By RoboForex Analytical Department

EUR/USD Shows Signs of Weakness Amid Fed Rate Expectations

As market participants reevaluate the Federal Reserve’s monetary policy, the EUR/USD exchange rate has dipped slightly, nearing the support level at 1.0905. The likelihood of a 25-basis-point rate cut by the Fed in November is currently estimated at 86.8%, indicating cautious sentiments surrounding further easing this year.

Germany’s Current Account Surplus Declines

Recent data from Germany revealed a current account surplus of 14.4 billion euros for August 2024. This figure marks the lowest surplus since May 2023 and fell short of analysts’ expectations of 19.9 billion euros. A prominent decrease in the goods segment points to potential weaknesses in Europe’s largest economy.

US Consumer Confidence Index Drops

In the United States, the University of Michigan’s preliminary Consumer Confidence Index for October fell to 68.9 points, compared to 70.1 in September, which was a five-month high. This decrease contrasts with expectations of an increase to 71.9 points and highlights year-on-year concerns over rising prices. The index rose from 63.8 in October 2023, indicating sustained consumer anxiety.

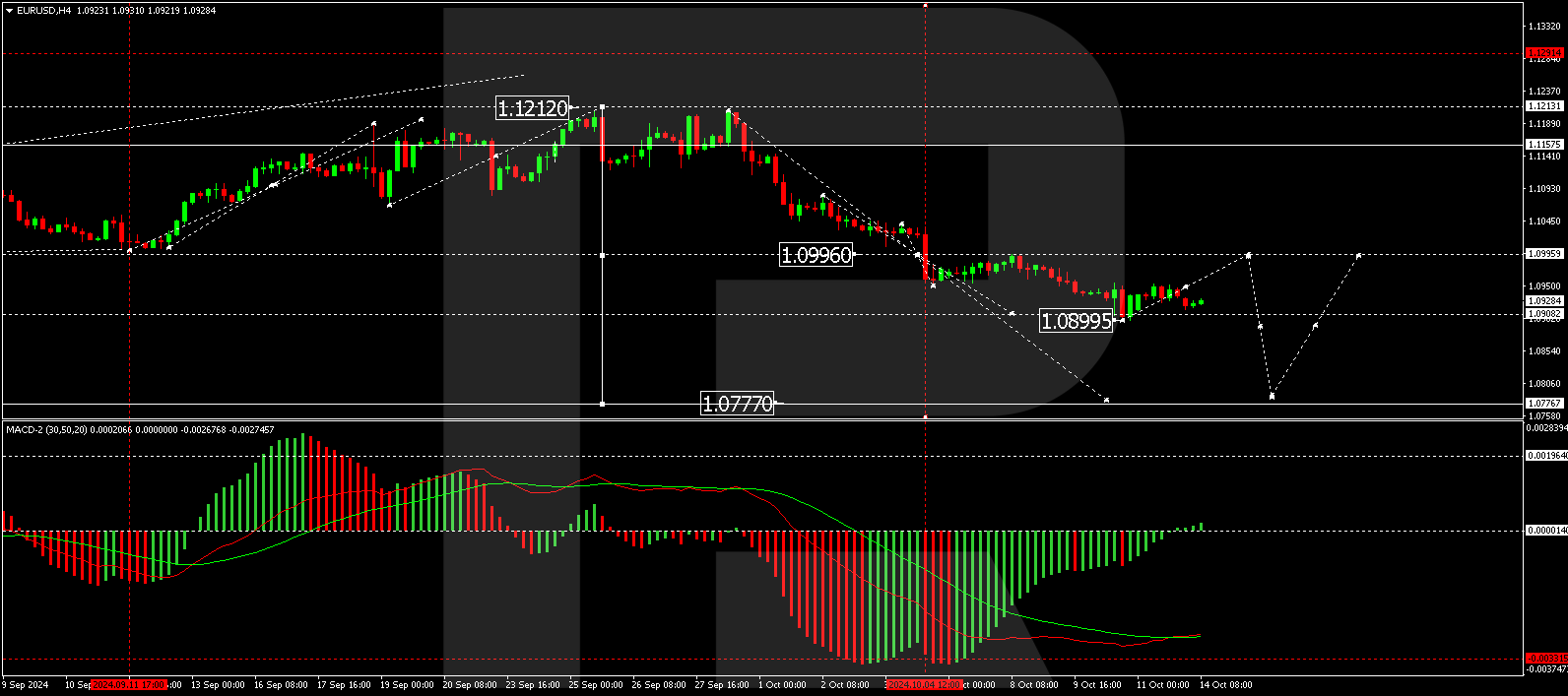

Technical Analysis of EUR/USD

The EUR/USD pair has demonstrated a downward movement reaching 1.0890, followed by a rally to 1.0953, and has since corrected to 1.0926. The market is currently forming a consolidation range around this level. If the price breaks below 1.0926, it may continue declining towards 1.0898. Alternatively, an upward breakthrough could prompt a corrective move towards 1.0995 before possibly slipping again to 1.0777. The MACD indicator, while below zero, shows early signs of upward movement, suggesting potential short-term bullish corrections amid an overall bearish trend.

On the hourly chart, after hitting a high of 1.0953, the market corrected to 1.0925 and has now broken below 1.0926. This suggests a possible extension of the consolidation range towards 1.0898. A drop to this level might lead to a retest of 1.0926 from below, followed by a corrective rise to 1.0995. The Stochastic oscillator, currently above 50 but trending towards 20, indicates that short-term declines may occur before potential recovery.

Disclaimer

Any forecasts contained herein are based on the author’s personal opinion. This analysis should not be considered as trading advice. RoboForex bears no responsibility for trading outcomes based on the recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs