Cisco Reports Strong Growth Amid Competitive Landscape

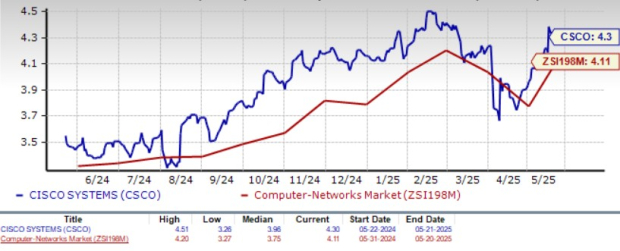

Cisco Systems (CSCO) shares currently trade at a premium, reflected by a Value Score of D. The company’s forward 12-month price/sales ratio stands at 4.3X, which exceeds the Zacks Computer Networks industry average of 4.11X.

Comparison with Industry Peers

Cisco’s shares outperform its closest rivals, such as Extreme Networks (EXTR) and NETGEAR (NTGR). Specifically, Extreme Networks has a forward 12-month P/S ratio of 1.75X, while NETGEAR’s stands at 1.23X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Recent Share Price Movement

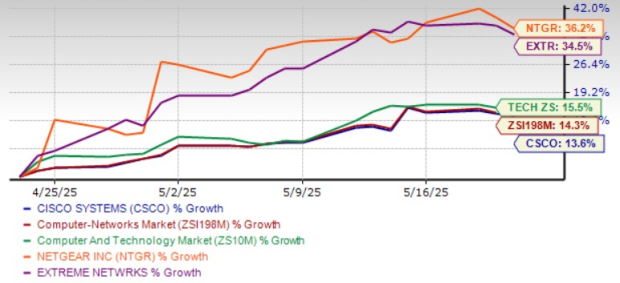

Over the past month, Cisco shares have risen by 13.6%. However, this figure is below the industry average of 14.3% and the Zacks Computer & Technology sector’s return of 15.5%. Compared to NETGEAR and Extreme Networks, whose shares increased by 36.2% and 34.5%, respectively, Cisco’s performance shows it has faced obstacles in a challenging macroeconomic environment.

Performance Overview

Image Source: Zacks Investment Research

Strong AI and Security Growth

Cisco has made significant strides in artificial intelligence (AI) and security. In the third quarter of fiscal 2025, security revenues surged 54% year over year, while networking revenues grew by 8%.

Order Growth and Future Prospects

During the same quarter, total product orders rose by 20% year over year, and 9% on an organic basis. Notably, networking product orders achieved double-digit growth owing to web-scale infrastructure and enterprise routing. Additionally, WiFi 7 orders saw triple-digit growth sequentially.

AI Initiatives and Partnerships

Cisco introduced an AI factory architecture developed with NVIDIA (NVDA), aimed at driving up revenues from AI. With over $600 million in AI infrastructure orders in the third quarter, Cisco surpassed its $1 billion annual target ahead of schedule. This strategic partnership with NVIDIA aims to create AI-ready data center networks and bolster Cisco’s market position.

Strengthening Security Business

Cisco’s security offerings continue to thrive, backed by strong demand for solutions like Cisco Secure Access, Hypershield, and XDR. These offerings collectively acquired more than 370 new customers in the latest quarter, further solidifying Cisco’s presence in the security domain.

Forward Guidance for Fiscal 2025

Looking toward fiscal 2025, Cisco expects revenues between $56.5 billion and $56.7 billion, an increase from previous guidance of $56 billion to $56.5 billion. Non-GAAP earnings per share are projected between $3.77 and $3.79, above the earlier estimate of $3.68 to $3.74.

Consensus Estimates

The Zacks Consensus Estimate for Cisco’s fiscal 2025 revenues stands at $56.57 billion, which reflects a year-over-year growth of 5.14%. Additionally, the consensus for earnings per share is $3.77, indicating a slight increase of 0.27% compared to previous estimates.

Why Cisco Stock is Rated a Hold

Cisco’s innovative portfolio positions it well for growth in the tech market. However, the company faces challenges from stiff competition and a tough macroeconomic climate, suggesting a cautious approach for potential investors.

Current Stock Trends

Cisco shares trade above both the 50-day and 200-day moving averages, indicating a positive trend. However, investors might consider holding off on purchasing until conditions improve.

Overall Score and Outlook

CSCO currently holds a Zacks Rank #3 (Hold). Investors might benefit from waiting for more favorable conditions before acquiring shares.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.