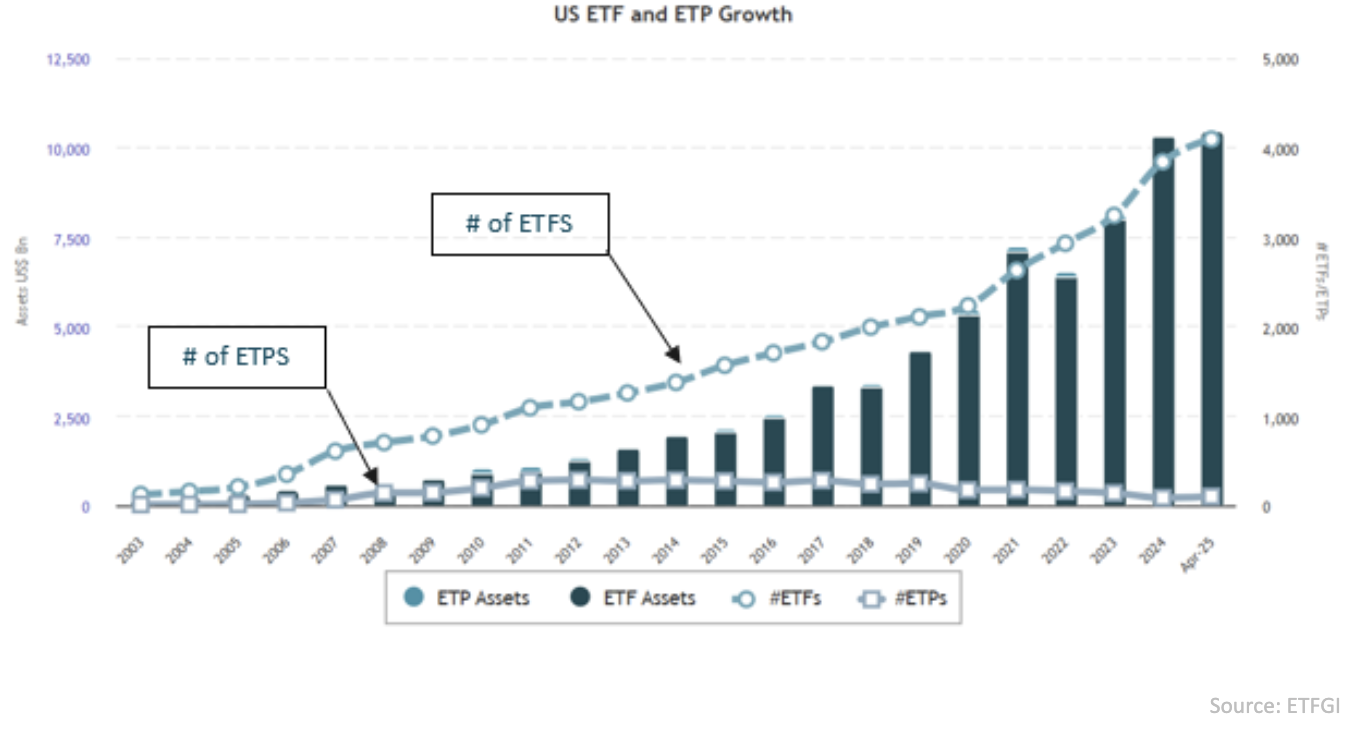

As of today, there are over 4,000 exchange-traded funds (ETFs) in the U.S., with total assets exceeding $10 trillion, according to ETFGI. ETFs, introduced in Canada in 1990, have become a significant component of the financial market ecosystem. On average, ETFs trade approximately $186 billion daily, which is more than double the transaction volume of the entire European stock market.

ETFs allow for trading throughout the day on stock exchanges, with key differences from mutual funds, including their ability to sell at current market prices. These funds have evolved from being solely index trackers to including active portfolios and thematic investments. It’s notable that international stock ETFs are valued at around $1.7 trillion, while bond ETFs account for over $1.9 trillion in assets.

According to recent data, about 81% of retail investors’ net buying is allocated to ETFs, although they represent less than 6.4% of daily ETF trading volume. The trading landscape is primarily dominated by hedge funds, banks, and market makers, with the 100 most liquid ETFs comprising 70.5% of total ETF trading despite being just 3% of all ETFs.