Tech Giants Microsoft and Meta Navigate Earnings Season Challenges

Earnings season is underway, and this week features a packed reporting schedule. Major players include Microsoft (MSFT) and Meta Platforms (META), both members of the influential Mag 7 group.

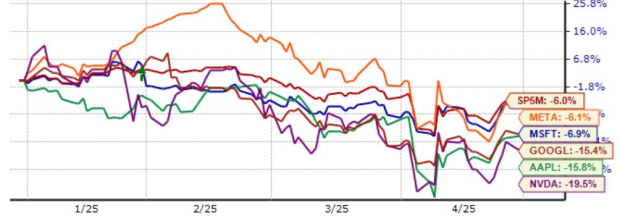

Recently, the overall Mag 7 trade has lost momentum, as investors trim their exposure amid large price gains and tariff uncertainties. However, MSFT and META have shown resilience, leading the group in year-to-date performance.

Image Source: Zacks Investment Research

How do the quarterly expectations compare? Let’s take a closer look.

Meta: Ad Revenue Critical for Performance

Over the past three months, META shares have dropped about 20%, underperforming the S&P 500 significantly. A positive reaction followed its last quarterly report, but broader economic and tariff concerns quickly dampened investor enthusiasm.

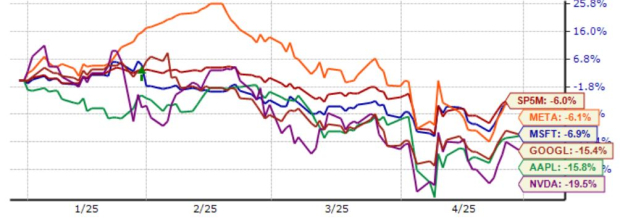

Analysts have lowered their earnings per share (EPS) expectations, with the current Zacks Consensus EPS estimate at $5.21—down nearly 5% since early February. Sales projections remain stable, anticipating an 11% EPS growth along with a 13% rise in overall sales.

Image Source: Zacks Investment Research

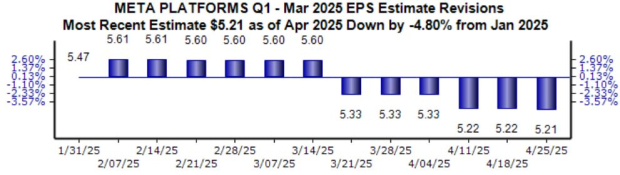

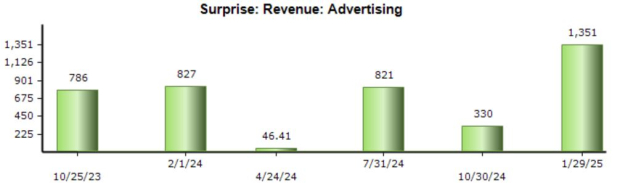

Advertising results will be a focal point, as this segment comprises the bulk of META’s revenue. The Zacks Consensus Estimate for advertising sales is set at $40.4 billion, reflecting a 13.4% increase compared to last year.

Image Source: Zacks Investment Research

Historically, META has exceeded consensus estimates, achieving six consecutive earnings beats.

Image Source: Zacks Investment Research

Microsoft: Cloud Performance in the Spotlight

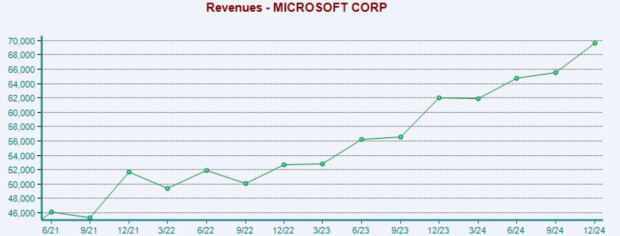

Conversely, Microsoft’s EPS and sales expectations have remained steady, indicating a stable outlook compared to META. The current consensus anticipates a 9% growth in EPS and an 11% increase in sales, sustaining the tech giant’s growth trajectory.

Image Source: Zacks Investment Research

Microsoft’s Intelligent Cloud segment, including Azure services, will capture attention. The Zacks Consensus Estimate for cloud sales stands at $26.1 billion.

Investors will likely focus on the cloud outlook and guidance in the earnings release, especially given recent market anxieties. To inspire confidence, Microsoft would need to deliver strong results along with optimistic projections.

Additionally, the company’s capital expenditures are crucial, considering its substantial investments in data center expansions amid the AI surge. Reports indicate that Microsoft has already scaled back some of these initiatives, making it a key discussion point in the upcoming earnings call.

Conclusion

This week marks a significant moment in the Q1 2025 earnings cycle, with Microsoft and Meta leading the charge among the Mag 7 members. For META, advertising results are pivotal as the company utilizes AI advancements to enhance user relevance.

For MSFT, cloud performance is paramount, especially amid the growing investor interest in AI developments. Positive commentary and a robust outlook will be essential as they navigate this earnings season.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.