Investing Opportunities: Oversold Stocks in Consumer Staples

Finding undervalued stocks in the consumer staples sector can be a wise investment strategy, especially during market dips.

The Relative Strength Index (RSI) is a helpful tool for investors, measuring a stock’s momentum by comparing its daily gains to its daily losses. When the RSI falls below 30, the stock is generally considered oversold, indicating it may be a good time to buy, according to Benzinga Pro.

Below is a list of notable companies in the consumer staples sector with RSIs around or below 30.

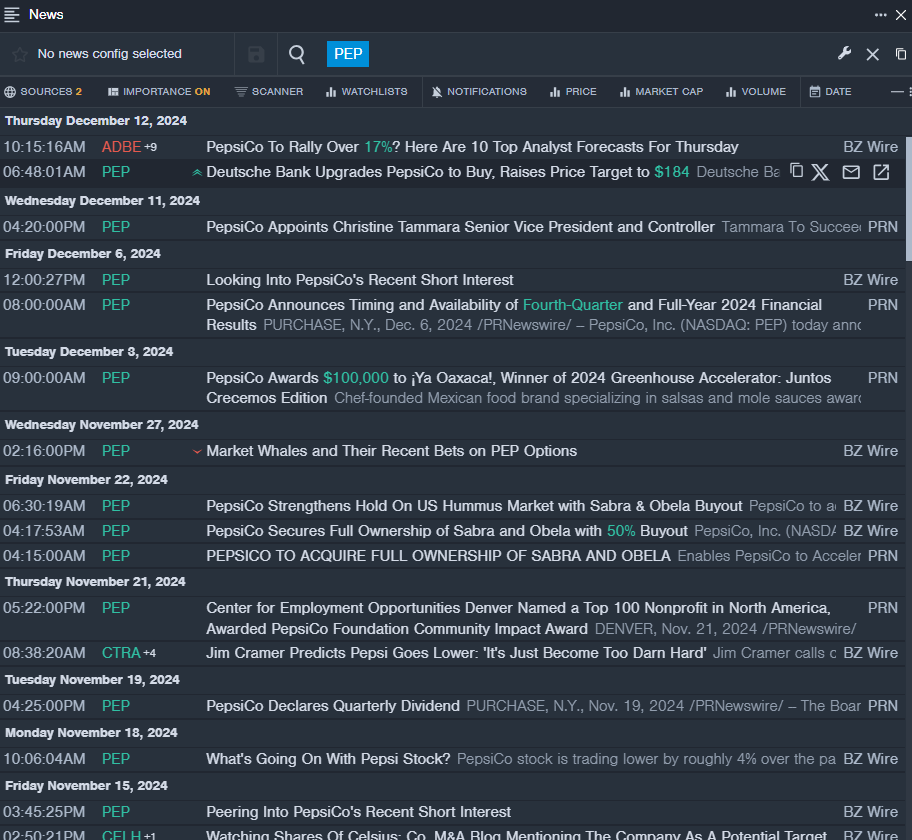

PepsiCo Inc PEP

- On December 12, Deutsche Bank analyst Steve Powers rated PepsiCo as a Buy, upgrading it from Hold and raising the price target from $179 to $184. Recently, PepsiCo’s stock has dropped roughly 7% over the past month, reaching a 52-week low of $149.71.

- RSI Value: 26.8

- PEP Price Action: PepsiCo shares fell 0.8% to finish at $151.72 on Monday.

- Updates about PEP are available through Benzinga Pro’s real-time newsfeed.

Mondelez International Inc MDLZ

- On December 11, Mondelez International’s Board approved a new share buyback program worth up to $9 billion for its Class A common stock. This program will start on January 1, 2025, and run until December 31, 2027, replacing an existing program that still has about $2.8 billion remaining. Mondelez’s stock has fallen approximately 9% over the last month, with a 52-week low of $58.90.

- RSI Value: 21.7

- MDLZ Price Action: Mondelez shares decreased by 1.1%, closing at $59.56 on Monday.

- Benzinga Pro’s charting tools helped track the trends of MDLZ stock.

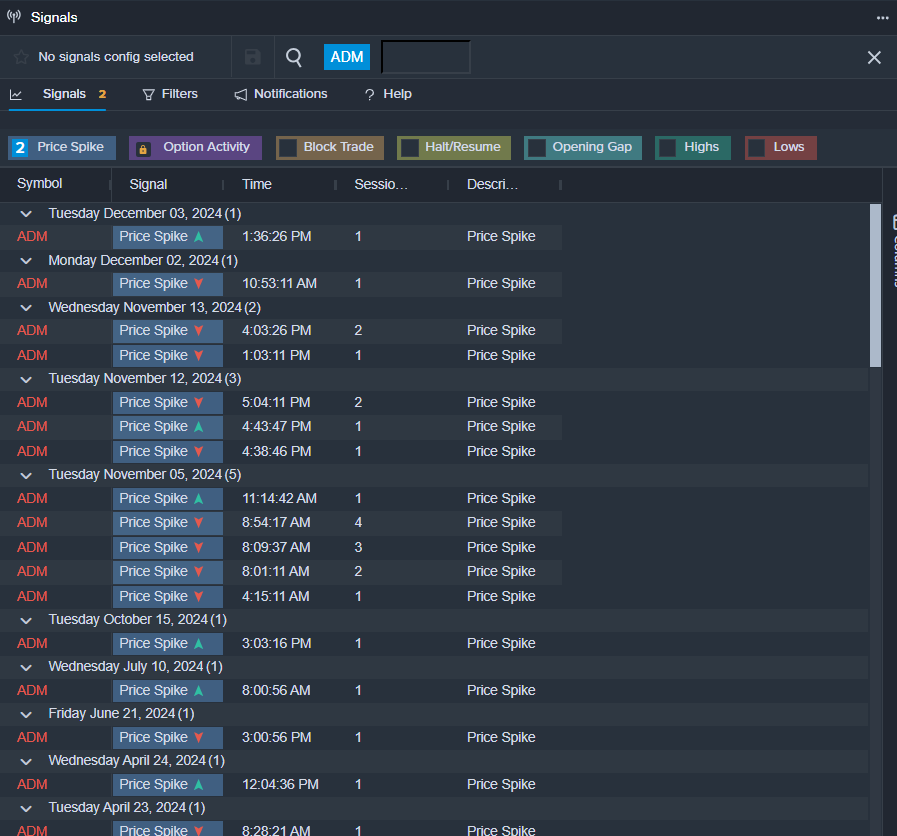

Archer-Daniels-Midland Co ADM

- On December 11, ADM announced an extension of its share repurchase program until 2029, expanding it to a total of 300 million shares. The stock has dipped about 8% in the last month, currently holding a 52-week low of $48.92.

- RSI Value: 28.6

- ADM Price Action: Archer-Daniels-Midland shares fell 1% to close at $50.07 on Monday.

- Monitoring services from Benzinga Pro indicated a potential breakout for ADM shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs