Understanding Analyst Recommendations: Insights on AppFolio (APPF)

When making investment decisions about buying, selling, or holding a stock, many investors turn to analyst recommendations for guidance. While media reports on rating changes by brokerage analysts can impact stock prices, it’s essential to evaluate their significance carefully. Let’s explore what analysts are saying about AppFolio (APPF) before examining the reliability of brokerage recommendations and how investors can effectively utilize them.

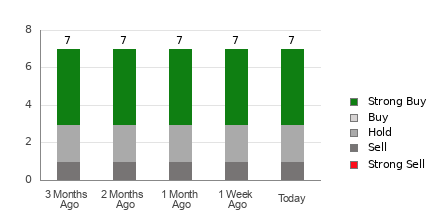

Current Brokerage Recommendations for AppFolio

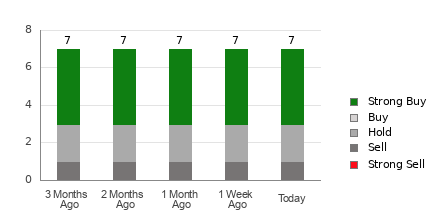

AppFolio holds an average brokerage recommendation (ABR) of 2.00, on a scale from 1 to 5 (Strong Buy to Strong Sell), as assessed by seven brokerage firms. A rating of 2.00 conveys a Buy recommendation. Within the seven ratings leading to this ABR, four exist as Strong Buys, which constitutes 57.1% of all recommendations.

Check price target & stock forecast for AppFolio here>>>

Limitations of Brokerage Recommendations

While the ABR favors buying AppFolio, relying on this alone may not be prudent. Research indicates that brokerage recommendations frequently do not successfully guide investors towards stocks with substantial price increase potential.

This discrepancy often arises from the vested interests of brokerage firms associated with the stocks they cover. Data suggests that for every “Strong Sell” rating issued, analysts typically assign five “Strong Buy” recommendations. This pattern reveals a misalignment between analyst ratings and retail investors’ actual interests.

Thus, using this information serves best as a means to corroborate one’s findings or as a component within a larger, informed approach to investment decisions.

Utilizing the Zacks Rank for Better Insights

The Zacks Rank, a proprietary model, assigns stocks into five categories (1 being Strong Buy and 5 being Strong Sell) and has a robust track record for predicting stock performance. Integrating the ABR with the Zacks Rank can bolster informed investment choices.

Differentiating ABR from Zacks Rank

It’s crucial to distinguish between the ABR and the Zacks Rank, as though both utilize a 1 to 5 scale, they operate differently. The ABR is based solely on brokerage recommendations and can include decimals (e.g., 1.28). Conversely, the Zacks Rank derives its evaluations from earnings estimate revisions, reflected in whole numbers from 1 to 5.

Historically, brokerage analysts have tended towards overly optimistic recommendations due to conflicts inherent within their firms. In contrast, the Zacks Rank is informed by more timely earnings estimate revisions, correlating strongly with actual price movements in the stock market.

Current Outlook for AppFolio

Examining earnings estimate revisions for AppFolio reveals a slight decline in the Zacks Consensus Estimate, now at $5.35, representing a 0.5% drop over the past month. This downward trend reflects growing analyst pessimism regarding the company’s earnings prospects and could suggest potential stock price declines.

The consensus estimate’s recent change, combined with other factors, has resulted in a Zacks Rank #4 (Sell) for AppFolio. For a comprehensive list of Zacks Rank #1 (Strong Buy) stocks, see here>>>>.

Consequently, it is advisable to approach the Buy-equivalent ABR for AppFolio with caution.

Emerging Opportunities in the Semiconductor Sector

The semiconductor sector remains robust, with one emerging stock set to outperform even the likes of NVIDIA, which has experienced over +800% growth since our recommendation. This new top chip stock is expected to benefit from the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things, with overall semiconductor manufacturing projected to soar from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

AppFolio, Inc. (APPF): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.