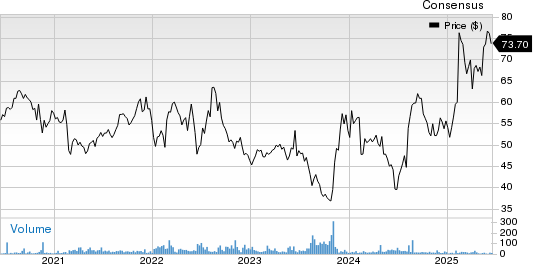

Tesla (TSLA) has experienced a stock decline of -7.1% over the past month, contrasting with the S&P 500’s gain of +1.7%. The Zacks Automotive – Domestic industry has also seen a decrease of -2.8% in the same period. For the current quarter, Tesla is projected to report earnings of $0.43 per share, a drop of -17.3% year-over-year, with the earnings estimate recently revised up by +7.8%.

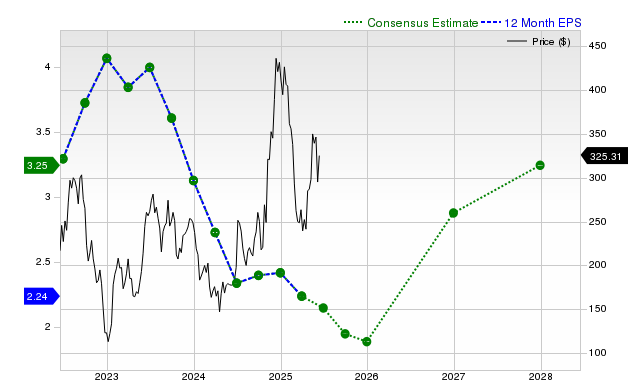

The consensus revenue estimate for Tesla stands at $23.5 billion, indicating a -7.8% change from the previous year. For the current fiscal year, the earnings estimate of $1.89 reflects a decline of -21.9%. The company’s valuation indicates it is overvalued compared to peers, reflected in a Zacks Rank of #5 (Strong Sell), predicting underperformance in the near term.

In the last reported quarter, Tesla posted revenues of $19.34 billion with an EPS of $0.27, both representing declines from the previous year. The earnings surprise was -38.64% and revenue fell short of the consensus estimate by -7.84%.