Amazon’s Stock Faces Challenges Despite Promising Business Sectors

The recent sell-off in the stock market has impacted many companies, including the renowned “Magnificent Seven,” with Amazon(NASDAQ: AMZN) seeing a notable decline. As of early April, the stock has decreased by 20% since the start of the year and trades nearly 30% below its all-time high reached in early February.

These early results may influence Amazon’s performance in 2025. To assess potential outcomes, let’s delve into Amazon’s businesses and financials to determine if the stock remains a viable option this year.

Wondering where to invest $1,000 right now? Our analysts have identified the 10 best stocks to buy at this time. Learn More »

A Closer Look at Amazon Today

Some investors might be surprised to learn that Amazon’s e-commerce segment is not the best reason to consider buying its stock. While it contributes the largest portion of revenue, retailing typically has low margins and often serves as a loss leader, supporting higher-margin software ventures.

Among these ventures are services for third-party sellers and digital advertising. By leveraging its robust sales platform, Amazon profits by collaborating with independent retailers who sell on its site. In exchange, Amazon takes a percentage of their revenue. Additionally, the company generates income by displaying advertisements on its platform, a model that has proven lucrative for tech giants like Alphabet and Meta Platforms.

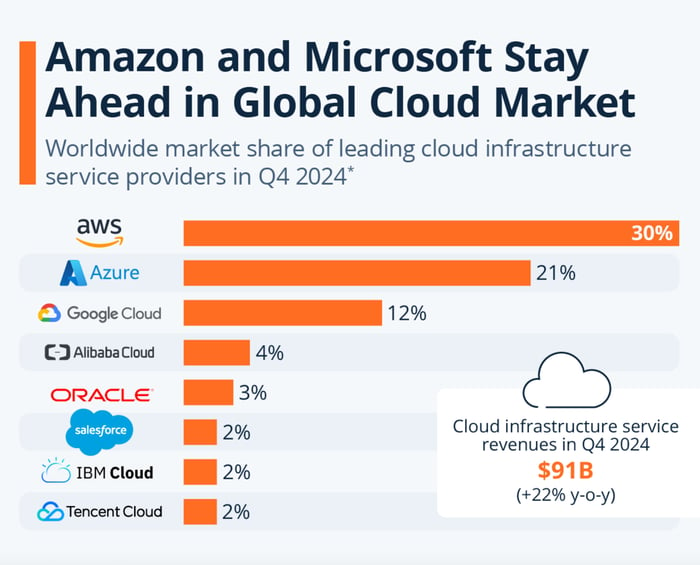

Nevertheless, the most profitable segment, Amazon Web Services (AWS), is unrelated to retail. AWS has revolutionized the cloud computing industry. Despite increased competition, Amazon continues to lead this sector.

Image source: Statista.

With the rising demand for generative AI, Amazon is also well-positioned to benefit financially from this technology. In fact, this segment has yielded a 37% operating margin in 2024, a commendable increase from 26% the previous year.

Examining Amazon’s Financials

Will Amazon’s cloud and software sectors propel the company forward in 2025? For 2024, Amazon reported net sales totaling $387 billion, reflecting a 10% growth. This growth resulted in an operating income of $69 billion, an impressive 86% annual increase, primarily driven by AWS’s $40 billion contribution. After accounting for non-operating incomes and expenses, Amazon’s net income reached $59 billion, which is 95% higher than in 2023.

Although Amazon does not typically provide annual guidance, analysts expect revenue growth to continue at 10% in 2025. This is likely to bode well for an ongoing increase in operating income. However, projected profit growth is anticipated to slow dramatically, with estimates indicating a rise of only 15% in 2025. Investors often react negatively to such deceleration in net income growth, which could adversely affect the stock in the current year.

On a more positive note, Amazon’s valuation has become increasingly attractive, with the stock currently trading at a P/E ratio of 32. The decline in valuation is commonly attributed to the company’s maturity, evidenced by its market capitalization of almost $1.9 trillion. Historically, Amazon has often traded at P/E ratios exceeding 50. Even if earnings growth plateaus in the 15% range, current multiples may still entice investors to consider buying amid a dip in revenue growth.

Looking Ahead: Amazon in 2025

Despite the current market upheaval, Amazon (NASDAQ: AMZN) appears to have considerable potential for strong performance in 2025. However, the decline in valuation coupled with decelerating earnings growth could present challenges for its stock price.

Amazon’s third-party seller and advertising divisions continue to exhibit robust double-digit revenue growth, while AWS’s operating income is on an upward trajectory. Such successes may lead investors to question whether the current valuation is too low, creating a rare interest in this tech titan.

Amazon exemplifies adaptability, having evolved from an online retailer to a technology powerhouse. Given its successful business units and favorable P/E ratio, now might be an opportune moment to acquire shares.

Should You Invest $1,000 in Amazon Right Now?

Before making a decision to invest in (NASDAQ: AMZN), consider this important insight:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks to invest in at the moment, and Amazon did not make the list. The selected stocks have the potential for significant returns in the upcoming years.

For instance, when Nvidia was recommended on April 15, 2005… if you invested $1,000 at that time, you’d now have $590,231!*

Stock Advisor offers investors a straightforward guide to success, including portfolio-building strategies, regular analyst updates, and two new Stock picks each month. The Stock Advisor service has outperformed the S&P 500 by more than four times since 2002*. Don’t miss the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of April 5, 2025.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. Randi Zuckerberg, who was a director at Facebook and is Mark Zuckerberg’s sister, is on the board as well. Will Healy holds no position in any mentioned stocks. The Motley Fool has positions in and recommends Alphabet, Amazon, and Meta Platforms. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.