C3.ai Faces Challenges Amidst Overvaluation and Competition

C3.ai shares currently show signs of overvaluation, reflected in a Value Score of F. The company trades at a forward 12-month Price/Sales ratio of 6.65X, exceeding the sector’s average of 5.78X. This positions C3.ai as relatively pricey compared to competitors such as Infosys (3.73X), Stem (0.27X), and Taboola.com (0.46X).

Price/Sales (F12M)

Image Source: Zacks Investment Research

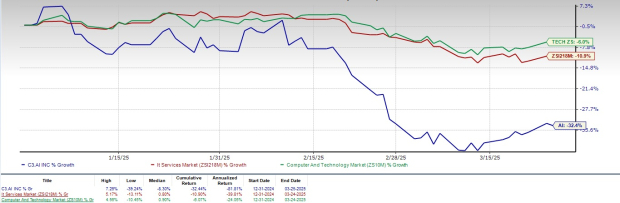

Year-to-date, C3.ai shares have dropped by 32.4%, contrasting sharply with the Zacks Computer & Technology sector’s 6% decline and a 10.9% reduction within the Zacks Computers – IT Services industry. This underperformance is largely due to macroeconomic uncertainties coupled with increasing competition in the enterprise AI market.

C3.ai Underperforms Compared to Sector and Industry

Image Source: Zacks Investment Research

Despite these challenges, C3.ai is expanding its customer base significantly, driven by advancements in both Enterprise AI and Generative AI products.

AI Push Helps C3.ai Gain New Customers

Notably, in the third quarter of fiscal 2025, C3.ai secured 66 agreements, including 50 pilot projects, which marks a 72% year-over-year growth. This surge indicates a rising demand for its AI offerings.

C3.ai’s progression includes a March 2025 partnership with PwC aimed at facilitating large-scale AI transformations within vital industries like banking, manufacturing, and utilities. This alliance combines C3.ai’s sophisticated AI solutions, such as C3 AI Reliability, Anti-Money Laundering, and Energy Management, with PwC’s industry insights to promote predictive maintenance, prevent financial fraud, and enhance energy efficiency.

C3.ai Grows Through Strategic Partnerships and AI Innovations

C3.ai has positioned itself as a leading AI player, notably through increasing interest in C3 Generative AI solutions and expanding its partner ecosystem. In the third quarter of fiscal 2025, the company established 47 agreements via its partnerships, which is a remarkable 74% increase from the previous year.

Collaboration with major firms like Microsoft (MSFT), Amazon (AMZN) through its cloud platform, AWS, and McKinsey QuantumBlack has bolstered their sales cycles and broadened their global footprint. During the same quarter, C3.ai and Microsoft closed 28 agreements across nine industries, marking an impressive 460% increase from the previous quarter. Additionally, the joint sales pipeline grew by over 244% year over year, with sales cycles reducing by nearly 20% sequentially.

Moreover, in the same quarter, the partnership with AWS was extended to expedite the adoption of advanced enterprise AI solutions, focusing on a robust go-to-market strategy, integrated offerings, and enhanced AI capabilities for commercial applications. C3.ai’s applications are now available on key platforms including Microsoft Azure, AWS, and Alphabet’s (GOOGL) Google Cloud, making them more accessible for businesses. The collaboration with Google Cloud is intended to boost AI deployment for clients further.

C3.ai Projects Strong Revenue Growth

C3.ai’s growing popularity and demand for its AI solutions have led to optimistic projections. For the fourth quarter of fiscal 2025, the company anticipates revenue between $103.6 million and $113.6 million. For the entire fiscal year, revenue expectations range from $383.9 million to $393.9 million.

C3.ai’s Earnings Estimates Indicate a Mixed Outlook

The Zacks Consensus Estimate for fourth-quarter fiscal 2025 revenue stands at $108.40 million, representing a 25.18% increase versus the previous year’s quarter. However, the consensus estimate for loss is set at 21 cents per share, which has remained unchanged over the last month, indicating a significant 90.91% decline year-over-year.

For fiscal 2025, the revenue consensus is $388.47 million, suggesting a year-over-year growth of 29.67%. However, the consensus for loss is anticipated at 47 cents per share, also unchanged over the past 30 days.

C3.ai, Inc. Price and Consensus

C3.ai, Inc. Price-Consensus Chart | C3.ai, Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

What Should Investors Do With AI Stock Now?

In light of the robust demand for C3 Generative AI solutions and its growing partner network, C3.ai still grapples with intense competitive pressures within the enterprise AI landscape. Such competition complicates the company’s goal of establishing a stronger market presence.

Consequently, C3.ai plans to heavily invest in its products to capture more market share, although this strategy is likely to pressure profit margins in the short term, rendering the stock a risky option for investors.

Additionally, C3.ai faces broader macroeconomic concerns that could impair its development and adoption across various sectors. Concerns about stretched valuations also persist.

Currently, C3.ai holds a Zacks Rank #3 (Hold), suggesting it may be prudent for investors to wait for a more favorable entry opportunity in the stock. For additional insights, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was specifically chosen by a Zacks expert as the #1 pick to increase +100% or more in 2024. Although not every recommendation may succeed, prior selections have yielded impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks in this report are currently under the radar of Wall Street, providing a great opportunity to invest early.

Today, discover these 5 potential high-gainers >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today. Click to access this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report.

Microsoft Corporation (MSFT): Free Stock Analysis report.

C3.ai, Inc. (AI): Free Stock Analysis report.

Alphabet Inc. (GOOGL): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.