Adobe Inc. (ADBE) reported a 15% year-over-year growth in total monthly active users for fiscal Q4 2025, bolstered by increasing demand for AI-driven products such as Creative Cloud, Acrobat, Firefly, and Express. The company anticipates an annualized recurring revenue growth of 10.2% for fiscal 2026, with projected revenues between $25.9 billion and $26.1 billion for the full year, and Q1 revenues expected between $6.25 billion and $6.3 billion.

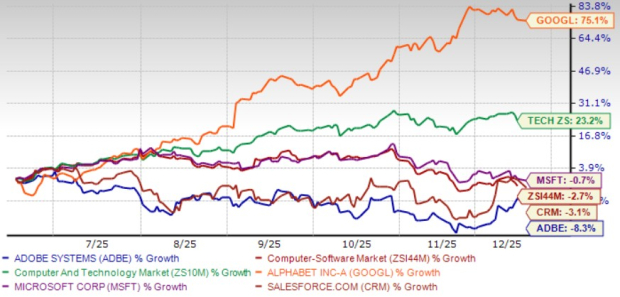

Despite these gains, Adobe faces intense competition in the AI sector from major players like Microsoft, Alphabet, and Salesforce. Adobe’s shares have declined 8.3% over the past six months, while Microsoft’s and Alphabet’s stocks have seen notable increases. The Zacks Consensus Estimate for Adobe’s fiscal 2026 earnings stands at $23.50 per share, reflecting a growth of 12.2% compared to 2025.

Adobe’s current valuation, at 12.65 times price/book, is higher than that of its competitors, indicating a potentially stretched valuation. Investors are advised to consider the risks associated with competition and valuation before making investment decisions, as Adobe holds a Zacks Rank of #3 (Hold).