By RoboForex Analytical Department

EUR/USD on Edge Ahead of Presidential Election and Fed Meeting

The EUR/USD currency pair remains stable around 1.0878 as investors prepare for the upcoming US presidential election. The outcome could greatly influence the pair’s movement. A victory for Donald Trump may strengthen the USD, possibly pushing the exchange rate higher. In contrast, if Kamala Harris wins, analysts predict the USD could drop by 1-2%.

This expected volatility isn’t only due to the election results; it also stems from the Federal Reserve’s meeting set for Wednesday. Analysts anticipate a slight interest rate cut of 25 basis points. Participants in the market are especially eager for guidance from the Fed concerning future rate changes, with many predicting another cut by December.

While there are significant economic data releases on the horizon, the impact of these announcements could be overshadowed by the election and Fed meeting.

EUR/USD Technical Analysis

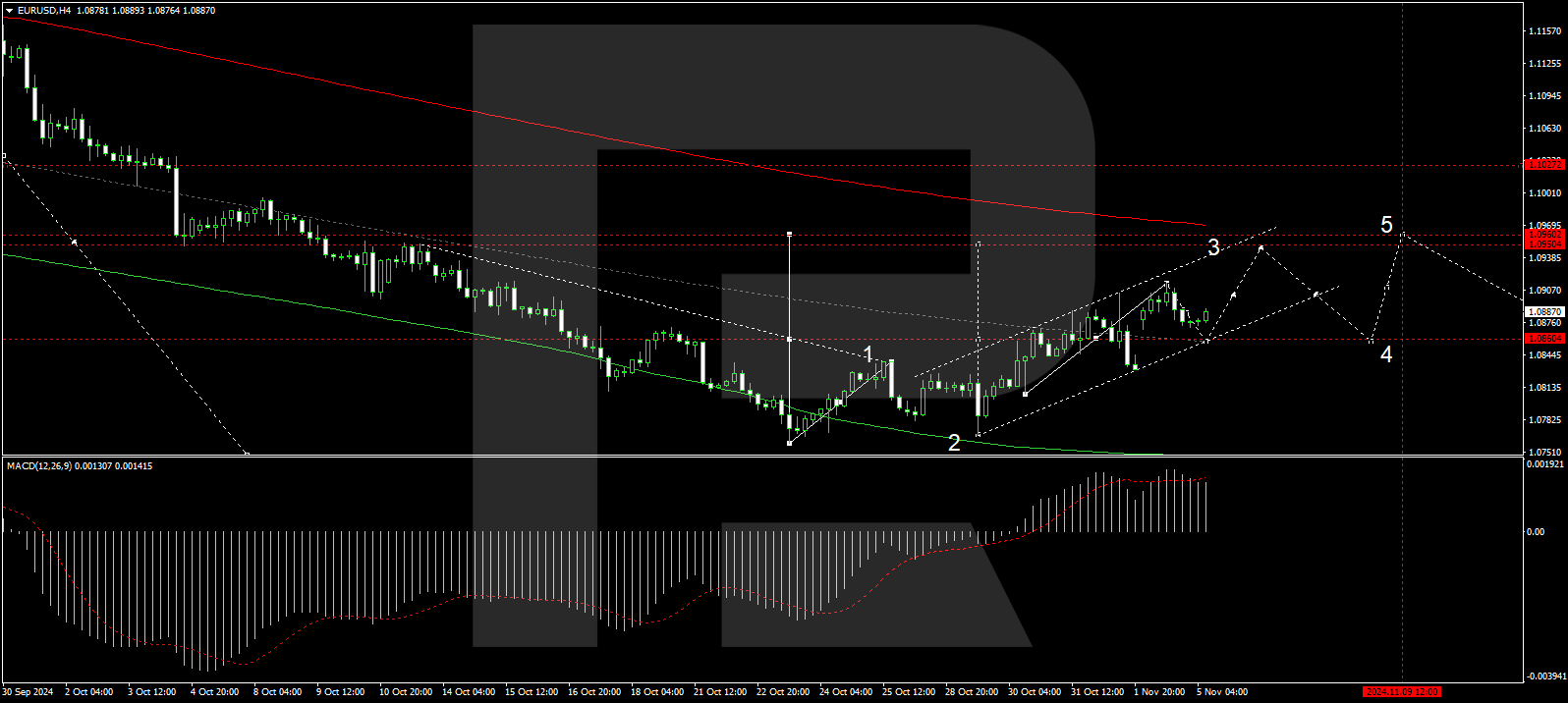

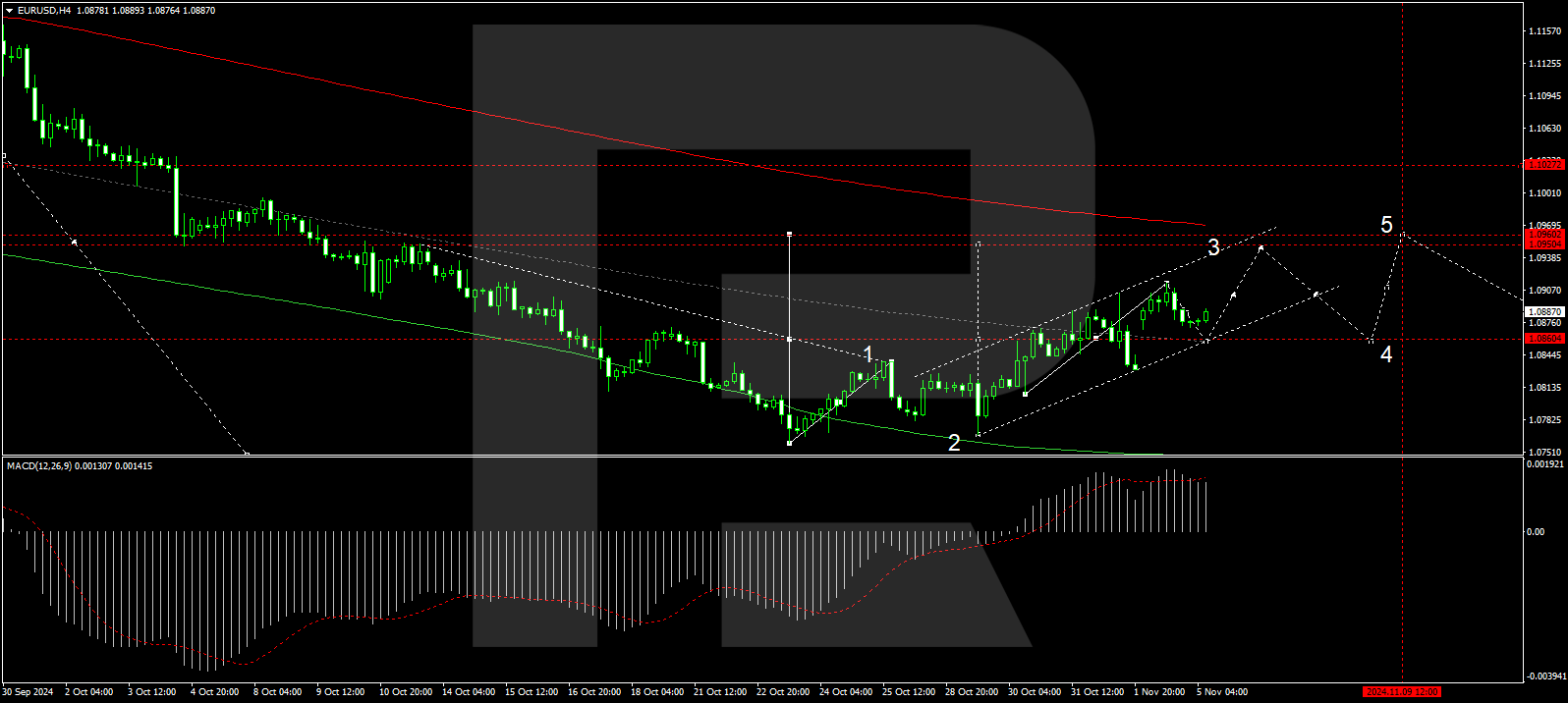

Recent market trends show that EUR/USD has moved towards 1.0913, marking part of a third growth wave targeting 1.0950. Following this target, a retreat to 1.0860 is likely, leading to a wider consolidation range around that area. Technical tools, including the MACD, hint at a possible upward movement, suggesting it may reach 1.0960 before experience a corrective dip to 1.0860.

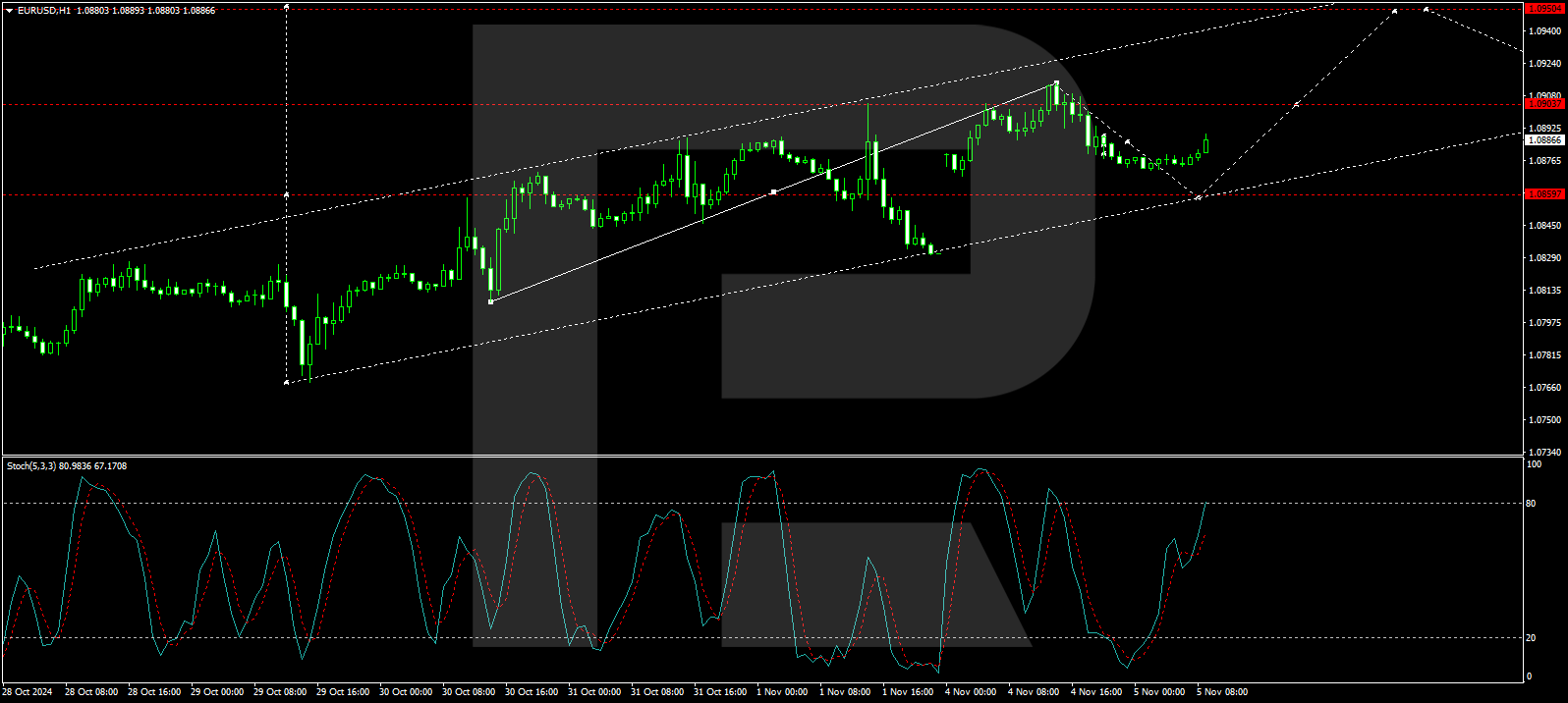

A support level at 1.0872 has triggered upward momentum towards 1.0900, which should be tested soon. If this level is broken, the upward trend could advance toward 1.0950. The Stochastic oscillator supports this short-term expectation, showing upward momentum with its signal line approaching the upper area around 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs