Amazon Set to Reveal Earnings: A Focus on Cloud Computing’s Impact

Zacks Thematic Screens offers insight into 30 promising investment themes shaping our future. From innovative technology and renewable energy to advancements in healthcare, our themes help guide you toward meaningful investment opportunities. For access to the Thematic lists, click here >>> Thematic Screens – Zacks Investment Research.

This article examines the ‘Cloud Computing’ theme and focuses on notable stocks within this sector.

Understanding Cloud Computing

Cloud computing provides on-demand access to computing resources like servers, storage, databases, and software over the Internet, commonly operating under a pay-per-use model. This represents a fundamental shift from traditional on-premises infrastructure to remote cloud solutions, relying on virtualization and automation.

Instead of investing in and managing physical data centers, organizations can tap into a shared pool of resources from a cloud service provider whenever needed. This transition reduces operating costs, enhances productivity, and boosts scalability.

For those interested, here’s the link to our Cloud Computing thematic list – Cloud Computing.

Amazon to Report Quarterly Earnings

Amazon (AMZN) shares provide an excellent entry point for investors eager to engage with the cloud computing landscape, thanks to its Amazon Web Services (AWS) division. Recognized as a leader in the cloud market, AWS offers a range of services, including computing power, storage, databases, and AI/ML capabilities.

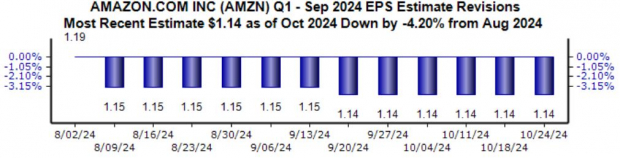

The company is scheduled to announce its quarterly earnings after market close on Thursday. Analysts have slightly lowered expectations, with a Zacks Consensus EPS estimate of $1.14, reflecting a 4% decrease since early August. Despite this adjustment, AWS is projected to experience considerable growth, with an anticipated 34% year-over-year increase in EPS.

Image Source: Zacks Investment Research

Historically, AWS has exceeded consensus expectations in four out of its last six earnings reports. For the upcoming announcement, the Zacks Consensus estimate for AWS revenue stands at $27.6 billion, nearly a 20% increase compared to the same period last year.

The recent year-over-year growth for AWS is notable, especially following a period of slower growth. The current buzz surrounding artificial intelligence seems to have rekindled investor confidence.

Image Source: Zacks Investment Research

In terms of valuation, the forward 12-month earnings multiple is currently 33.3X, significantly lower than its five-year median of 60.3X and peaks of 123.4X. Furthermore, the current PEG ratio is 1.2X, well below historical averages.

Image Source: Zacks Investment Research

Given the current emphasis on AI, extensive discussions around AWS’s performance are anticipated during the earnings call, potentially influencing stock movement post-announcement. Over the last three months, shares have displayed limited movement, which could lead to significant volatility depending on the earnings results.

Conclusion

Thematic investing enables investors to align their portfolios with contemporary trends. A blend of long-term and short-term themes plays a critical role in determining which companies thrive as economies evolve and markets adapt.

By utilizing the Zacks Cloud Computing Thematic screen, Amazon AMZN emerged as a focal point, especially in light of its quarterly earnings report following Thursday’s market close.

Stay informed on quarterly releases: Check out Zacks Earnings Calendar.

Get Exclusive Access for Only $1

That’s right.

Years ago, we surprised our members by offering a month’s access to all our stock picks for just $1. No further obligations.

Many capitalized on this opportunity, while others hesitated, worried there might be a catch. Our goal is straightforward: we want you to familiarize yourself with our portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and others that reported 228 positions with double- and triple-digit gains in 2023 alone.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.