CBRE Group Anticipates Strong Earnings Growth Ahead of Fourth Quarter Report

Market Leader Prepares for Earnings Reveal

Valued at $43.1 billion by market cap, Dallas-based CBRE Group, Inc. (CBRE) serves as the global leader in commercial real estate services and investment. The company offers integrated services to real estate investors and occupiers through its Advisory Services, Global Workplace Solutions, and Real Estate Investments segments. With over 130,000 employees across more than 500 offices worldwide, CBRE operates in over 100 countries.

Impressive Earnings Expected for Q4

As CBRE gears up to announce its fourth-quarter results before the markets open on Thursday, Feb. 13, analysts project the company will report a non-GAAP profit of $2.21 per share. This figure represents a remarkable 60.1% increase from $1.38 per share reported in the same quarter last year. Notably, CBRE has exceeded Wall Street’s bottom-line expectations in each of the last four quarters. In its most recent quarter, adjusted earnings per share jumped 66.7% year-over-year to $1.20, surpassing analysts’ estimates by 13.2%.

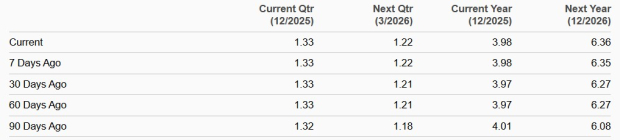

Future Earnings Projections Indicate Continued Growth

Looking ahead, for the full fiscal 2024, CBRE is expected to achieve an adjusted EPS of $4.99, reflecting nearly a 30% increase from $3.84 in fiscal 2023. Furthermore, projections for fiscal 2025 indicate a 21.6% year-over-year rise in earnings to $6.07 per share.

Stock Performance Outshines Major Indices

In the past year, CBRE stock has surged by 59.5%, significantly outperforming the S&P 500 Index’s ($SPX) 25.5% gain and the Real Estate Select Sector SPDR Fund’s (XLRE) 5.7% increase during the same period.

Robust Q3 Results Drive Stock Price Higher

After announcing its strong Q3 results on Oct. 24, CBRE’s stock rose 8.4%. The company recorded operational gains across its key business segments and continued to strengthen its strategic positioning. An increase in leasing activities and property sales led to a solid 14.8% year-over-year revenue growth, exceeding $9 billion and surpassing Wall Street’s expectations. Moreover, CBRE maintained a low net leverage ratio of 1.26x and reported an impressive 63.3% increase in adjusted net income to $369 million.

Positive Analyst Sentiment

CBRE’s cash flow outlook remains strong. The company saw free cash flow rise 60.9% year-over-year to $494 million in Q3. The consensus on CBRE stock is upbeat, with a “Strong Buy” rating overall. Among the 11 analysts covering the stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” and two suggest “Hold.” The mean price target of $151.30 indicates an 8.5% premium over current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.