Dayforce Inc. Expected to Report Strong Q1 Earnings Growth

Dayforce Inc. (DAY), a leader in human capital management (HCM) software, has a market capitalization of $8.8 billion. The company provides a cloud-based platform offering services such as human resources, payroll, tax management, and workforce management. Additionally, it offers Powerpay, a specialized HR and payroll solution targeted at small businesses. Based in Minneapolis, Minnesota, Dayforce is set to report its first-quarter earnings on Wednesday, May 7, before markets open.

Analysts Predict Earnings Surge

Before the earnings release, analysts project that Dayforce will achieve a profit of $0.36 per share. This represents a significant 71.4% increase compared to the $0.21 per share reported in the same quarter last year. The company has a mixed earnings history; it has exceeded estimates in two of the past four quarters and missed in two. In the previous quarter, Dayforce reported earnings per share (EPS) of $0.37, surpassing analysts’ consensus estimates by 37% due to strong performance across enterprise and global sales, alongside a commendable annual gross retention rate of 98%.

Expected Earnings Growth for Future Fiscal Years

Looking ahead, analysts forecast that Dayforce will report an EPS of $1.48 for the current fiscal year, which reflects a 49.5% increase from $0.99 in fiscal 2024. Furthermore, projections indicate that earnings could rise by 21.6% year-over-year to $1.80 per share in fiscal 2026.

Stock Performance and Market Comparisons

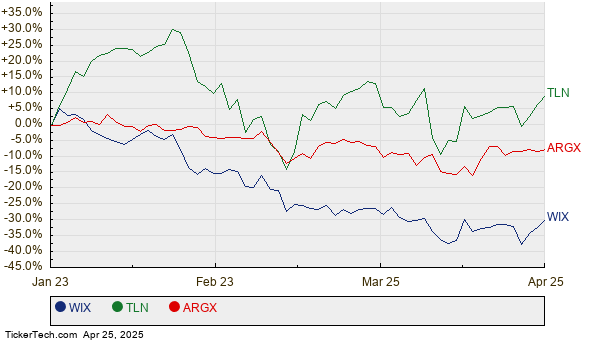

Over the last year, shares of DAY have decreased by 4.1%, underperforming the S&P 500 Index, which gained 8.2%, and the Technology Select Sector SPDR Fund, which posted a 3.7% return in the same period.

Upon releasing its fourth-quarter earnings on February 5, DAY shares experienced an 8% drop. The company’s revenue increased by 16.4% year-over-year, totaling $465.2 million. This growth was primarily fueled by a 19.1% increase in Dayforce’s recurring revenue, amounting to $347.9 million. Moreover, the adjusted EBITDA margin saw a 3% uptick to 27.8%, resulting in an adjusted EBITDA of $129.2 million, reflecting a 30.2% growth from the previous quarter.

Analysts Hold Moderately Optimistic Views

The consensus opinion on Dayforce stock is moderately optimistic, earning a “Moderate Buy” rating overall. Among the 18 analysts covering the stock, ten recommend a “Strong Buy,” one suggests a “Moderate Buy,” and seven advise to “Hold.” The mean price target stands at $73.88, indicating a substantial 29% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.