Microsoft Shares Surge: Key Financial Indicators to Watch

Microsoft (MSFT) has emerged as one of the most searched stocks recently. As such, investors may want to examine several critical factors that could impact the stock’s performance in the coming months.

In the last month, Microsoft’s shares have jumped by +23.5%, significantly outpacing the Zacks S&P 500 composite, which saw a +13.1% increase. The Zacks Computer – Software industry, where Microsoft belongs, has similarly risen by 21%. The pressing question is: What lies ahead for the stock?

While media speculation or rumors may spark immediate changes in price, fundamental factors ultimately drive long-term buy-and-hold decisions.

Revisions to Earnings Estimates

At Zacks, we prioritize changes in a company’s earnings projections, as we believe these figures reflect the stock’s fair value through the present value of future earnings.

Our analysis focuses on how sell-side analysts are adjusting their earnings estimates based on the latest business conditions. When these estimates increase, so does the stock’s fair value. A higher fair value compared to the current market price often attracts buyers, leading to upward price movement. Empirical studies confirm a strong link between revisions in earnings estimates and stock price fluctuations.

For the current quarter, Microsoft is projected to report earnings of $3.35 per share, marking a +13.6% increase from the same quarter last year. The Zacks Consensus Estimate has adjusted upward by +2% over the past month.

For the current fiscal year, the estimated earnings are $13.30, reflecting a +12.7% change compared to last year, with an increase of +2.1% in the last month.

Looking ahead to the next fiscal year, the consensus estimate of $14.86 indicates an 11.7% increase from what Microsoft is expected to report for the current year. This figure has also improved by +1.7% in recent weeks.

Microsoft’s Zacks Rank of #3 (Hold) reflects these changes in estimates and indicates a potential alignment with the broader market’s performance in the near term.

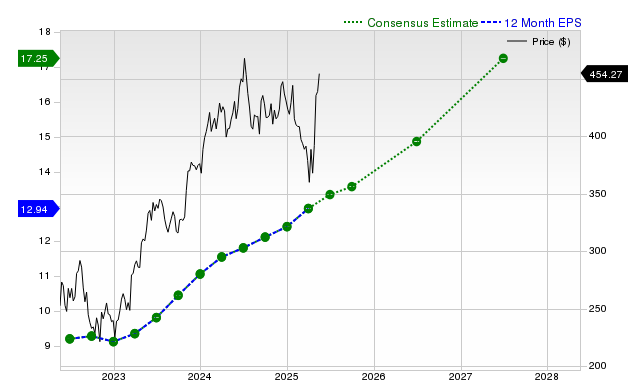

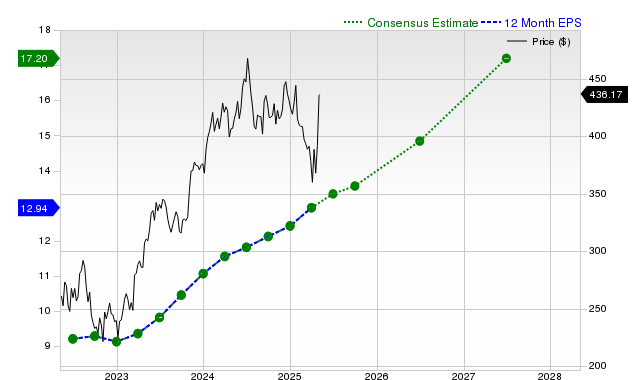

12-Month EPS

Projected Revenue Growth

While earnings growth is vital for financial health, revenue growth is equally important. Sustaining earnings increases requires a company to effectively raise its revenues over an extended period.

For Microsoft, the consensus sales estimate stands at $73.73 billion for the current quarter, indicating a +13.9% year-over-year growth. Projections for the current and next fiscal years are $278.62 billion and $313.16 billion, reflecting increases of +13.7% and +12.4%, respectively.

Last Reported Results and Surprise History

In its last quarterly report, Microsoft achieved revenues of $70.07 billion, up +13.3% compared to the previous year. The earnings per share (EPS) of $3.46 also shows improvement from $2.94 a year ago.

Compared to the Zacks Consensus Estimate of $68.38 billion, Microsoft’s reported revenues represented a surprise of +2.46%, while the EPS surprise was +8.13%.

The company has consistently surpassed consensus EPS estimates over the last four quarters, indicating strong financial performance across the board.

Valuation

Understanding a stock’s valuation is crucial for making informed investment decisions. Analyzing whether a stock’s current price reflects its intrinsic value can significantly impact future performance.

When evaluating a company’s valuation multiples—such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF)—it helps to compare these figures to historical values and industry peers to determine if the stock is overvalued, undervalued, or fairly valued.

As per the Zacks Style Scores system, Microsoft has a D grade for value metrics, indicating that it trades at a premium compared to its peers. Click to explore the valuation metrics contributing to this rating.

Conclusion

The insights discussed here, among other data available on Zacks.com, can assist in evaluating whether Microsoft merits close attention amid market buzz. Its Zacks Rank of #3 suggests it may perform in line with broader market trends in the near term.