The Estee Lauder Companies Inc. EL is reaping benefits from the implementation of a Profit Recovery Plan and robust presence in emerging markets where demand is growing. The company’s strategic initiatives, including innovation pipeline optimization and AI integration, are aimed to bolster profitability.

However, challenges such as softness in mainland China and geopolitical tensions are risks. Let’s delve deeper.

Rebuilding Profitability

Estee Lauder commenced the implementation of its Profit Recovery Plan for the fiscal 2025 and 2026 (announced in November 2023) aimed at fortifying profitability, fostering accelerated sales growth and enhancing operational agility. This plan is tailored to improve gross margins, streamline costs and diminish overhead expenses while amplifying investments in pivotal consumer-facing endeavors. Upon successful execution, management anticipates a notable enhancement in gross margin and cost structure, amplifying operational leverage for future endeavors.

As part of the plan, it intends to bolster investments in enhancing its brands to foster sustainable growth. The company’s globally implemented integrated business planning process is enhancing operational inventory management. It streamlined its innovation pipeline for the fiscal 2025 and 2026, prioritizing trend-setting products. Management expects to realize an incremental operating profit of $1.1-$1.4 billion through the fiscal 2025 and 2026.

Furthermore, management is strategically integrating AI across its global brands to enhance traditional strengths and elevate customer experiences. The company’s collaboration with leading technology firms remains focused on leveraging AI to accelerate market responsiveness and deliver tailored media targeting solutions at scale.

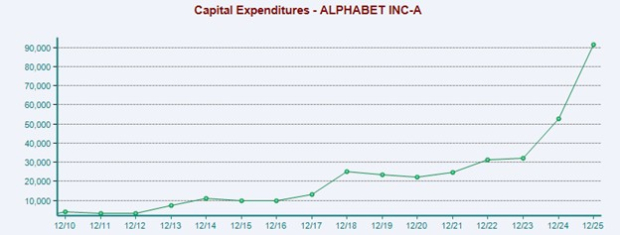

Image Source: Zacks Investment Research

Solid Presence in Emerging Markets

Estee Lauder has a strong presence in emerging markets, where demand appears to be growing. The company derives significant revenues from emerging markets like Thailand, India, Russia and Brazil, which encourages it to make distributional, digital and marketing investments in these countries. As a result, the company is well insulated from macroeconomic headwinds in developed nations. In its lastearnings call management highlighted that strong double-digit growth in Mexico, Brazil and India during third-quarter fiscal 2024 propelled outstanding performance in emerging markets year to date. The company has also been building infrastructure across emerging regions that help generate continued growth.

Hurdles on the Way

Estee Lauder continues to operate in a challenging macroeconomic environment and geopolitical tensions across certain parts of the world. The company has been battling softness in the mainland China region for the past few quarters. In the third quarter of fiscal 2024, the company experienced lower-than-expected net sales in mainland China, reflecting the impact of ongoing softness in overall prestige beauty stemming from subdued consumer confidence and softness during holidays and key shopping moments.

Lowered View

Considering macroeconomic challenges — including softness in overall prestige beauty in mainland China and geopolitical volatility in certain regions — management lowered its top-line outlook for the fiscal 2024.

For fiscal 2024, management now projects a net sales decline of 2-3%. The company had earlier expected the metric in the range of a 1% decline and a 1% increase. Organic net sales are anticipated to decline 1-2% in the fiscal 2024. Organic net sales were earlier anticipated in the range of a 1% decline and a 1% increase in the fiscal 2024. Adjusted earnings per share (EPS) are expected in the band of $2.14-$2.24, suggesting a decline from $3.46 reported in the fiscal 2023. Adjusted EPS are projected to decline 33-36% at constant currency compared with a decline of 34-38% projected earlier.

Despite these challenges, proactive measures are being implemented to mitigate the impact and sustain resilience in the face of evolving market dynamics. The Zacks Rank #3 (Hold) company’s shares have gained 8.2% in the past three months compared with the industry’s 4.9% growth.

Top 3 Picks

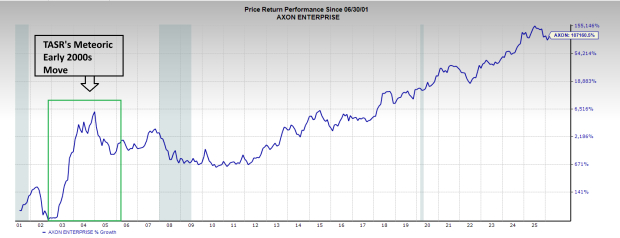

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

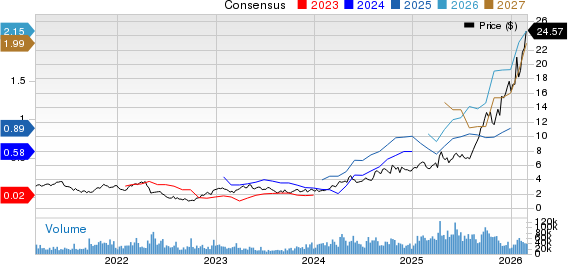

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2 (Buy). UTZ has a trailing four-quarter earnings surprise of 2% on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 24.6% from the year-ago reported numbers.

McCormick & Company, Inc. MKC is a leading manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors. It currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for McCormick & Company’s current fiscal-year sales and earnings indicates advancements of 0.3% and 5.6%, respectively, from the year-ago reported figures. MKC has a trailing four-quarter earnings surprise of 5.4%, on average.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.