Identifying Oversold Stocks in the Financial Sector: Opportunities Await

Current market conditions have led to some financial stocks being labeled as oversold, presenting potential buying opportunities for investors.

The Relative Strength Index (RSI) serves as a valuable momentum indicator. By comparing a stock’s performance on days with price increases versus days with decreases, traders gain insights about possible short-term movements. Typically, a stock is deemed oversold when its RSI falls below 30, as reported by Benzinga Pro.

Here’s a closer look at notable oversold stocks in the financial sector, characterized by RSIs near or below 30.

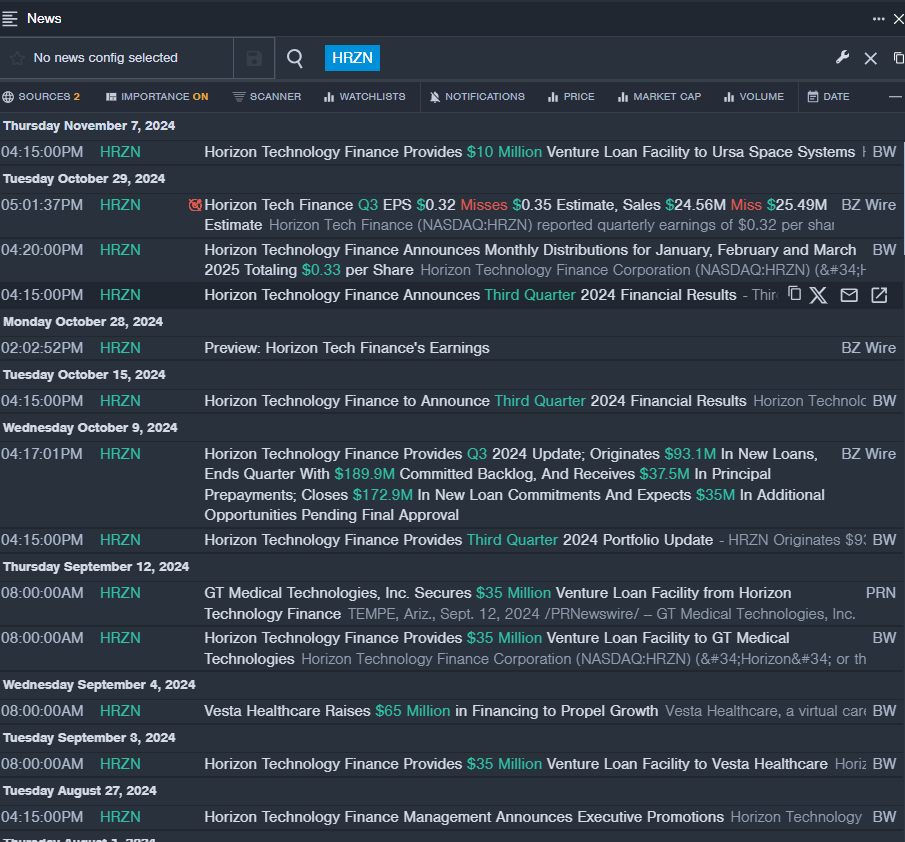

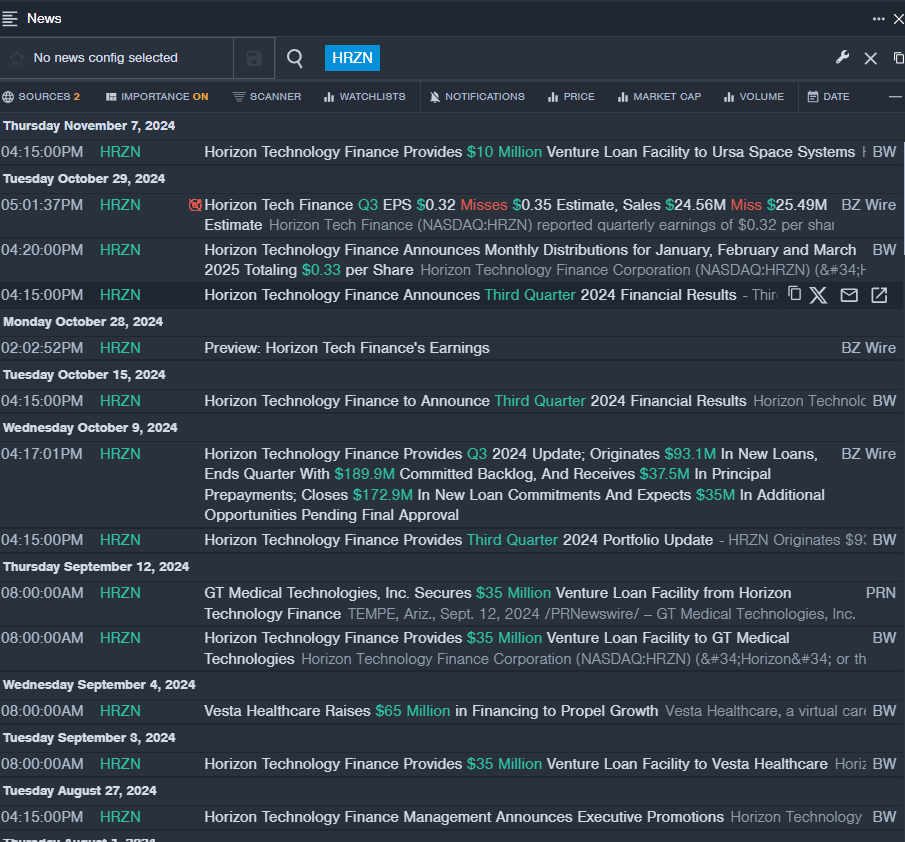

Horizon Technology Finance Corp HRZN

- On Oct. 29, Horizon Tech Finance released disappointing quarterly results. “We had a solid third quarter, as we originated a number of new, high-quality loans that returned our portfolio to quarter-over-quarter growth, while we saw the venture debt market begin to improve,” stated Robert D. Pomeroy, Jr., CEO of Horizon. Over the past week, the company’s stock declined approximately 9%, reaching a 52-week low of $8.50.

- RSI Value: 14.14

- HRZN Price Action: Horizon Technology Finance shares fell 6.6% to close at $8.57 on Monday.

- Benzinga Pro’s real-time newsfeed provided updates on HRZN.

Pennantpark Floating Rate Capital Ltd PFLT

- On Dec. 12, PennantPark Floating Rate Capital announced an increase in their joint venture investment. PFLT and their partner plan to allocate an additional $100 million in capital toward PSSL. The stock has fallen about 3% in the past week and has a 52-week low of $10.28.

- RSI Value: 28.02

- PFLT Price Action: Shares of Pennantpark Floating Rate Capital decreased by 1%, closing at $10.81 on Monday.

- Benzinga Pro’s charting tool successfully identified trends in PFLT stock.

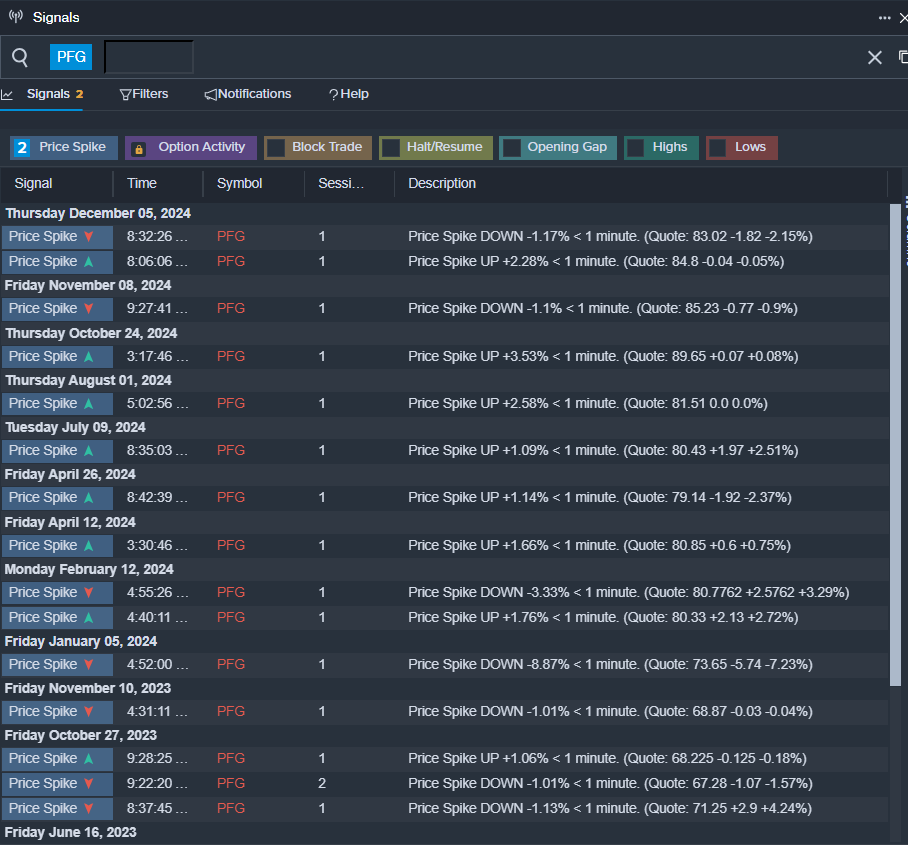

Principal Financial Group Inc PFG

- On Dec. 11, analyst Elyse Greenspan from Wells Fargo downgraded Principal Financial from Equal-Weight to Underweight, adjusting the price target down from $84 to $75. Over the last month, the stock has dropped nearly 9%, with a 52-week low of $72.21.

- RSI Value: 26.47

- PFG Price Action: Shares of Principal Financial fell 0.3%, closing at $78.67 on Monday.

- Benzinga Pro’s signals feature indicated a potential breakout for PFG shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs