# Lessons from History: Navigating Stock Market Corrections

Editor’s Note: On Saturday, we shared the first part of a new report from InvestorPlace CEO Brian Hunt, titled What to Do When the Stock Market Drops. Today, we present the conclusion. We hope you find it insightful – stay safe out there, and keep your spirits high.

Hello, Reader.

If you haven’t yet read the initial segment of this series, please click here for essential insights regarding bear markets.

For every challenge that America faces, countless brilliant individuals are at work developing innovative solutions. These talented experts are creating impressive products and services aimed at enhancing our everyday lives.

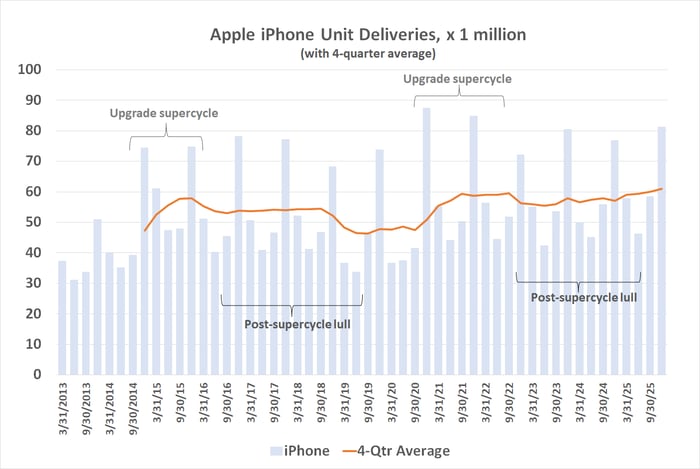

Consider the inventors of vital innovations like the light bulb, the television, the pacemaker, the airplane, and the iPhone.

They are the visionaries behind successful companies such as Starbucks, Facebook, Amazon, Whole Foods, Apple, Nike, and Google.

These businesses have offered employment opportunities to millions, provided essential goods and services to grateful consumers, and generated substantial wealth for their shareholders, all through creativity and innovation.

Importantly, these innovators operate within the United States. Contrary to pessimistic viewpoints, Warren Buffett, the renowned investor, asserts that America remains the prime environment for conducting business.

- We benefit from deep and liquid capital markets.

- Our legal system upholds the rule of law.

- Excellent accounting practices ensure transparency.

- We actively encourage innovation and entrepreneurship.

- Property rights are respected and upheld.

- Our transportation infrastructure is robust and efficient. (If you believe U.S. infrastructure is lacking, a visit to a developing country may offer a different perspective).

- We have a large population of affluent consumers eager to purchase quality products and services.

The advancements made by American entrepreneurs have enabled the average citizen to enjoy a standard of living superior to that of kings from a century ago.

Even those in America’s “low-income” brackets benefit from improved medical care, better nutrition, superior transportation, and greater access to information than individuals with similar wealth levels did in 1919.

In essence, free markets, innovation, and productive enterprises have facilitated remarkable progress even amidst wars, recessions, and bear markets.

This trend has persisted for centuries and will likely continue in the future, regardless of temporary market setbacks.

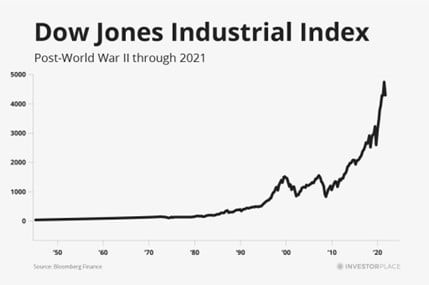

Below is a chart illustrating the trajectory of the Dow Jones Industrial Index from post-World War II through 2021.

Remarkable, isn’t it?

Market downturns such as those in 1987, 2000, and 2008, while distressing at the time, are merely temporary blips in the long-term growth trend. The conclusion is unmistakable: Over time, American prosperity continues to rise, and the stock market trends upward.

With this context in mind, it’s wise to “make the trend your friend” and disregard the critics. Avoid panicking during market corrections, and don’t let sensational headlines push you to sell shares of high-quality, innovative companies prepared to transform the future.

In times of market corrections, I urge you to prioritize what is essential: progress, transformative industry trends, creating value for others, and innovation.

Historically, shareholders of innovative companies serving their customers have accumulated significant wealth despite adverse market conditions.

This has been the most reliable path to wealth in America for over a century, and it is likely to remain so for another century. Consequently, sustaining a positive outlook on human progress and innovation forms the foundation of our strategies at InvestorPlace.

This is also the reason we provide our subscribers with our insights whenever they inquire about our “bear market survival” strategies.

Our approach to “bear market survival” focuses on the facts presented, maintaining a long-term outlook, and seeking quality stocks at discounted prices.

Our strategy does not involve panic selling of stocks.

When investors can shift their focus away from short-term market fluctuations and interest rates to the larger picture, they elevate their understanding of money and investing.

This shift represents a crucial milestone on the journey to mastering personal finance.

The Next Time You’re Tempted to Panic About a Bear Market, Examine These Eight Charts

Since 1928, the S&P 500 has experienced 26 bear markets, yet after each, stocks have rebounded to achieve new all-time highs. The historical record is impeccable.

Contemporary examples illustrate that a prudent “bear market strategy” involves keeping the facts in focus, adopting a long-term perspective, and resisting the urge to flee from stocks.

We believe these eight charts serve as a remedy for a detrimental financial ailment known as “Short-Term-itis.”

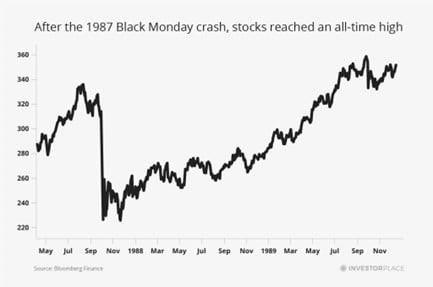

For instance, during the notorious 1987 “Black Monday” crash, the stock market plummeted 33.5% in just one day, resulting in a temporary global financial crisis. However, history shows that this, like every other downturn, was just a temporary disruption.

Historic U.S. Stock Market Recoveries After Major Declines

Panic surged through financial markets on Black Monday in 1987, leading to a sharp decline. However, just under two years later, the stock market achieved an all-time high.

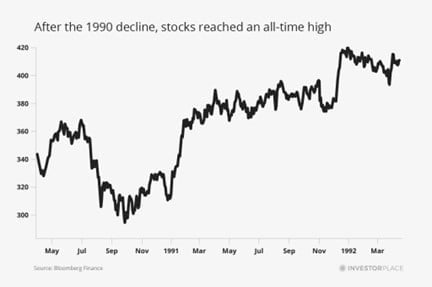

The 1990 market decline was driven by fears of a U.S. recession and the Gulf War, resulting in a 19.9% drop. Nevertheless, stocks bounced back and reached a new all-time high within a year.

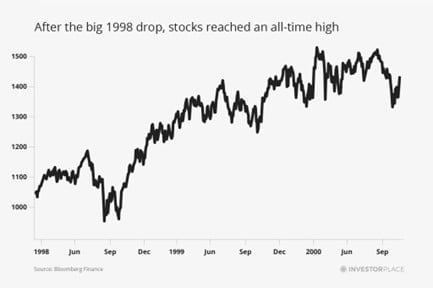

In 1998, another decline saw stocks drop by 19.3% over several months. Yet, by early 1999, the market achieved a new all-time high, demonstrating resilience.

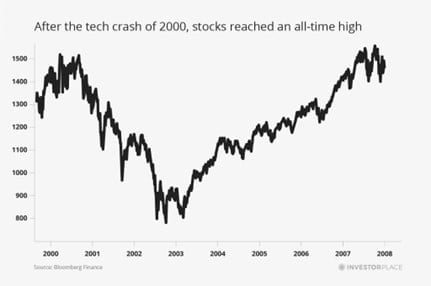

From 2000 to 2002, a bear market followed the dot-com bubble’s peak in March 2000, marking one of the worst downturns in U.S. history. Despite this, the stock market ultimately recovered and reached new heights in 2007.

Market Recoveries After Major Declines: A Historical Overview

After the tech crash of 2000, the stock market saw a dramatic fall but eventually rebounded. Stocks plummeted significantly during this period, yet they reached an all-time high in 2013, demonstrating resilience and recovery potential. Investors who remained committed during this downturn made considerable gains in the subsequent bull market.

Impact of the Great Financial Crisis

Next, the Great Financial Crisis of 2008 triggered a remarkable decline in stocks, which dropped by 56%. Following this severe downturn, the market underwent a substantial recovery, eventually leading to a decade-long bull market. Investors who seized the opportunity during this phase saw significant wealth accumulation, highlighted by a new all-time high in 2013.

Rebounding After the 2011 Decline

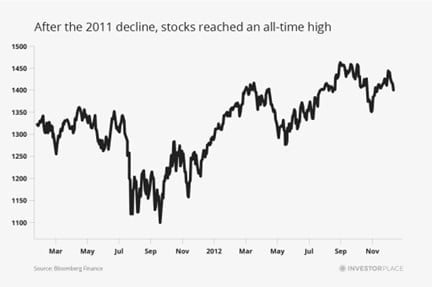

Amid the ongoing recovery post-2008, the market faced another challenge in late 2011, where stocks experienced a decline of approximately 19%. However, this dip did not hinder the upward momentum; by early 2012, the market rebounded, achieving a new high.

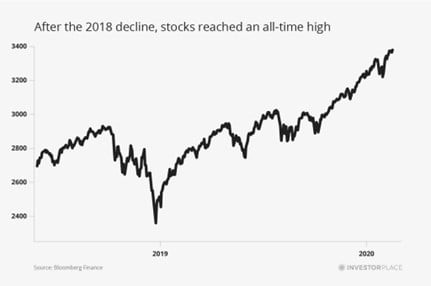

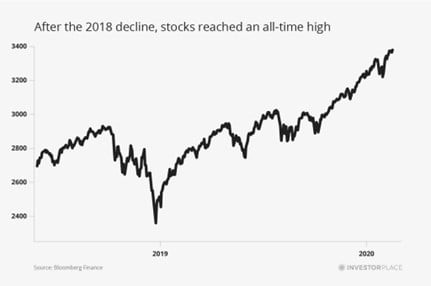

Challenges in 2018 and Subsequent Recovery

The market underwent another challenging period in 2018, registering another 19% decline. Despite this setback, stocks managed to recover by the summer of the following year, again reaching a new all-time high. This pattern of recovery demonstrates the market’s resilience over time.

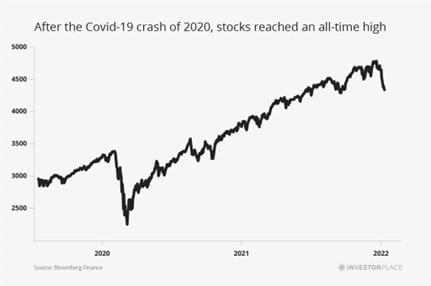

Market Corrections and Recoveries: A Historical Perspective

The COVID-19 pandemic initiated a dramatic drop in the stock market, plummeting by 53% in under two months as the severity of the crisis became apparent. This rapid downturn was mitigated significantly by government stimulus efforts, allowing the market not only to recover but also to achieve a new all-time high by year’s end.

Recapping Major Bear Markets

This analysis has taken you through the notable financial declines of the last six decades. Key moments include the Black Monday crash of 1987, the dot-com collapse of 2000, and the Great Financial Crisis of 2008.

It is evident that each historically significant downturn was followed by a recovery, leading to new highs in the market. This trend illustrates a consistent pattern: every major stock market correction or bear market in American history has resulted in renewed all-time highs.

Thus, it is crucial to emphasize the importance of focusing on foundational elements during these volatile times. Concentrate on progress, transformational industry trends, value creation, and innovation. Despite numerous external challenges over the last century, investors in innovative companies have consistently built wealth.

As we look ahead, remember that investing in America’s growth has historically proven beneficial. A sound strategy for surviving bear markets involves assessing long-term facts, maintaining a forward-looking perspective, and holding onto stocks.

Best regards,

Brian Hunt