Adobe Sets Expectations for Q1 Fiscal 2025 Earnings Report

Adobe (ADBE) is scheduled to release its first-quarter fiscal 2025 financial results on March 12.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Financial Projections for First Quarter

For the first quarter of fiscal 2025, Adobe anticipates total revenues between $5.63 billion and $5.68 billion. The company also expects non-GAAP earnings in the range of $4.95 to $5.00 per share.

The Zacks Consensus Estimate for revenues stands at $5.65 billion, indicating a 9.11% increase from the previous year. Meanwhile, the consensus for earnings remains at $4.97 per share, reflecting a 10.94% growth year over year.

In recent quarters, ADBE’s earnings have consistently exceeded the Zacks Consensus Estimate, yielding an average surprise of 2.59% over the last four quarters.

Adobe Inc. Price and EPS Surprise

Adobe Inc. price-eps-surprise | Adobe Inc. Quote

Segment Performance Insights

For the upcoming first quarter, Adobe projects that its Digital Media segment will generate revenues between $4.17 billion and $4.20 billion. The Zacks Consensus Estimate for this segment is currently at $4.18 billion, reflecting a year-over-year increase of 9.6%. Notably, the Creative Cloud is expected to generate $3.33 billion, representing an 8.5% growth compared to the previous year. Document Cloud revenues forecasts stand at $855 million, which indicates a robust growth of 14% from last year’s figures.

Adobe estimates revenues for its Digital Experience segment will fall between $1.38 billion and $1.40 billion, with the Experience Subscription revenues anticipated to be $1.27-$1.29 billion. Here, the consensus for Digital Experience segment revenues is pegged at $1.40 billion, showing an 8.5% year-over-year increase, while subscription revenues have a Zacks Consensus Estimate of $1.29 billion, equating to 10.8% year-over-year growth.

Driving Factors Before Earnings Announcement

Key growth drivers for Adobe include its advanced Generative AI (GenAI) portfolio and strategic collaborations with major partners like Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL). These partnerships likely contributed to Adobe’s revenue growth in the first fiscal quarter.

Adobe has broadened its GenAI portfolio with recent launches like Firefly Image Model 3 and enhancements in vector and video models. The incorporation of these advanced tools into Adobe’s applications—Lightroom, Photoshop, Premiere, InDesign, and Express—has enhanced user experiences for creative professionals, achieving over 16 billion cumulative Firefly generations.

Furthermore, Adobe Express shows a strong adoption rate among businesses. Integrations with popular apps, including ChatGPT, Google, Slack, and Hubspot, are expanding its customer reach significantly.

The release of the Document Cloud AI Assistant across various platforms, along with Adobe GenStudio’s integration of Express, Firefly, and related services, highlights the increasing utility of Adobe’s solutions in content management for enterprises.

These aspects suggest that Adobe’s fiscal Q1 2025 results are likely to be solid, even amid challenges such as stiff competition and slow monetization of its GenAI solutions.

Comparative Performance Analysis

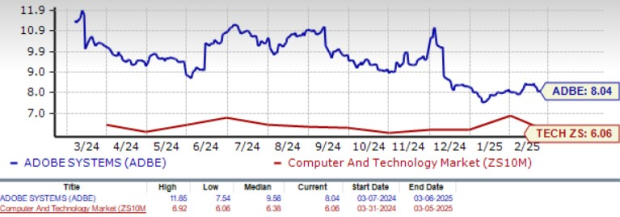

Over the last 12 months, Adobe’s stock has declined by 20%, underperforming the broader Zacks Computer and Technology sector, which saw an 11.1% increase, and the Zacks Computer Software industry, which experienced a 0.7% rise over the same period.

ADBE Stock Performance

Image Source: Zacks Investment Research

Currently, Adobe’s stock appears to be overvalued, indicated by a Value Score of D. It trades at a forward 12-month price-to-sales ratio of 8.16X, which exceeds the sector average of 6.06X.

P/S Ratio (F12M)

Image Source: Zacks Investment Research

Outlook: Can ADBE Leverage Strong Offerings?

With a solid product portfolio and a unique approach to AI, Adobe is increasingly appealing to a diverse customer base. Recent releases include Firefly Standard and Firefly Pro, providing customers with access to premium video and audio features. The company has also launched a public beta for the Firefly application, which now generates image vectors and videos using the Firefly Video Model.

Adobe’s partnership with Amazon brings the Adobe Experience Platform to Amazon Web Services, while collaborations with Google, Meta, Microsoft Advertising, Snap, and TikTok are pivotal growth drivers.

Significantly, the integration of Acrobat PDF technology into Microsoft Edge and Google Chrome fosters increased adoption, as evidenced by rising conversions from free to paid subscriptions for Acrobat extensions.

Should Investors Buy, Hold, or Sell Ahead of Q1 Results?

Adobe’s growth is supported by heightened demand for its creative products. The effective synergy among its Creative Cloud, Document Cloud, and Adobe Experience Cloud drives revenue expansion. The launch of new AI functionalities, including Express, Acrobat AI Assistant, and GenStudio for Performance Marketing, further diversifies Adobe’s product offerings. These innovations are likely to enhance Adobe’s market share and monetization potential in the near future.

However, challenges remain, particularly with rising competition in the GenAI sector from entities like OpenAI and barriers to monetization of its AI solutions.

Technically, ADBE shares are currently below the 200-day moving average, suggesting a bearish trend may be underway.

ADBE Shares Trade Below 200-Day SMA

Adobe Receives Hold Rating Amidst Market Analysis

Image Source: Zacks Investment Research

Adobe holds a Zacks Rank #3 (Hold), indicating that investors may benefit from waiting for a more favorable moment to begin accumulating shares. This rating suggests that while the stock is stable, current conditions may not be optimal for significant investment.

Explore the Latest Zacks Recommendations

For those interested in market opportunities, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Act Now: Zacks Top 10 Stocks for 2025 Released

Don’t miss out on the chance to invest early in Zacks’ top 10 stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this selection has shown remarkable success. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio achieved an impressive +2,112.6%, greatly outpacing the S&P 500’s +475.6%. Sheraz has meticulously evaluated 4,400 companies within the Zacks Rank to identify the best 10 for the coming year. Get ahead of the curve and discover these stocks with significant growth potential.

Want the latest insights from Zacks Investment Research? Download your complimentary copy of the 7 Best Stocks for the Next 30 Days today. Click to access this free report.

For those interested in specific stock analyses, reports are available for major companies:

- Amazon.com, Inc. (AMZN): Free Stock Analysis report

- Microsoft Corporation (MSFT): Free Stock Analysis report

- Adobe Inc. (ADBE): Free Stock Analysis report

- Alphabet Inc. (GOOGL): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.