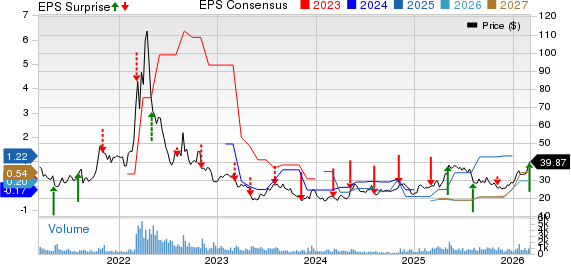

Chewy’s Market Position and Financials

Chewy (NYSE: CHWY) is experiencing significant challenges, with its stock down 70% over the past five years, despite high customer satisfaction. The company reported net sales of $3.12 billion for the third quarter of 2025, marking an 8.3% year-over-year increase. A notable 84% of these sales come from its Autoship program, which enhances customer retention.

The competitive landscape is intense as Amazon captures nearly 50% of the online pet supply market, while Chewy holds 41% and Walmart accounts for 33%. Chewy’s gross and net margins stand at 29.8% and 1.9%, respectively, compared to Amazon’s 50% gross margin. The U.S. pet industry is valued at approximately $152 billion and is projected to grow at a 6% CAGR, reaching $192 billion by 2028.

Investors should consider Chewy’s position within a market filled with fierce competition, especially from low-cost rivals. While its fundamentals show improvement, analysts suggest staying cautious before making investment decisions in Chewy.