Akamai Technologies Faces Stock Decline Amid Market Challenges

With a market capitalization of $12.3 billion, Akamai Technologies, Inc. (AKAM) is a key player in the cybersecurity and cloud computing sectors. Based in Cambridge, Massachusetts, Akamai develops solutions that enable global enterprises to build, secure, and enhance their applications and digital experiences.

Publicly traded companies with valuations exceeding $10 billion are categorized as “large-cap” stocks, a classification that fits Akamai. The firm offers an extensive defense to protect enterprise data and applications through its full-stack cloud computing solutions, emphasizing performance and cost-effectiveness on a widely distributed platform.

Active Investor: FREE newsletter going behind the headlines on the hottest stocks to uncover new trade ideas

However, Akamai’s stock has experienced significant volatility recently. The company’s shares fell by 25.9% from their 52-week high of $109.98. Over the past three months, AKAM has decreased by 15.9%, notably underperforming compared to the iShares U.S. Technology ETF (IYW), which dropped 11.2% in the same period.

On a year-to-date (YTD) basis, AKAM has lost 14.7%, also trailing the IYW with its 9.3% decline. Additionally, when looking at the past 52 weeks, Akamai has slumped 25.6%, lagging behind the IYW’s modest 6.9% rise.

Akamai shares have remained below their 50-day and 200-day moving averages since late February, indicating ongoing challenges in market performance.

Despite reporting strong Q4 2024 results—including an adjusted earnings per share (EPS) of $1.66 and revenue exceeding $1 billion on February 20—Akamai’s stock price plunged by 21.7% the following day. This significant drop stemmed from disappointing revenue guidance for 2025, which revealed expectations of weakened demand. The company projected full-year revenue between $4 billion and $4.2 billion, falling short of Wall Street’s expectations. Furthermore, its adjusted EPS forecast of $6 to $6.40 disappointed investors, prompting a sharp sell-off of shares.

In comparison, rival AvePoint, Inc. (AVPT) has performed well, with its shares soaring 86.9% over the past year, despite a YTD decline of 10.5%.

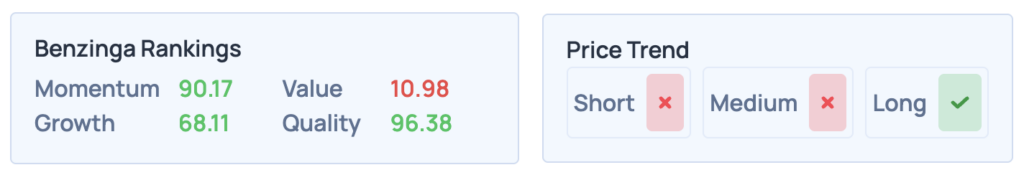

Nevertheless, despite recent underperformance, analysts maintain a moderately positive outlook for Akamai. The stock has a consensus rating of “Moderate Buy” from the 20 analysts following it, and it is currently trading below the mean price target of $104.84.

On the date of publication, Sohini Mondal did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is for informational purposes only. For further information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.