Alibaba’s Performance: Insights on Earnings and Revenue Growth

Alibaba (BABA) has recently emerged as one of the most searched stocks on Zacks.com. Investors should consider several critical factors that may influence the stock’s future performance.

Over the past month, Alibaba shares have declined by -23.7%, in contrast to the Zacks S&P 500 composite’s -3.6% change. Additionally, the Zacks Internet – Commerce industry, which includes Alibaba, experienced a loss of 7.7%. This raises an essential question: Where is the stock heading in the near future?

While media speculations may trigger immediate price fluctuations, fundamental factors ultimately guide long-term buy-and-hold decisions.

Understanding Earnings Estimate Revisions

At Zacks, we emphasize the importance of changes in earnings projections. We believe the fair value of a stock is linked to the present value of its future earnings.

We analyze how sell-side analysts revise their earnings estimates in response to the latest business developments. If these estimates rise, the fair value of the stock increases as well. A higher fair value than the current market price attracts investors, potentially driving the stock price upward. This trend highlights the strong correlation between earnings estimate revisions and short-term stock price movements.

According to projections, Alibaba is expected to report earnings of $1.37 per share for the current quarter, which indicates a year-over-year decline of -2.1%. Importantly, the Zacks Consensus Estimate has remained stable over the past 30 days.

The consensus earnings estimate for the current fiscal year stands at $8.80, reflecting a year-over-year increase of +2.1% with no changes in the estimate in the last month.

For the next fiscal year, analysts project a consensus earnings estimate of $10.83, representing a notable increase of +23.1% compared to the previous year. This estimate too has shown no changes over the past month.

The Zacks Rank, which evaluates stocks based on earning estimates, gives Alibaba a #1 (Strong Buy) rating. This rating results from several factors including the magnitude of recent changes in consensus estimates.

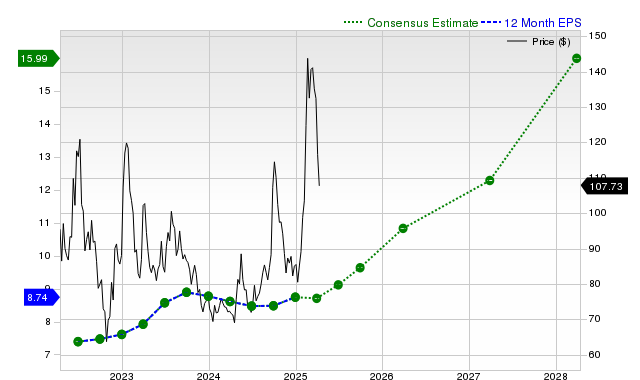

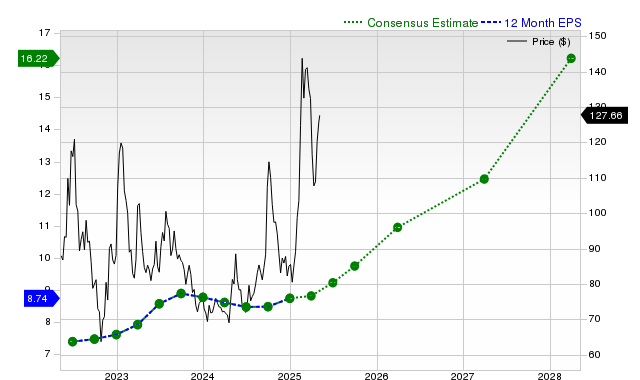

Below is a chart depicting the evolution of Alibaba’s forward 12-month consensus EPS estimate:

12 Month EPS

Prospects for Revenue Growth

While earnings growth is a vital sign of a company’s financial health, revenue growth is equally crucial. A company typically cannot sustain earnings increases over time without a corresponding rise in revenues. Understanding revenue growth potential is essential.

For Alibaba, the consensus sales estimate for the current quarter is $33.08 billion, signaling a year-over-year growth of +7.6%. Additionally, projected sales figures of $137.03 billion for the current fiscal year and $143.44 billion for the next fiscal year reflect increases of +5% and +4.7%, respectively.

Recent Results and Earnings Surprise History

In its last reported quarter, Alibaba achieved revenues of $38.38 billion, showing a +4.7% year-over-year change. The reported EPS of $2.93 exceeded the $2.67 reported last year.

Against a Zacks Consensus Estimate of $38.19 billion, the reported revenues generated a surprise of +0.51%. However, the EPS fell short of expectations by -4.87%.

Over the last four quarters, Alibaba has surpassed consensus EPS estimates twice and exceeded revenue estimates three times.

Assessing Valuation

Considering a stock’s valuation is crucial for making informed investment decisions. It helps assess whether the stock price accurately represents the intrinsic value and growth potential of the business.

To evaluate the current valuation multiples—like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF)—comparing these metrics with historical values offers insights into the stock’s valuation status. Additionally, comparing the company with its peers provides clarity on the reasonableness of its price.

Guided by the Zacks Value Style Score, which assesses both traditional and unconventional valuation metrics to rate stocks from A to F, Alibaba receives a B rating. This suggests it is trading at a discount compared to its peers. Click here to review this score’s underlying valuation metrics.

Conclusion

The information presented here, along with additional insights from Zacks.com, can help determine if monitoring the market conversation surrounding Alibaba is worthwhile. The current Zacks Rank #1 indicates a potential for Alibaba to outperform the broader market in the near future.

5 Stocks Set to Double

Each stock listed has been selected by a Zacks expert as a top candidate for potentially gaining +100% or more in 2024. Although not every pick will succeed, previous recommendations have seen significant gains like +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks in this report remain under Wall Street’s radar, presenting a unique opportunity for investors. To find out more about these stocks, check back today.

For the latest recommendations from Zacks Investment Research, you can download “7 Best Stocks for the Next 30 Days.” Click here for this free report.

Alibaba Group Holding Limited (BABA): Free stock analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.