“`html

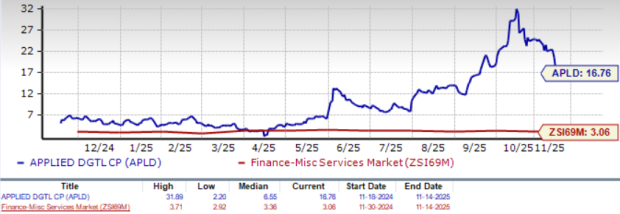

Applied Digital (APLD) is facing skepticism regarding its stock valuation, currently trading at a forward Price/Sales (P/S) ratio of 16.76, significantly higher than the Financial Miscellaneous Services industry’s 3.06, and above peers like RIOT Platforms (RIOT) and Equinix (EQIX), which have P/S ratios of 7.04 and 7.77 respectively. The company, which has shifted focus from cryptocurrency hosting to AI infrastructure, has seen a remarkable appreciation of 209.5% year-to-date (YTD), contrasting sharply with a 6.4% decline in its sub-industry.

APLD’s strong valuation is bolstered by roughly $11 billion in contracted lease revenue through CoreWeave for the 400-megawatt Polaris Forge 1 project. For the fiscal second quarter, analysts project revenues of $75.95 million, marking an 18.91% year-over-year increase. APLD is also moving forward with substantial development efforts, including 700 megawatts under construction and an active pipeline of about 4 gigawatts poised for development.

Despite these promising developments, loss estimates for the upcoming quarter stand at 10 cents per share. Existing investors may hold their positions, while new investors are advised to seek a more favorable entry point due to APLD’s premium valuation relative to industry peers.

“`