AbbVie Inc. Reports Strong Performance Despite Market Fluctuations

AbbVie Inc. (ABBV), based in North Chicago, Illinois, is a leading biopharmaceutical company engaged in discovering, developing, manufacturing, and selling pharmaceuticals globally. With a market capitalization of $361.9 billion, AbbVie focuses on addressing health challenges through innovations in immunology, oncology, aesthetics, neuroscience, and eye care.

Falling into the “mega-cap” category, AbbVie’s stature is underscored by its substantial market cap, positioning it as a dominant player in the drug manufacturing industry. The company’s extensive portfolio includes top-selling medications such as Humira, Imbruvica, and Rinvoq. A commitment to research and development underlines AbbVie’s strategy, contributing to its robust pipeline of innovative therapies and enhancing its global market presence.

Active Investor: FREE newsletter going behind the headlines on the hottest stocks to uncover new trade ideas

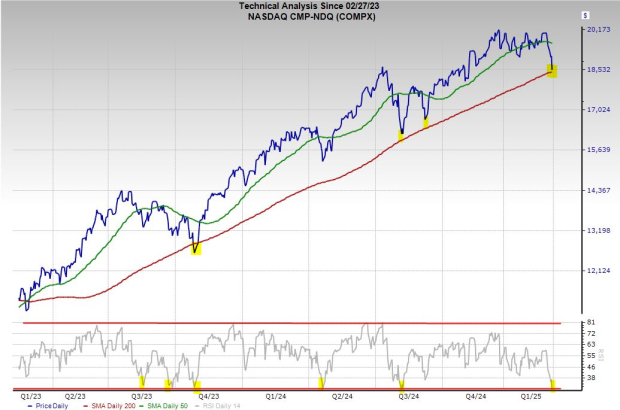

Recently, AbbVie shares experienced a slight decline of 1.1% from their 52-week high of $207.32, reached on October 31, 2024. Over the past three months, AbbVie’s stock has increased by 12%, outperforming the Health Care Select Sector SPDR Fund’s (XLV) modest gains during the same period.

In the longer term, AbbVie’s shares have appreciated by 15.4% year-to-date and 14.5% over the last 52 weeks, surpassing XLV’s year-to-date increase of 7% and minor returns over the past year.

To further confirm this bullish trend, AbbVie has consistently traded above its 50-day and 200-day moving averages since late January.

The company’s solid performance is largely attributed to the success of its immunology products, Skyrizi and Rinvoq. Additionally, new launches such as Venclexta and Vraylar, along with promising therapies like Ubrelvy, Elahere, and Qulipta, strengthen its neuroscience and oncology offerings. The recent approval of Vyalev for advanced Parkinson’s disease enhances its portfolio even further. Ongoing research related to Botox and Juvederm is also poised to create additional growth opportunities for AbbVie. Moreover, the firm’s strategy of acquisitions and integration of advanced technology continues to boost its prospects.

On January 31, AbbVie shares climbed over 4% following the release of its Q4 results. The reported revenue of $15.1 billion exceeded analyst expectations of $14.9 billion. Furthermore, AbbVie’s adjusted earnings per share (EPS) stood at $2.16, surpassing the anticipated $2.13. For the full year, AbbVie forecasts an adjusted EPS between $12.12 and $12.32.

Notably, AbbVie’s competitor, Eli Lilly and Company (LLY), has outperformed with a year-to-date gain of 17.3% and 18.3% over the past year.

According to Wall Street analysts, sentiments around AbbVie are moderately optimistic. The stock holds a consensus rating of “Moderate Buy” from 25 analysts, with a mean price target of $207.20, indicating a potential upside of 1.1% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.