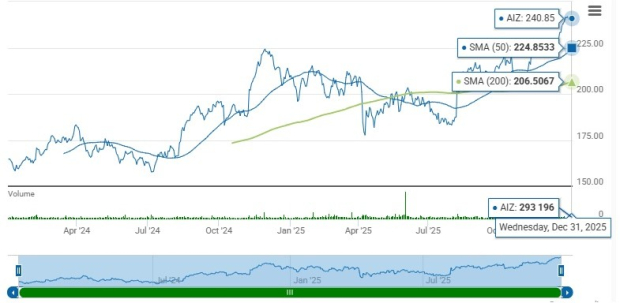

Shares of Assurant, Inc. (AIZ) closed at $240.85 on Wednesday, nearing its 52-week high of $243.76. The stock has risen 24.5% over the last six months, outpacing the industry’s growth of 3.6% and showing solid upward momentum, trading above the 50-day and 200-day simple moving averages of $225.33 and $207.85, respectively. The company has a market capitalization of $12.15 billion.

Assurant’s earnings have grown 16.6% over the past five years, surpassing the industry average of 10.2%, and it’s projected to achieve an earnings per share (EPS) increase of 17% in 2025, with expected revenues of $12.80 billion. Additionally, the average target price for AIZ is set at $255.67, indicating a potential upside of 5.5% from its current price.

Return on equity for Assurant stands at 18.6%, above the industry average of 15%, and the return on invested capital (ROIC) has reached 12.2%, outperforming the industry average of 2%. The company’s strategy focuses on fee-based businesses, which contribute 52% of segmental revenues and are expected to grow in double digits over the long term.