Analysts Predict Bright Future for Vanguard’s Small-Cap ETF

In the latest analysis from ETF Channel, we’ve examined the Vanguard S&P Small-Cap 600 Value ETF (Symbol: VIOV) and compared its current trading price against the estimated analyst target prices for its underlying holdings. The analysis suggests an implied target price of $102.43 per unit for VIOV.

Current Price vs. Analyst Target

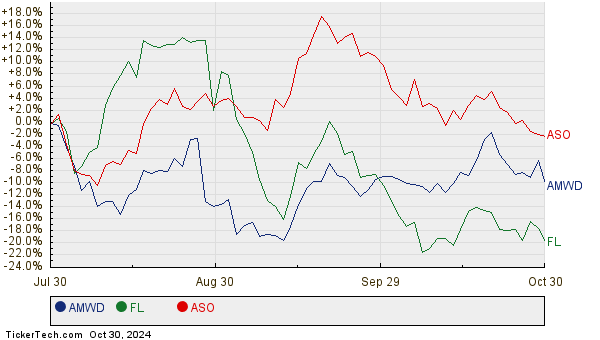

Trading recently at approximately $92.23 per unit, VIOV appears to offer an upside potential of 11.06%. This projection is based on the average analyst expectations for the ETF’s underlying assets. Noteworthy among these are American Woodmark Corp. (Symbol: AMWD), Foot Locker, Inc. (Symbol: FL), and Academy Sports & Outdoors Inc. (Symbol: ASO), each showing significant upside potential based on their analyst price targets.

Highlighted Holdings with Upside Potential

For example, American Woodmark Corp., trading at $91.65 per share, has an average analyst target of $114.67—a potential increase of 25.11%. Similarly, Foot Locker’s recent price of $23.11 presents an upside of 24.56% to its target price of $28.79. Academy Sports & Outdoors is projected to rise by 22.15% from its current price of $52.16, with a target of $63.72. Below is a chart documenting the recent performance of these stocks:

Summary of Analyst Targets

The following table summarizes the current analyst target prices for the ETF and its significant holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Small-Cap 600 Value ETF | VIOV | $92.23 | $102.43 | 11.06% |

| American Woodmark Corp. | AMWD | $91.65 | $114.67 | 25.11% |

| Foot Locker, Inc. | FL | $23.11 | $28.79 | 24.56% |

| Academy Sports & Outdoors Inc | ASO | $52.16 | $63.72 | 22.15% |

Investors Should Consider Analyst Justifications

The optimism reflected in these target prices invites questions: Are analysts justified in their projections, or are they too hopeful? Investors should conduct thorough research to determine whether these targets align with recent market developments or whether they are based on outdated information.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Investment Brokerages Dividend Stocks

• TIXT market cap history

• ETFs Holding RCKY

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.