Analyzing Wall Street’s Take on Agnico Eagle Mines (AEM)

When investors consider whether to buy, sell, or hold a stock, they often turn to recommendations from Wall Street analysts. Changes in these ratings from sell-side analysts can significantly influence stock prices. But how valid are these recommendations?

Let’s delve into the current consensus among Wall Street analysts regarding Agnico Eagle Mines (AEM).

Agnico Eagle Mines’ Average Brokerage Recommendation

Agnico Eagle Mines boasts an average brokerage recommendation (ABR) of 1.47, on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Strong Sell. This rating is derived from the recommendations of 15 brokerage firms. An ABR of 1.47 falls between a Strong Buy and a Buy rating.

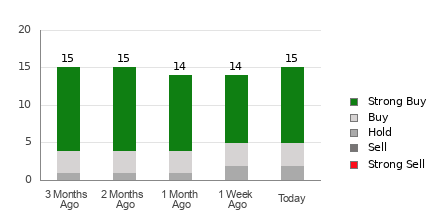

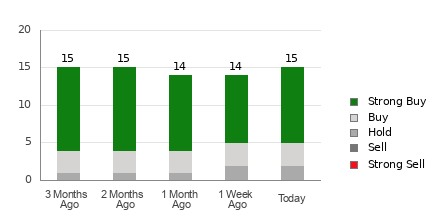

Analyzing the recommendations that contribute to this rating, 10 are designated as Strong Buy while three are classified as Buy. Thus, Strong Buy and Buy recommendations constitute 66.7% and 20% of all assessments, respectively.

Trends in Brokerage Recommendations for AEM

Explore price targets and stock forecasts for Agnico here>>>

Despite the ABR suggesting a recommendation to buy Agnico, investors should refrain from basing investment decisions solely on this data. Research indicates that brokerage recommendations have had limited success in predicting stocks with the greatest potential for price increases.

This raises the question: why is that? Analysts from brokerage firms often have vested interests in the stocks they cover, which tends to result in an overly positive bias in their ratings. Our analysis reveals that for every “Strong Sell” recommendation, there are five “Strong Buy” ratings issued by brokerage firms.

Consequently, the true direction of a stock’s price movement may not be accurately reflected in these ratings. Therefore, using these recommendations as a way to validate your own research or as a supplementary indicator is often more beneficial.

Understanding Zacks Rank vs. ABR

The Zacks Rank, our proprietary stock rating tool, has an impressive track record validated by external audits. This tool categorizes stocks into five groups—from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell)—and helps investors forecast near-term price performance.

Although both the Zacks Rank and ABR use a scale of 1 to 5, they assess quite different factors. The ABR is based solely on brokerage recommendations and is often displayed with decimal places (e.g., 1.28). Conversely, the Zacks Rank is a quantitative model influenced by earnings estimate revisions and presented as whole numbers.

While brokerage analysts tend to issue ratings that favor a stock due to their companies’ interests, the Zacks Rank provides a more accurate reflection based on earnings estimate trends. Empirical research shows a strong link between stock price movements and earnings estimate revisions.

Additionally, unlike the potentially stale nature of the ABR, the Zacks Rank is continuously updated in response to revisions in earnings estimates, making it a timely resource for investors.

Evaluating Investment Potential for AEM

For Agnico Eagle Mines, recent earnings estimate revisions have led to a notable increase of 15.2% in the Zacks Consensus Estimate for the current year, now standing at $5.63.

This rising optimism among analysts regarding Agnico’s earnings suggests a substantial opportunity for the stock to perform well in the near term. The magnitude of this consensus estimate revision, alongside several additional earnings-related factors, has secured Agnico a Zacks Rank #2 (Buy).

So, while the Buy-equivalent ABR for Agnico may be valuable, investors are encouraged to consider it alongside other analytical tools.

Zacks Identifies Top Semiconductor Stock

In other news, Zacks has identified a leading semiconductor stock that stands at only 1/9,000th the size of NVIDIA, which soared over +800% since its recommendation. While NVIDIA remains strong, this new stock is poised for significant growth.

This emerging stock supports strong earnings growth and a widening customer base, positioning itself well to meet the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is projected to rise from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.