D.R. Horton Set to Announce Q2 Fiscal 2025 Results on April 17

D.R. Horton Inc. (DHI) is expected to release its earnings report for the second quarter of fiscal 2025 (ending March 31, 2025) on April 17, prior to the market opening.

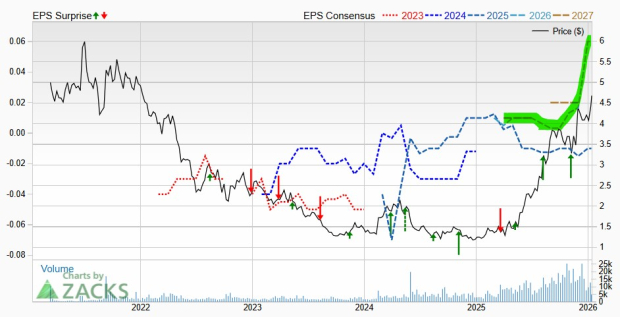

In the previous quarter, the company exceeded the Zacks Consensus Estimate by 8.8% for earnings and 6.8% for revenues. However, these figures represent declines of 7.4% for earnings and 1.5% for revenues compared to the same period last year.

D.R. Horton has beat earnings expectations in three of the last four quarters, with an average surprise of 6.1%—with one miss within this timeframe.

Current Earnings Estimates for D.R. Horton

The consensus estimate for this quarter’s earnings per share (EPS) remains at $2.67, unchanged over the last 60 days. This estimate reflects a significant decline of 24.2% from the EPS of $3.52 reported the previous year. (For the latest EPS estimates and surprises, check Zacks’ Earnings Calendar.)

D.R. Horton, Inc. Price and EPS Surprise

D.R. Horton, Inc. price-eps-surprise | D.R. Horton, Inc. Quote

The revenue consensus is set at $8.09 billion, which would mark an 11.2% decrease year-over-year.

Factors Affecting DHI’s Q2 Performance

Revenue Overview

D.R. Horton’s total revenues for the fiscal second quarter are projected to show weakness primarily in the Homebuilding segment. The company anticipates total revenues to fall within the range of $7.7 billion to $8.2 billion, down from $9.1 billion in the same quarter last year.

Within the Homebuilding segment, which constituted 94.1% of first-quarter fiscal 2025 revenues, a decline is expected due to the reduced number of homes closed. This decrease is attributed to persistent high mortgage rates and uncertainties related to new tariffs. The anticipated total homes closed during the second quarter is between 20,000 and 20,500 units, down from 22,548 closures the prior year.

Our model estimates Homebuilding revenues will decline 11% year-over-year to $7.54 billion. Additionally, we predict home closures will reach 20,180 units, reflecting a 10.5% decrease from the previous year. The Rental Property segment, contributing 2.9% of first-quarter fiscal 2025 revenues, is estimated to generate $290 million, indicating a decline of 21.9% year-over-year. Conversely, revenues from Forestar, which constituted 3.3% of total revenues, are projected to grow 14.7% year-over-year to $382.8 million. The Financial Services segment, contributing 2.4% of total revenues, is expected to report revenues of $225.9 million, showing a modest increase of 0.1%.

Margin Outlook

Ongoing inflation and concerns about labor and material supplies amid tariff discussions are likely to lead to decreased margins in the fiscal second quarter. Additional costs from DHI’s operating platform expansion and increased incentives are expected to exert further pressure. The company anticipates home sales gross margins to fall between 21.5% and 22%, down from 23.2% year-over-year. Our model predicts this metric will land at approximately 21.7%, reflecting a contraction of 150 basis points.

We anticipate homebuilding SG&A expenses as a percentage of revenues to rise to 8.4%, up from 7.2% the previous year.

Orders and Backlog Insights

For the fiscal second quarter, our model predicts net sales orders will decline by 4% to 25,406 units. The backlog is projected to be 16,230 units, reflecting a 9.2% decrease from the 17,873 units reported last year. The value of the backlog is estimated at $6.31 billion, indicating a year-over-year decline of 10.3%.

Insights from the Zacks Model for DHI

Our proven model does not indicate a definitive earnings surprise for D.R. Horton this quarter. The likelihood of an earnings beat increases with a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold), but this is not applicable in DHI’s case.

Earnings ESP: DHI currently has an Earnings ESP of -0.54%. Discover the top stocks before their reports with our Earnings ESP Filter.

Zacks Rank: D.R. Horton holds a Zacks Rank of 3 at present. You can view today’s complete list of Zacks #1 Rank stocks here.

Promising Stocks in the Construction Sector

Several companies in the Zacks Construction industry meet the criteria for a favorable earnings surprise in their upcoming quarters:

Vulcan Materials Company (VMC) possesses an Earnings ESP of +5.71% and a Zacks Rank of 3. Earnings for the first quarter of 2025 are projected to remain stable year-over-year. Vulcan has posted positive earnings surprises in two of the last four quarters, with an average surprise rate of 4.6%.

United Rentals, Inc. (URI) presents an Earnings ESP of +5.32% and a Zacks Rank of 3. Earnings for the first quarter of 2025 are anticipated to decline by 2.5%. United Rentals has exceeded earnings estimates in two of the past four quarters with an average surprise of 1.2%.

Martin Marietta Materials, Inc. (MLM) shows an Earnings ESP of +1.37% coupled with a Zacks Rank of 3. Martin Marietta has successfully beaten earnings estimates in two of the last four quarters, although it has encountered a negative average surprise of 1.7%. Expected earnings for the first quarter of 2025 are down 3.1%.

Discover the Best Stocks for the Coming Month

Recently released, financial experts have identified 7 elite stocks from a list of 220 Zacks Rank #1 Strong Buys. These stocks are deemed “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market by more than double, averaging a gain of +23.9% per year. Highlight these hand-picked stocks for immediate consideration.

Investors Eye D.R. Horton’s Upcoming Q2 Earnings Reports

Key Stocks to Watch

Investors should be particularly interested in several companies ahead of their earnings reports:

- Vulcan Materials Company (VMC) – Free Stock Analysis Report

- D.R. Horton, Inc. (DHI) – Free Stock Analysis Report

- Martin Marietta Materials, Inc. (MLM) – Free Stock Analysis Report

- United Rentals, Inc. (URI) – Free Stock Analysis Report

Investors looking for further insights on D.R. Horton should refer to the comprehensive analysis provided in this article. Read more here.

Zacks Investment Research is a trusted source for financial insights.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.