adding risk for potential investors.

Should You Buy SoundHound AI Stock Now?

Adding complexity to the situation is Nvidia, which disclosed its stake in SoundHound earlier this year. This investment has likely fueled interest and positivity around the stock. Without this backing, SoundHound might not have experienced such an uptick in popularity.

Balancing this hype with SoundHound’s financial realities is challenging. The competition from tech giants with robust financial resources developing their voice AI solutions is intense. While SoundHound AI warrants attention, it might not be the best buy at this moment.

Opportunity Awaits – Don’t Miss Out

Have you ever felt you missed out on investing in skyrocketing stocks? If so, consider this.

Our analysts sometimes identify stocks they believe are on the verge of significant growth, dubbed “Double Down” stocks. If you fear missing your chance, the time to invest is now before it’s too late. Here’s what the numbers show:

- Amazon: A $1,000 investment made when we recommended it in 2010 would be worth $21,266 now!*

- Apple: A $1,000 investment from 2008 would have grown to $43,047!*

- Netflix: Invest $1,000 when we doubled down in 2004, and you’d have $389,794!*

Currently, we are issuing “Double Down” alerts for three exceptional companies. Opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.