“`html

Warren Buffett’s Investment Philosophy

Warren Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A, BRK.B), has achieved a total return of 5,502,284% over six decades, with a compound annual growth rate (CAGR) of 19.9%, significantly outperforming the S&P 500 even when factoring in dividend reinvestment.

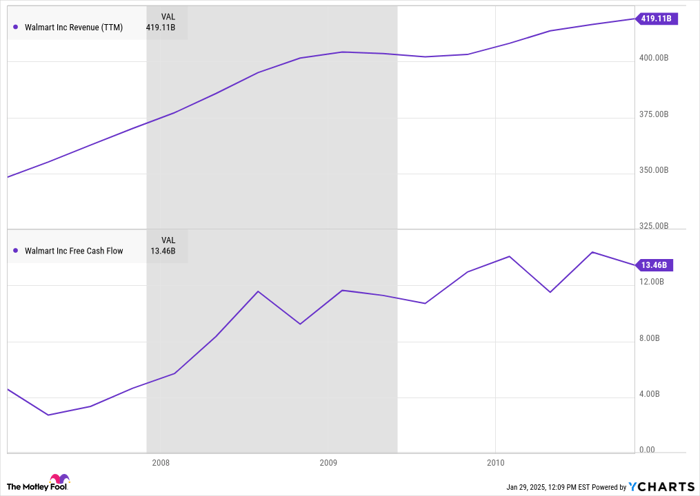

Buffett advises focusing on high-quality companies with reliable cash flow and strong brands, such as Apple, American Express, and Coca-Cola. He emphasizes long-term investment strategies, cautioning against short-term speculation and market timing while encouraging index fund investments for most individuals due to their alignment with overall economic growth.

For first-time investors, Buffett recommends regularly investing in S&P 500 index funds as a simple and effective way to build wealth over time, with an emphasis on patience and consistency through market fluctuations.

“`