Wall Street’s Rally Boosted by Strong Earnings Reports

The past week brought significant movement on Wall Street, with the markets closing on a positive note last Friday. Following several days of intense trading, a new wave of strong earnings and favorable economic indicators propelled stocks higher as investors entered the weekend with optimism.

Currently, stocks continue to reach fresh record highs, fueled primarily by one key element: strong earnings.

Solid Earnings Season Underway

As we approach the midpoint of third-quarter earnings season, results are impressively positive.

About 40% of the S&P 500 companies have reported their earnings, with approximately 75% exceeding earnings per share (EPS) predictions. On average, these companies’ EPS is around 6% higher than expected. Furthermore, the blended EPS growth rate for Q3 stands at over 3%.

This indicates that a majority of companies are not only surpassing expectations but are also experiencing healthy earnings growth.

Increasing Earnings Projections

Current forecasts suggest that profits across the S&P will increase by upwards of 13% in the upcoming quarter, maintaining a similar expected growth rate in the following quarter. In the two quarters after that, profits are projected to rise by approximately 11% and 17%, respectively.

This means that not only is the current earnings season strong, but the outlook also suggests an upward trend in earnings growth for the next several quarters.

This bodes well for the ongoing stock rally.

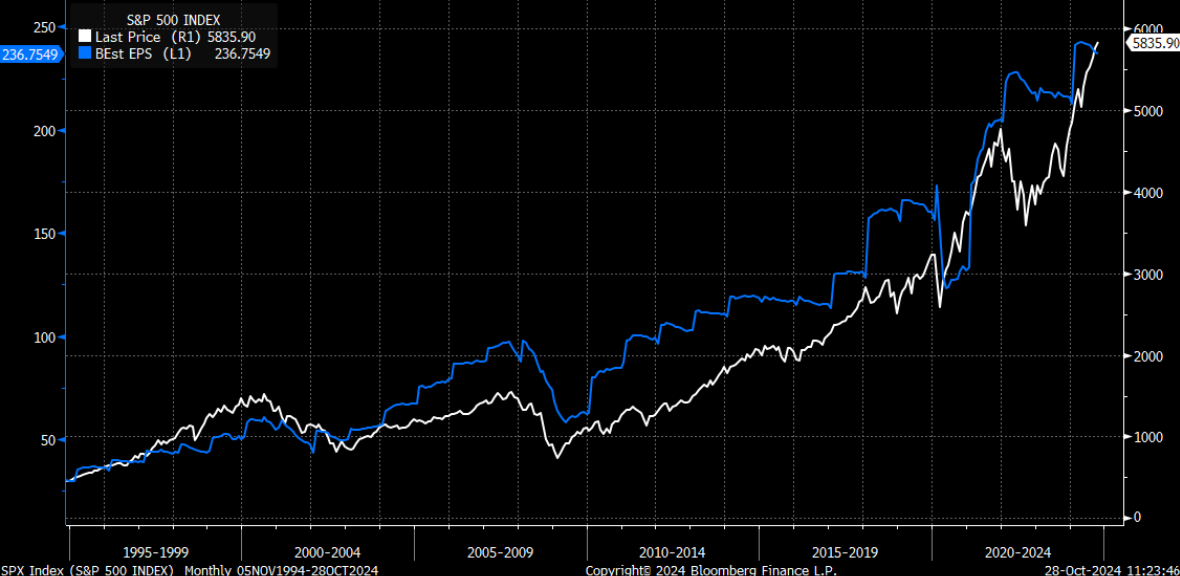

Historically, stock prices correlate with earnings. A chart comparing the earnings of the S&P 500 (blue) to the index’s price (white) over the past 30 years shows a strong, almost perfect relationship between the two.

With earnings set to rise significantly over the next year, it is reasonable to expect a substantial increase in stock prices as well.

Conclusion: A Bright Future Ahead

The encouraging earnings results this season contribute to a positive outlook for Wall Street.

Particularly exciting are the prospects for AI stocks. These stocks are anticipated to experience the most significant growth in the coming quarters.

In this quarter alone, tech companies are seeing an earnings growth of approximately 16% year-over-year, the highest among any sector.

With forecasts continuing to climb, the future looks bright for tech firms, especially as they aim for earnings growth exceeding 20% next year.

Given that tech earnings are already on an upward trajectory, we strongly believe AI stocks will lead this current rally.

For investors, this is an opportune moment to consider investing in promising AI stocks.

We are committed to identifying the best AI stocks available in the market.

Explore some of our top recommendations to capitalize on this ongoing rally.

On the date of publication, Luke Lango did not hold any positions in the securities mentioned in this article.

P.S. Stay informed with Luke’s latest market insights by checking out our Daily Notes! Read the most recent updates on your Innovation Investor or Early Stage Investor subscriber site.