Etsy Faces 28.4% Share Decline Amid Economic Challenges

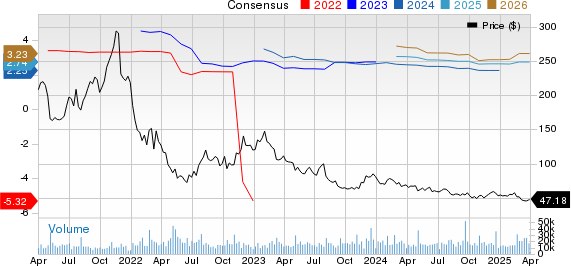

Etsy (ETSY) has seen its share price drop by 28.4% over the past twelve months. This performance starkly contrasts with the Zacks Retail-Wholesale sector’s increase of 11.2% and the S&P 500 index’s rise of 6.9%. Furthermore, Etsy lagged behind the Zacks Internet – Commerce industry’s growth of 16.1% during the same time period.

Economic Pressures Impacting Sales

The primary reason for Etsy’s underperformance stems from weaker consumer discretionary spending amid ongoing macroeconomic challenges. Currently, the e-commerce sector is experiencing a slowdown, particularly impacting buyers from lower household income brackets. This trend has led to a 4.4% year-over-year decline in Etsy’s gross merchandise sales (GMS) for 2024. With economic pressures likely to persist, Etsy’s marketplace sales may continue to feel the effects in the upcoming years.

Intensifying Competition in E-Commerce

Etsy also faces increased competition from larger online retail players such as Amazon (AMZN), eBay (EBAY), and Alibaba (BABA). Amazon maintains dominance through aggressive pricing, wide selection, and convenience via its Prime loyalty program. Meanwhile, eBay consistently works to enhance the buying and selling experience for its customers. Alibaba, controlling around 80% of the Chinese e-commerce market, is also expanding its footprint internationally. Over the past year, shares of Amazon, eBay, and Alibaba have risen by 5.2%, 29.5%, and 80.2%, respectively.

Strategic Initiatives for Growth

In light of these challenges, Etsy has developed several strategic initiatives for 2025 aimed at enhancing its GMS. The company plans to leverage artificial intelligence (AI) to improve search and discovery, optimize the buyer experience for smoother navigation and checkout, and bolster seller support with advanced tools and advertising services. Additionally, Etsy intends to expand its marketing efforts, invest in AI-driven personalization, and pursue growth in international markets through localized offerings and improved logistics.

Projected Earnings and Revenue

The Zacks Consensus Estimate indicates that Etsy’s earnings per share for the first quarter of 2025 will be 53 cents, a slight decrease of one penny from the last 30 days. This estimate reflects a year-over-year growth of 10.42%. For revenues, analysts predict a total of $644.45 million, signaling a slight year-over-year decline of 0.23%.

Etsy has fallen short of the Zacks Consensus Estimate for earnings in three of its last four quarters, with an average surprise of -5.29% in the negative direction.

Conclusion: Holding Etsy Stock is Advisable

Etsy has carved a unique niche in the market for handmade and vintage products, attracting buyers looking for distinctive offerings. Nevertheless, the high price points of these goods have led to reduced spending amid broader economic challenges. Although Etsy grapples with declining GMS and fierce competition from larger companies, it is focusing on critical growth strategies—particularly in search, discovery, and customer service enhancements. Its initiatives for global expansion and personalized services aim to foster long-term growth, despite potential macroeconomic headwinds affecting performance.

Currently, Etsy holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more suitable entry point in 2025. More details on top-performing stocks can be found on Zacks.

Top Stock Picks for the Upcoming Month

Industry experts have identified 7 elite stocks from a current pool of 220 Zacks Rank #1 Strong Buys. These stocks are anticipated to deliver significant price gains in the near term.

Since 1988, this curated list has outperformed the market, achieving an average annual return of +24.3%. Investors should pay close attention to these handpicked stocks.

Want the latest insights from Zacks Investment Research? Today, you can download the list of the 7 Best Stocks for the Next 30 Days.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.